August 14th-August 20th // Estimated Reading Time: 8 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. A couple more Q2 earnings reports, Meta in the news, and Netflix making moves. But first, another major M&A rumor…

Join us for our next Live Learning Event: Attention Metrics Explained (Minus the BS), led by U of Digital’s Shiv Gupta and Adelaide CEO Marc Guldimann.

In this session, we'll cover HOW attention metrics work, WHY we need attention metrics for measurement, and how to GET STARTED using them. REGISTER NOW, it's free!

Top Stories 👁

Criteo is holding M&A discussions with Skai to bolster its retail media play 🔒

Source: Digiday

August 14th, 2024

Summary: Criteo appears to be in advanced negotiations to buy Skai, which was known as Kenshoo before it rebranded in 2021. Skai was traditionally known for paid search optimization, and in recent years it has invested heavily in e-commerce capabilities and helping brands activate within the walled gardens. A potential deal could be worth hundreds of millions of dollars, with one source telling Digiday that Israel-based Skai could fetch more than $500M. Since its founding in 2006, Skai has raised more than $60M in addition to an undisclosed venture round. Adding Skai would help Criteo increase its reach for brands as it continues its transformation from retargeter to retail media powerhouse. Criteo has made multiple acquisitions in recent years and has scored some big wins recently, including becoming Microsoft Advertising's preferred onsite media partner.

A deal would be the latest sign of increased M&A activity in ad tech, with MiQ acquiring Pathlabs, Connatix and JW Player merging 🔒, and Outbrain scooping up Teads for $1B.

No deal is imminent at this time.

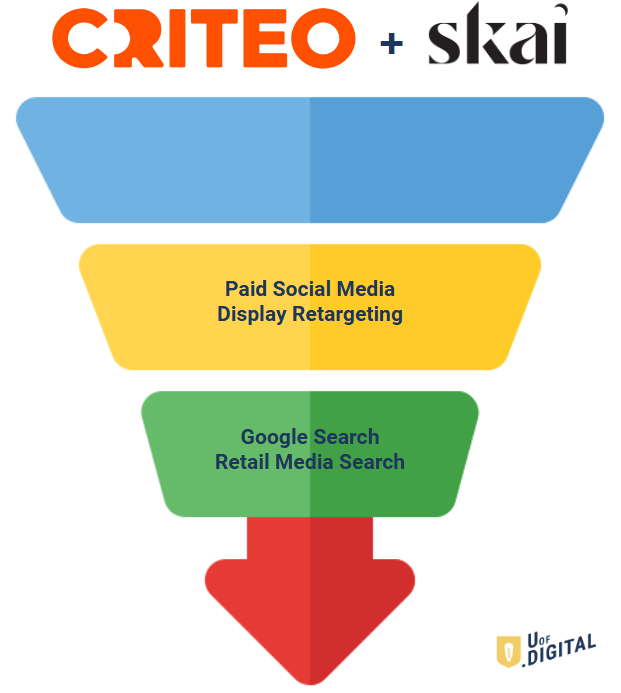

Opinion: What does Criteo do for brands that sell products online and in-store, today?

What could Criteo do for these brands if it buys Skai?

It could do retail media search, Google search, display retargeting, and paid social activation, at scale, with tech that has been proven to drive performance. And Criteo would be able to tie it all together with a robust user graph and closed-loop attribution.

If you’re a performance marketer trying to sell products, that’s a pretty compelling story. Beyond working with the walled gardens directly, Criteo would (almost) become a must-buy.

In the past, Criteo has been plagued by the “one-trick pony” label. Even with the company evolving into retail media, this has still been a problem. By having a more comprehensive solution for performance, Criteo can a) get more hooks into brands and b) offer economies of scope and scale. It can solidify its role as the go-to performance platform for brands that sell products online and in-store.

Acquiring Skai might be one of the final touches to Criteo’s makeover. Now let’s see if the deal actually happens—$500M is a lot of dough…

The Last of Q2 Earnings

Walmart (👍): Revenue was up 4.8% to $169.3B, beating estimates. Revenue from its US ad unit, Walmart Connect, was up 30%, and ad sales from marketplace sellers were up nearly 50%. The retailer raised its full-year guidance higher than expectations, sending shares 6% higher.

Dentsu (👍): Quarterly organic revenue was up 0.2%, driven by strength in the Japanese market. Other regions struggled, but the agency holding company touted new wins and sequential growth. Dentsu reaffirmed its full-year organic growth of 1%. Shares rose 8%.

Other Notable Headlines ✍

Netflix deepens ad tech ties with clean rooms - Netflix is partnering with clean rooms Snowflake, LiveRamp, and InfoSum to enable advertisers to match their data to Netflix data for targeting, privacy-centric reach and frequency measurement, and attribution. Clean room tech is table-stakes these days as a means to help companies share data in a privacy-safe way, and streaming services like Disney already offer this capability. Netflix, of course, is still playing catch-up in building out its ad business after launching its ad tier nearly two years ago. Netflix has partnered with The Trade Desk, Magnite, and Google as it tries to grow its programmatic capabilities; Netflix is also going to launch its own ad server next year after initially partnering with Microsoft to oversee ad tech and sales. Its efforts to make it easier to buy ads—and its decision to continue lowering ad rates— is bearing fruit: Netflix increased ad sales by 150% this upfront season.

Disney, Fox, Warner Bros. Discovery sports streaming venture launch blocked by federal judge in win for Fubo - The new sports streaming service “Venu Sports” was supposed to launch in two weeks, but a federal judge has temporarily blocked its debut. The judge ruled that Fubo's claim that Venu Sports would reduce competition in sports streaming and harm consumers will likely succeed. Warner Bros. Discovery, Disney, and Fox Corporation hold the rights to NFL, NBA, MLB, NHL, tennis, soccer, golf, NASCAR, and UFC events, all of which would be part of the $42.99-per-month Venu Sports package that would be nearly impossible to compete against. Fubo said that it has tried to offer a sports-only streaming package for years, but that the defendants’ bundling requirements forced the company to pay “hundreds of millions of dollars” to license unnecessary content. Fubo's stock soared 17% following the ruling. A trial for its antitrust lawsuit hasn't been set, but Warner Bros. Discovery, Disney, and Fox Corporation will appeal the ruling.

Jounce Partners With Self-Serve Buying Platform AdLib To Block MFA By Default - AdLib is a “meta DSP,” which connects to various DSPs, offering an additional tech layer that can filter out inventory from low-quality made-for-advertising (MFA) sites by default. The AdLib-Jounce Media partnership will bring these capabilities to mid-size advertisers, which often can't afford MFA-blocking solutions or agencies that buy directly from high-quality publishers. Through the partnership, advertisers can use Jounce Media's exclusion list of MFA sites to ensure that their AdLib campaigns don't include these offending domains. AdLib will also have access to Jounce Media's inclusion list of reputable publishers, which will allow the platform to curate in-demand pools of inventory. These lists are updated daily. So far, industry efforts to reduce the amount of ad spend flowing to MFA sites have lowered MFA bid requests to 10%, compared to 30% in July 2023. With 1 in 10 bid requests coming from MFA sites, there's still room to improve.

Meta Is Opening Up A Smidge More To Third-Party Attribution - Meta's ad platform will use AI to help advertisers achieve their business objectives and measure incrementality, while a new API can directly connect the platform to third-party measurement tools. So far, Meta is testing integrations with Google Analytics and Northbeam, and direct connections for Triple Whale and Adobe Analytics are coming soon. The new "conversion value rules" feature lets advertisers optimize campaigns based on their desired goal, which could be lifetime value or profit. Another setting (available in late 2024) will allow advertisers to track incremental conversions. Meta plans to expand testing in the coming months using test-and-control groups. Third-party measurement vendors will help advertisers objectively understand which channels are driving conversions, rather than relying on Meta (generously) grading its own homework…

Other Notable Headlines

(that you should know about too) 🤓

Meta Will Ask Supreme Court To Block Class-Action Over Metrics - In 2018, Facebook was accused of inflating its reach metrics to convince advertisers to buy more ads at higher prices. A judge had previously allowed the class-action suit to proceed.

Meta draws fresh questions from EU over its CrowdTangle shut-down - CrowdTangle was Meta's social media monitoring and analytics tool that let researchers and journalists track disinformation on Facebook and Instagram.

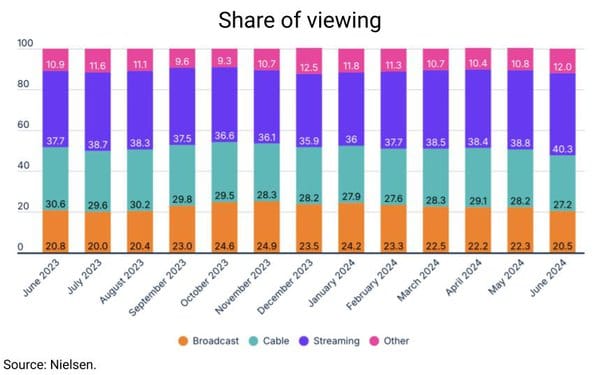

Nielsen: 'Total TV' Sets Another Record: 41.4% Share In July - Nielsen’s Total TV "Snapshot" measures total day viewing through its national TV panel plus streaming video.

Adelaide Secures $1.4M Seed Expansion Led by Aperiam Ventures to Advance Attention Measurement & Activation - The attention measurement vendor will use the seed-extension funding to boost its product capabilities and grow its global team.

Google apologizes to advertisers for major Shopping Ads glitch - The glitch led to some products being displayed in other advertisers' accounts, potentially exposing competitors' sensitive business data. Advertisers weren't impressed by Google's apology.

IAB Launches 'Diligence Platform' For Privacy Compliance - Diligence Platform, powered by SafeGuard Privacy, helps companies in the digital advertising industry keep up with various federal and state-level privacy regulations and make sure their partners are compliant.

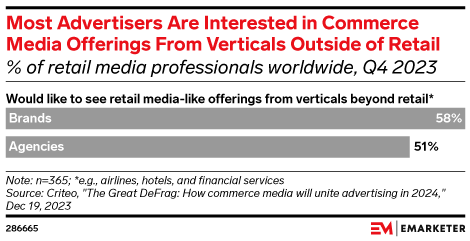

Most advertisers are interested in commerce media outside of retail - Fifty-eight percent of brands would like to use commerce media offerings from companies in verticals such as airlines, hotels, and financial service institutions.

The 'crazy' fix for Google's monopoly that investors are whispering about 🔒- The hairbrained idea: force Google to make its search index publicly available for all to use.

National Public Data admits hackers stole Social Security numbers in massive breach reportedly affecting nearly all Americans - Hackers stole the names, email addresses, phone numbers, social security numbers, and mailing addresses of almost all Americans.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!