September 24th-September 30th // Estimated Reading Time: 13 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. IAS: From PE to shining PE.

U of Digital’s AI Accelerator is THE go-to course for marketing and advertising professionals looking to get a head start on AI.

And now the industry’s leading AI DSP, Yahoo DSP, is the exclusive sponsor of the AI Accelerator!

The next Accelerator launches on October 14th. Use promo code YahooDSP for 20% off individual tickets. Email [email protected] for team discounts. TICKETS ARE SELLING FAST, ENROLL NOW!

#KnowledgeIsPower #HumansAheadOfAI

Top Stories 👁

IAS Acquired by Private Equity Firm Novacap for $1.9B

Source: Adweek

September 24th, 2025

Summary: IAS provides independent verification and measurement of digital ad campaigns. The deal with Canadian private equity firm Novacap will take IAS private just four years after its June 2021 IPO, with shares valued at $10.30 each—a 22% premium over the September 23rd closing price. IAS has posted solid financials since becoming a public company, with revenue growing 12%+ annually over the past three years.

Vista Equity Partners, which acquired a majority stake in IAS in 2018, will exit its investment as part of this transaction. IAS CEO Lisa Utzschneider expressed enthusiasm for the PE backing, saying Novacap will provide "new resources to achieve our strategic goals" and help IAS become "the global benchmark for trust and transparency in digital media quality." IAS faces fierce competition from rival DoubleVerify and the AI-first verification startup Scope3.

This deal comes roughly a year after Bloomberg reported IAS was exploring a sale, which sent shares up nearly 12% at the time. Around the same period, IAS also raised prices of its brand safety solutions by 1-3 cents per CPM—a move that raised eyebrows given the company had been facing scrutiny from firms like Adalytics and government agencies, questioning the effectiveness of their brand safety tech.

The acquisition was unanimously approved by the IAS board and is expected to close later this year, pending regulatory approval.

Deal Grades:

Novacap: C+

IAS: B

Opinion: IAS is stuck.

The growth problem is straightforward. IAS and DoubleVerify are an ad verification duopoly. They've already captured most of the market. Marketers view verification as a necessary evil and a tax, not a growth driver. Marketers don’t want to pay more for verification services, they want to pay less. IAS & DV’s attempts to expand into adjacent areas like ad serving and attribution haven’t been impactful enough. Big platforms are building their own, in-house brand safety tools and eating into their market share. There's simply no clear path to the kind of growth that justifies an aggressive public market valuation.

Then there's the Scope3 problem. While IAS dealt with public company scrutiny earlier this year, like Adalytics reports and government investigations, VC-backed startup Scope3 was architecting verification solutions from scratch using AI to disrupt the market. Scope3 Founder and CEO Brian O’Kelley knows why IAS is going private; to compete with him. He even posted about it.

O’Kelley is right. IAS needs massive changes. Going private gives them some cover to do what's necessary: gut the product, rebuild around AI, make risky M&A bets, turn over the team, change the go-to-market strategy, and do it all without explaining everything to analysts every 90 days. Expect significant change over the next 18-24 months.

The industry is bifurcating. Legacy companies built on rules-based tech are entering their adapt-or-die phase. AI-native companies that are lightweight and dynamic are the future. It’s happening in ad verification now, but it makes us wonder: which other ‘mature’ ad sectors (e.g. DSPs, SSPs, etc.) might see a similar story play out in the next few years?

Salesforce challenger Zeta Global is making its biggest-ever acquisition as it looks to corner the loyalty market🔒

Source: Business Insider

September 30th, 2025

Summary: Zeta Global is buying Marigold's enterprise software business for $325M, including Marigold's Loyalty solutions, email platforms Cheetah Digital and Sailthru, and marketing automation platform Selligent. Marigold will continue operating its products for small and midsize businesses such as Campaign Monitor, Emma, and Vuture.

The acquisition helps expand Zeta's Fortune 500 customer base—Marigold serves over 100 large brands—and significantly strengthens Zeta's footprint in Europe, the Middle East, and Africa. Zeta currently has 567 global enterprise clients.

The move also fits into Zeta's strategy of trying to get clients to use multiple services, including organizing their customer data, targeting lookalike audiences with ads, and sending personalized emails after purchases. CEO David Steinberg says adding loyalty products will feed "trillions of data points" into Zeta's algorithm to boost targeting and advertising.

Zeta expects roughly $1.2B in 2025 revenue and projects the Marigold deal will be accretive in year one. This is Zeta's 17th acquisition since its founding in 2007. Last year, they acquired LiveIntent, an email-based ad network, for $250M.

Opinion: Zeta is assembling the infrastructure to bring together ad tech and mar tech in a way nobody else has pulled off.

Look at what Zeta now offers: CRM, CDP, DSP and ad network (LiveIntent), email and marketing automation (Sailthru, Selligent, Cheetah Digital), and now loyalty. This creates closed-loop data flow where every layer feeds the others. Customer joins loyalty program, that data informs ad targeting, ads drive email capture, email engagement refines the profile, which personalizes the next loyalty offer. And the marketing cycle goes ‘round and ‘round.

This is the vision everyone talks about but can't execute. Google has ad tech but no CRM or loyalty infrastructure. Salesforce has mar tech but advertising is an afterthought. Adobe tried with Advertising Cloud and failed.

If they pull it off, Zeta will have built something genuinely differentiated.

Other Notable Headlines

Horizon Media and Havas form joint venture to collaborate on big pitches—behind the move - The new entity, called Horizon Global, aims to give global marketers more options amid Omnicom's pending merger with IPG and reports of Dentsu exploring a sale of its international business. Horizon Global will operate independently with profits split evenly between the two agencies. Horizon Global will unite Horizon's Blu platform and Havas' Converged.AI system into BluConverged, while both agencies will continue operating separately and may even compete against each other on some pitches. The venture will service over 100 countries, though analysts predict it will still struggle to compete with the big holdcos on major global accounts—like Mars' recent $1.7B media review won by Publicis—which have traditionally been out of reach for mid-sized players.

DOJ v. Google: How Judge Brinkema Seems To Be Thinking After Week One - A central question in the remedies trial is whether divesting Google's ad exchange (AdX) and publisher ad server (DFP) is even feasible. Google revealed it has internally evaluated divestiture through "Project Sunday" and "Project Monday," determining a spin-off of its ad server would take about four years. One witness said AdX wasn't worth anything and should just be shuttered. Judge Brinkema expressed concerns about the impact on small publishers who currently use DFP for free. Another issue is confusion over terminology, with terms like "Final Auction Logic"—a lawyer-created concept describing ad server code that makes final ad selection decisions—leaving even industry experts flummoxed, which could favor Google's defense. Court resumes this week.

OpenAI launches ChatGPT Pulse to proactively write you morning briefs - Pulse represents a shift toward making ChatGPT work as a proactive assistant rather than a reactive chatbot. The new feature generates personalized reports for users overnight, offering five to 10 briefs when they first log on to get them up to speed on their day. Pulse is only available to $200-a-month Pro subscribers due to its compute-intensive nature, though OpenAI plans to roll it out to Plus subscribers and eventually all users once it becomes more efficient. Reports can include news roundups on specific topics, personalized briefs based on user context, and even toddler-friendly travel itineraries or Halloween costume suggestions. The feature integrates with Google Calendar and Gmail through ChatGPT's Connectors, parsing emails overnight to surface important messages and generating agendas for upcoming events.

Does Pulse open the door for OpenAI to advertising?

OpenAI debuts Sora 2 AI video generator app with sound and self-insertion cameos, API coming soon - The new AI video generation model includes synchronized audio and a new "cameo" feature that lets users insert themselves into AI-generated videos. And the new Sora app will have a traditional discovery feed and social features (ads?!). Watch out TikTok! The update comes after OpenAI's original Sora model wowed the world and then fell behind competitors like Google’s Veo3. Sora 2 features identity protections that require opt-in verification to prevent impersonation. ChatGPT Pro subscribers get access to a higher-quality model, while free users have generous usage limits. An API is coming "in the coming weeks" to let developers integrate Sora 2 into their own video editing tools.

Trump approves TikTok deal through executive order, Vance says business valued at $14 billion - The $14B valuation is significantly lower than previous analyst estimates of $30B to $35B for TikTok's US operations. Under the deal's terms, which China must still approve, a new joint-venture company will oversee TikTok's U.S. business. Oracle, Silver Lake, and Abu Dhabi-based MGX investment fund will control roughly 45% of the entity, ByteDance will hold less than 20%, and ByteDance investors and new holders will own 35%. Oracle will oversee the app's security operations and continue providing cloud computing services. No representatives from ByteDance were present at the signing, and there's no indication China has made the necessary legal changes for the deal to actually happen.

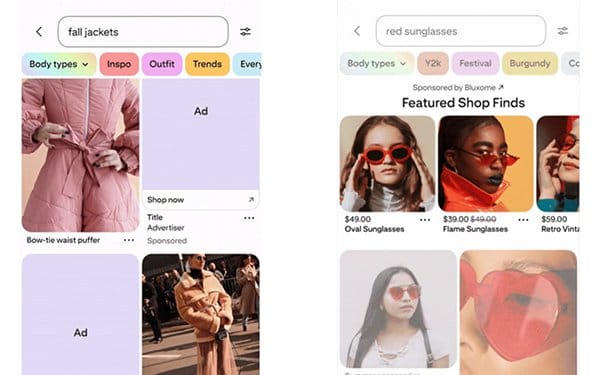

Pinterest Unveils New Ad Tool: Places Search At Top, Makes It Visual - "Top of Search" ads, now in beta testing, will provide a visual of a brand's products in prime real estate—within the top 10 search results—as well as in Related Pins, which is like a relevant content feed. Early tests show these ads produce on average a 29% higher clickthrough rate compared with standard campaigns and a 32% higher likelihood of attracting new viewers. Wayfair, one of the first testers, saw a 237% increase in click-through rate over a two-week period. Also at Pinterest Presents, the company's annual global advertising summit, Pinterest launched local inventory ads similar to Google's Local Inventory Ads, allowing retailers to display real-time prices for in-stock items within a shopper's local store.

AppsFlyer and Roku’s New SRN Integration Will Shed Light On CTV Campaign Impact - The self-reporting network (SRN) integration lets mobile app advertisers better track their streaming video campaigns across Roku ad platforms, including the recently launched Roku Ads Manager. This setup lets AppsFlyer send mobile activity like app installs to Roku, enabling it to more accurately target audiences likely to convert. Advertisers can also track multitouch journeys across TV and mobile in sequential order rather than relying on last-touch metrics from a singular device. AppsFlyer and Roku had an existing partnership that more narrowly applied to app install campaigns, with limited data from Roku’s endemic and OneView video placements. This expands their partnership.

The Trade Desk launches new AI tool to overhaul costly third-party data buying - A new product called Audience Unlimited uses AI to score and rank data segments from hundreds of third-party data providers. It also simplifies and streamlines data fees vs. TTD’s current a la carte data pricing model, resulting in lower data costs. Today, data can account for nearly 20% of media costs. The Trade Desk is also launching Koa Adaptive Trading Modes, which let buyers use full AI-driven optimization (called Performance Mode) or more manual oversight (called Control Mode, where buyers can manage their own bids, allocation, and optimization). Both features will roll out to select agencies later in 2025, before a wider launch in early 2026.

Best Buy will allow advertisers to ‘take over’ the in-store shopping experience - Best Buy will begin offering "takeover packages" next year that let advertisers show up across a store's footprint, including windows, entrances, physical displays, TV walls, PC displays, and checkout counters, for a month at a time. The program will be open to both endemic brands with products sold in stores as well as non-endemic advertisers like theatrical releases, streaming titles, quick-service restaurants, video games, or automotive brands. Best Buy President of Ads Lisa Valentino said the program responds to advertiser questions about how to leverage the retailer's thousands of brick-and-mortar locations. Best Buy executed 3K commerce media campaigns last year and expects double the number this year, powered by its in-house creative agency and creative hub called Best Buy Studios.

Other Notable Headlines

(that you should know about too) 🤓

OpenAI Looks to Build In-House Ad Infrastructure - OpenAI appears to be hiring for a growth marketing platform engineer to build capabilities for paid campaign management, ad platform integration, and attribution.

FTC Gives Final Omnicom/IPG Approval, Imposes Ideological Restrictions - The combined agency holding company now appears to be forbidden from considering publishers' political viewpoints, misinformation characterizations, or DEI commitments when buying ads—unless directed by clients.

Facebook and Instagram to charge UK users £3.99 a month for ad-free version - In order to hold privacy advocates and regulators at bay.

WARC Upgrades Global Ad Forecast On Surge In Retailer Social Spending - WARC predicts global ad spend will increase 7.4% year over year to $1.17T, up 1.2% from its June forecast.

2025 Outlook Study September Update: A Snapshot of the Latest Ad Spend Trends, Opportunities, and Strategies for Growth - Interestingly, the IAB has lowered its own ad spend forecast but its prediction is US-focused. It predicts US ad spend will grow 5.7%, down from previous estimates of 7.3% growth.

Video game maker Electronic Arts to be acquired for $52.5 billion in largest-ever private equity buyout - Investors include PE firm Silver Lake Partners, Saudi Arabia’s sovereign wealth fund PIF, and Affinity Partners, which is managed by Jared Kushner, President Donald Trump’s son-in-law.

Unlock Smarter B2B Decisions with LinkedIn’s Company Intelligence API - The API gives B2B companies better attribution capabilities and connect campaigns to pipeline and revenue.

NBCUniversal, DraftKings Enter New Multi-Year Advertising Agreement - Get ready to see DraftKings show up across NBCUniversal’s portfolio of sports properties, including NFL, PGA TOUR, NCAA football, and basketball coverage. Gambling for everyone, everywhere, all the time!

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!