September 11th-September 17th // Estimated Reading Time: 12 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. One week of #USvGoogle is in the books, The Trade Desk is “not” building a CTV OS, and the time has finally come to “talk” to your DSP…

Check out the top 7 #DataCleanRooms, with a breakdown of each, in this piece by Andrew Byrd of AdMonsters, featuring our own Myles Younger and U of Digital Expert Therran Oliphant!

Top Stories 👁

New AI Tool Is Offered To Programmatic Advertisers

Source: MediaPost

September 16th, 2024

Summary: Viant is characterizing its new ViantAI solution as the world's first fully autonomous ad platform. Advertisers can use ViantAI to quickly and efficiently manage every stage of their programmatic campaigns, from plan creation to execution and optimization. ViantAI is built on Viant's demand-side platform (DSP), which provided the training data to the AI.

ViantAI needs four pieces of information to create and execute a campaign: the advertiser's identity, campaign timeframe, budget, and objective, such as conversions or brand awareness. In an online demo, Viant co-CEO Tim Vanderhook created a campaign for specialty grocer Sprouts, with a $5M budget for Q4 and a goal to drive in-store visitors. From there, ViantAI identified Sprouts' target audience and the best channels to reach it. The platform allocated the budget across different channels, the optimal daypart, and frequency caps. ViantAI then created the line-by-line media plan including publishers, max CPMs, and number of impressions. Vanderhook acknowledged that it’s not fully autonomous yet, but it can get advertisers most of the way there without human involvement—”zero to 70% in an instant,” said Chris Vanderhook, Viant’s co-CEO. Tim Vanderhook stressed that the user is still in full control.

Coming soon: Viant will next integrate ViantAI media plans directly into its DSP via API, so that once a media plan is created, it will automatically be built in the DSP. Viant will also make it possible for advertisers to integrate their first-party data and campaign performance metrics directly into ViantAI.

Opinion: They stole our idea!

All kidding aside, this is really smart, and really well done. Sure, AI has been around for a long time in ad tech. But Viant is capitalizing on what first made AI sexy to the masses: conversational AI (AKA LLMs, like ChatGPT).

So what?

Viant is first-to-market with the next generation of AI programmatic ad-buying tools that will be conversational with a focus on outcomes, and will remove a lot of the rote work that goes into digital ad buying today. Sure, you could argue that PMax and Advantage+ already do this kind of thing, but they don’t quite take it to the level that Viant has.

Big picture, Viant AI is where all buying tools are headed, and they’ll all get there relatively fast, given how easy it already is to build AI agents on top of existing LLMs. That leads us to three important questions:

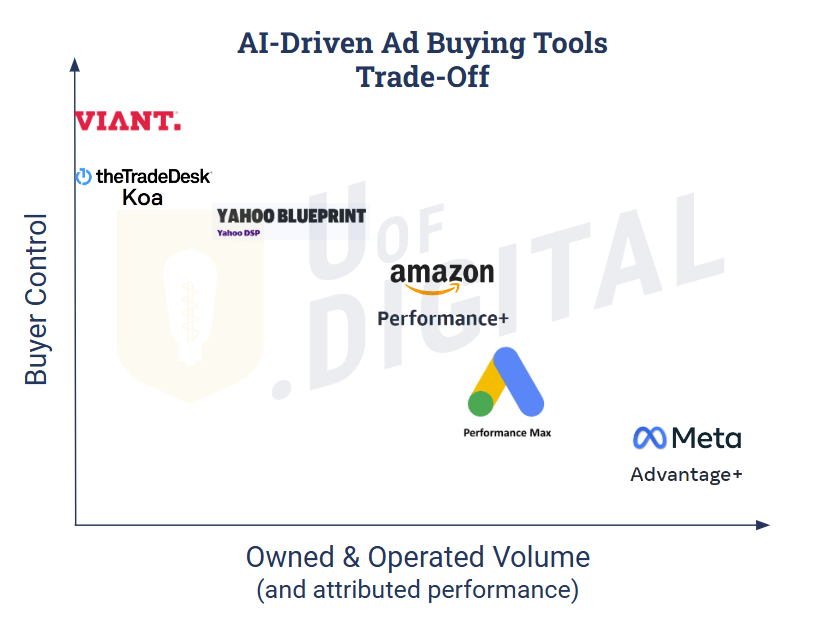

How will the AI buying tools from the various players differ? The U of Digital AI Ad Buying Tools KnowledgeScape™ explains the differences of key players in simple terms:

We believe this trend will continue. Big walled gardens that are able to drive strong performance will continue to build AI tools, but they will be used as a front to obfuscate what they do behind the scenes. Walled gardens will have the leverage to do this, because they perform so well. Meanwhile, others that are more open web-focused will home in on transparency and flexibility for advertisers who aren’t myopically focused on direct response results.What limits will these tools push? One way to think about this is the experience level and role type the AI is able to mimic. Right now, Viant’s AI can likely mimic the experience level of a junior trader with a few years of experience. Which means, it can conduct some basic audience planning and discovery, design a campaign, and set it up. Next, it'll be able to mimic a strategist with 5-10 years of experience. Which means it’ll be able to develop campaign strategy, from channels to budget to creative to measurement, and iterate on the fly. Eventually, it will be able to mimic a very seasoned marketing executive, and interface directly with various stakeholders to make sophisticated marketing decisions. By then, various stakeholders (like a CMO and a CTO) will have their own AI too. How soon until Viant’s AI is getting instructions from a client’s AI that has access to all the client’s marketing performance analytics and high-level strategy documents.

How will this impact / change the industry?

The current version of “managed service” evaporates (trading desks, hands-on-keyboard traders, programmatic agencies, etc.) and industry job descriptions shift from requiring the ability to “do” to the ability to “think”.

Some new form of managed service is born (perhaps the management of the advertising AI), because the ad industry once again spawns more than enough complexity to keep everyone employed. Ad tech gonna ad tech. 🤣🤣

Creative will be important once again! (OK, maybe this won’t happen, but we can hope!!!)

POLL: Where will see LLMs applied in advertising next?

It will be fascinating to watch how quickly all the other ad buying platforms release their own AI chatbots to keep up with Viant—and how the AI wave pushes the boundaries of all things advertising in the coming months and years.

Of course, we all know the end game…

Update On The Most Consequential Trial In Advertising History—#USvGoogle

This new section will be a fixture in the newsletter to help you stay up to date until Google’s antitrust trial concludes. We're halfway through the second week. There has been lots of testimony from a constellation of ad tech luminaries, and the case has often veered into the ad tech weeds. Here's a quick rundown of the action from the last week.

Who Testified:

Brad Bender, former Google product lead

Jed Dederick, The Trade Desk CRO

Rahul Srinivasan, former product manager

Google Ad Manager

Rajeev Goel, Pubmatic CEO

Tom Kershaw, former Magnite CTO

Chris LaSala, Google's former global commercialization manager

Brian Boland, Meta's former VP partnerships product marketing

Arnaud Creput, Equative CEO (formerly Smart Ad Server)

Brian O’Kelley, Scope3 CEO and former CEO AppNexus CEO

Neal Mohan, YouTube CEO and DoubleClick vet

Nirmal Jayaram, Google's senior director of engineering.

Important Revelations:

• Google knew its sky-high 20% take rate was “not long-term defensible” but kept it inflated because it had unique demand that was only available through AdWords.

• Google saw header bidding as a threat and tried to crush it with new tools and preferential treatment for Facebook in exchange for supporting its open bidding product.

• Google introduced unified pricing rules, which it knew publishers would hate, to gain more control.

• Google also saw yield management tools as a threat, so it bought yield management company AdMeld, integrated the tech into its exchange, and shut it down two years later.

Opinion of The Week:

What’s Next: DOJ witnesses testifying later this week: Scott Spencer, former Google VP of product management and DoubleClick vet, and Jonathan Bellack, former Google director of project management.

Other Notable Headlines ✍

‘They’re wrong’: The Trade Desk CEO denies Roku rival rumor amid reports it’s building a smart TV operating system 🔒- The smart TV newsletter Lowpass turned heads a few weeks ago when it reported that The Trade Desk was secretly building its own smart TV operating system that could compete with Roku, Amazon, Google, and other big tech giants. The Trade Desk CEO Jeff Green called the rumors that it wants to compete with Roku "wrong," pointing to its Roku partnership announced earlier this year. But it's not clear if he completely denied that The Trade Desk is building a TV OS. The next day, Lowpass came back with another report that Sonos is The Trade Desk's first hardware partner. According to the newsletter, Sonos will use The Trade Desk's TV OS and design its own hardware and user interface. And The Trade Desk will facilitate deals with app publishers.

InMobi secures $100M for AI acquisitions ahead of IPO - Like everyone else, Indian ad tech startup InMobi has its sights set on AI. The company plans to use the $100M in new funding from Mars Growth Capital, a joint venture between MUFG and Liquidity Group, to push further into AI initiatives and potentially make some AI-related acquisitions. InMobi has been pursuing AI to boost ad interactivity and better integrate native ads into content. InMobi plans to go public next year in India, targeting a $10B valuation, and forecasts $700M in annual revenue by the end of Q1 2025. Separately, InMobi is looking to raise $200M for its startup Glance, which offers an Android lock screen platform with ads.

Google Ads Will Now Use A Trusted Execution Environment By Default - A trusted execution environment (TEE) is a type of cloud-based architecture that lets a marketer match their company's first-party data to a partner’s for targeting and measurement. Google's new confidential matching feature uses a TEE built on its cloud infrastructure, and it will be offered as the default setting any time an advertiser uses first-party data in Customer Match on the Google Ads platform. The advertiser is the only party with access to the TEE, reducing potential data leakage; not even Google Ads can unlock the TEE. Advertisers can use any audience data derived from the TEE against third-party IDs (such as Google’s or LiveRamp’s) if the signals are based on data a customer shared with the advertiser. Google is working on developing best practices for TEEs with the IAB Tech Lab’s privacy enhancing technology working group and is making the architecture publicly available.

Disney, DirecTV Reach Deal Ending Two-Week Blackout of ESPN, ABC; Agreement Encompasses New Streaming Options - After a two-week impasse that blacked out NFL and college football games on DirecTV, Disney and DirecTV have worked out their differences in a new carriage agreement. DirecTV customers gain access to ESPN, ABC, FX, Disney Channel, National Geographic, FX, and other Disney channels. Disney had a similar disagreement last year with Charter Communications, which ended up getting the rights to provide Disney+ and ESPN+ in some of its subscription packages. The new agreement will give DirecTV flexibility in bundling Disney networks and streaming services under some DirecTV packages, as well as the rights to distribute ESPN's direct-to-consumer service being launched next year.

TikTok argued against its U.S. ban in court today. Here's what happened - Does free expression outweigh US national security? That's what TikTok argued this week as it fights for survival in the US under parent company ByteDance, which is based in China. Congress passed a law earlier this year that banned TikTok unless ByteDance sells the platform to a non-Chinese company. The ban is set to take effect on Jan. 19. Some 170M Americans use TikTok and could potentially see their First Amendment rights violated, the judges conceded, but the Chinese company has access to a massive amount of user data and control over an algorithm that could influence views, the government argued. TikTok has partnered with Oracle to oversee the flow of US user data and app security, but that has done little to appease lawmakers. The US Justice Department has asked the US Court of Appeals for the D.C. Circuit to rule on the case by December. If it doesn't like the outcome, TikTok can then appeal the ruling to the full Circuit Court and then the Supreme Court. As TikTok battles for its life in the US, another ByteDance-owned app, Lemon8, is surging in popularity. Mark Zuckerberg right now, somewhere:

Other Notable Headlines

(that you should know about too) 🤓

Magna Revises '24 U.S. Expansion To +11.4%, Most Bullish Yet - Magna has revised its annual forecast upward five times since June 2023, citing stronger macroeconomic trends and demand for digital media and CTV.

Paramount Global’s Ad Group Lays Off Staff as Part of Companywide Cost-Cutting Move - Paramount Advertising oversees multiplatform ad sales across CBS, BET, Comedy Central, MTV, Nickelodeon, Paramount+, Pluto TV, and other properties.

Instagram to automatically put teens into private accounts with increased restrictions and parental controls - Meta will begin rolling out a “teen accounts" feature, its most significant protections to give parents more control over their kids' social media use.

Unity cancels its engine runtime fee - Unity projects $20M in annual revenue. How will it meet that goal without charging engine runtime fees? Advertising. h/t Eric Seufert.

42 states and territories press Congress on social media warning labels - Surgeon General Vivek Murthy has called for warning labels on algorithm-driven social media platforms regarding the impact on the mental health of adolescents.

Meta to restrict data in Business Tools, impacting ad targeting - The walled gardens continue to clamp down on data leakage and privacy in very specific ways.

Meta fed its AI on almost everything you’ve posted publicly since 2007 - Unfortunately, there's no way to opt out of sharing text and photos posted to Facebook and Instagram, unless you live in Europe.

As Oracle Advertising nears shutdown deadline, ad tech companies are competing to recruit its staff 🔒- Companies like Integral Ad Science and DoubleVerify are trying to woo clients and staff of Oracle companies Grapeshot, Moat, and BlueKai ahead of the company's planned closure next month.

SEC charges Kubient CEO, CFO with accounting fraud, misleading investors - The executives lied about its platform's fraud-detection capabilities and claimed $1.3M in bogus revenue, according to regulators.

Drama at OpenWeb, as a new CEO is announced – and the founding CEO says he’s staying - Under-the-radar ad tech unicorn OpenWeb, which helps publishers set up and monetize comment sections with ads, is dealing with internal drama. The board has fired the founder and CEO, but he is refusing to step down. Unclear where things go from here.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!