October 17th-October 22nd // Estimated Reading Time: 9 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. Q3 earnings started trickling in. And Spotify made some noise with SAX.

Top Stories 👁

Spotify launching its own ad exchange, will partner with Trade Desk

Source: Axios

October 22nd, 2024

Summary: The streaming audio giant is going after more ad spend by making it easier for advertisers of all sizes to buy its inventory programmatically, beginning with video ads before expanding to audio ads soon. The new Spotify Ad Exchange (SAX) has begun testing its plugin with The Trade Desk, the largest independent demand-side platform (DSP) that will connect North American advertisers directly to Spotify's video ad inventory.

The Trade Desk is the first DSP to access SAX, and Spotify will integrate with Unified ID 2.0, The Trade Desk's cookieless identifier. Spotify will also be one of the biggest audio publishers to use OpenPath, The Trade Desk's product that directly connects advertisers to publishers without a third-party supply-side platform (SSP). Previously, advertisers who wanted to buy Spotify ads programmatically had to set up programmatic direct deals through Spotify's ad sales team.

In addition to investing in ad tech, Spotify is also bulking up its ad inventory by expanding its music videos to nearly 100 markets globally. Last year, it launched video ads for its connected TV apps through Roku.

Opinion: Good name. A SAX is a musical instrument. Spotify streams music. We dig.

Spotify is going from selling programmatic on a ‘direct’ basis (you had to call up a Spotify rep to setup a programmatic deal within your preferred DSP) to selling programmatic on a ‘walk-up’ basis (only through TTD for now, but eventually through many DSPs). Doesn’t seem like a big deal on the surface, but could open up opportunities for Spotify in the following ways:

Eliminate its SSP fees (we’ve heard that they were using Magnite and GAM as primary SSPs)

Increase demand, and consequently increase sell through rates and CPMs

Decrease the need for salespeople and consequently decrease overhead cost

Why now? Spotify cut a significant number of ad sales and account folks earlier this year to better manage cost and prepare for a shift towards programmatic monetization. Spotify has also been pushing hard into video, but its not known to be a video player and doesn’t have the sales chops to sell video. The shortcut to video monetization is programmatic demand.

This is yet another example of a major publisher cutting out SSPs and going direct to the industry’s spiggot of programmatic demand: the DSPs. While this is not an exclusive deal, it’s another first-to-market opportunity for The Trade Desk. The Trade Desk’s ‘Premium Internet’ strategy seems to be working on the supply side, as they’re getting more big publishers and walled gardens (like Disney, Roku, and Spotify) to bring down their walls, cut out the SSPs, adopt UID 2.0, adopt OpenPath, and monetize programatically through their platform. All while they continue to accumulate demand by being the go-to purveyor of high-quality, brand-safe, MFA-free programmatic inventory.

We’ll see if their strategy is truly working in a few weeks when they report Q3 earnings…

Q3 Earnings Start Trickling In 📈

Netflix (👍): Q3 revenue was up 15% to $9.83B, beating estimates. Its ad tier grew 35% quarter over quarter; ad-supported subscribers accounted for more than half of all new sign-ups. The streaming service added 5.1M net new subscribers, totaling 282.7M subscribers across all tiers. Shares reached a record high.

Publicis (👍): Organic revenue was up 5.8%. Publicis scored some big client wins, including The Hershey Company, and made two big deals for influencer agency Influential and ecom specialist Mars United Commerce. The French holding company raised its 2024 organic growth projection to at least 5.5%, up from 5%-6%. Shares inched up nearly 2%.

Omnicom (🤷): Organic revenue was up 6.5%, compared to 5.2% in Q2 and 4% in Q1. OMG scored several big wins in Q3, including the media accounts for Amazon Americas🔒and Michelin. The holding company confirmed 4%-5% organic growth for 2024. Shares dipped more than 2%.

IPG (👎): Organic revenue was flat. It's been a rough few years for the holding company, which has put its agencies R/GA and Huge up for sale. IPG maintained its 2024 organic growth projection of 1%. Shares fell 6%.

Opinion: It’s the beginning of Q3 earnings reports, with Netflix and Publicis announcing strong performance. Some predicted that ad spend in the second half of the year would accelerate due to the Paris Summer Olympics and US elections, so we’ll see if that holds true. Fingers crossed.

Other Notable Headlines ✍

Zeta Global Completes Acquisition of LiveIntent - Talk about a fast close. It was two weeks ago that we learned that marketing cloud Zeta Global would buy LiveIntent in a $250M deal🔒. LiveIntent was a legacy email marketing platform that branched out into other services like identity and newsletter ad sales. LiveIntent's first-party data, including an identity graph built on 235M hashed email addresses, and a publisher network with more than 2K premium media companies were a big draw for Zeta, which now has deeper access to both buy-side and sell-side data. This deal will give Zeta a leg up on future-proofing its data platform and creating additional value in planning, activation, identity, measurement, analytics, and monetization. Zeta apparently laid off ~35 LiveIntent employees on the day the deal closed.

Uber has discussed a bid for travel booking company Expedia - Uber is in early talks to buy travel booking company Expedia, which is worth around $20B. There's uncertainty around whether an acquisition will actually happen, but a deal could open new monetization opportunities and a path to becoming a "super app" for Uber, which has a market cap of about $168B. The ride-sharing company has benefited from strength in its UberEats food delivery service, which has pushed Uber's stock to new heights in the past year. Uber CEO Dara Khosrowshahi was also CEO of Expedia from 2005 to 2017 and is still a non-executive Expedia board member. Expedia also owns the travel sites Hotels.com, Vrbo, and Orbitz. The commerce media implications of a merger could be massive, as both companies bring ~$1B in ad revenue to the table.

Google replaces executive in charge of Search and advertising - Lots of restructuring is afoot at Google. The company appointed search and ads leader Prabhakar Raghavan as its new chief technologist. Veteran Google executive Nick Fox will replace Raghavan as the new head of Google's Knowledge & Information team, which includes Google's search, ads, geo, and commerce products. Raghavan took the helm of ads and commerce in 2018, and he took control of search and assistant in 2020. He led the development of all kinds of products, ranging from Performance Mx to AI Overviews. Google will also fold the Gemini app team led by Sissie Hsiao into Google DeepMind, an AI research group, under Demis Hassabis. Google will also merge the assistant team with its platforms and devices team.

Google To Pause Election Ads After Polls Close As Political Ad Revenue Skyrockets - The restrictions apply across the company's platforms for any ads about the US elections and their processes and outcomes. State or federal public information campaign ads are not included in the limitations. It's not clear how long Google will pause the ads, but the company said it will tell advertisers when it's lifted. It's not the only company that will pause political ads; Meta will also block new political, electoral, and social issue ads during the last week of the US election campaign, although ads that previously appeared on the platform before the blackout will be allowed to continue running during the last week.

Publishers Are Skeptical of Adtech's Latest Buzzword, Curation 🔒- Curation products from SSPs and DSPs package publisher inventory and data into deals that help achieve various advertiser goals, but publishers say the products may be yet another ad tech tax that hurts their direct sales without adding much, if any, value. One publisher platform source went as far as calling curation tech "turds rolled in glitter" (which may be the best ad tech quote of all-time). Publishers say curation products may undercut the value of their first-party data and generate less revenue than direct-sold deals. while cannibalizing open auction demand. In many cases, publishers also have no control over how curation services are packaging their inventory. Curation services can also hurt DSPs, as Ari Paparo of Marketecture notes. One publisher said that its inventory prices all decreased in 2023 because curation products cannibalized its direct deals.

Just remember. Turds rolled in glitter.

Other Notable Headlines

(that you should know about too) 🤓

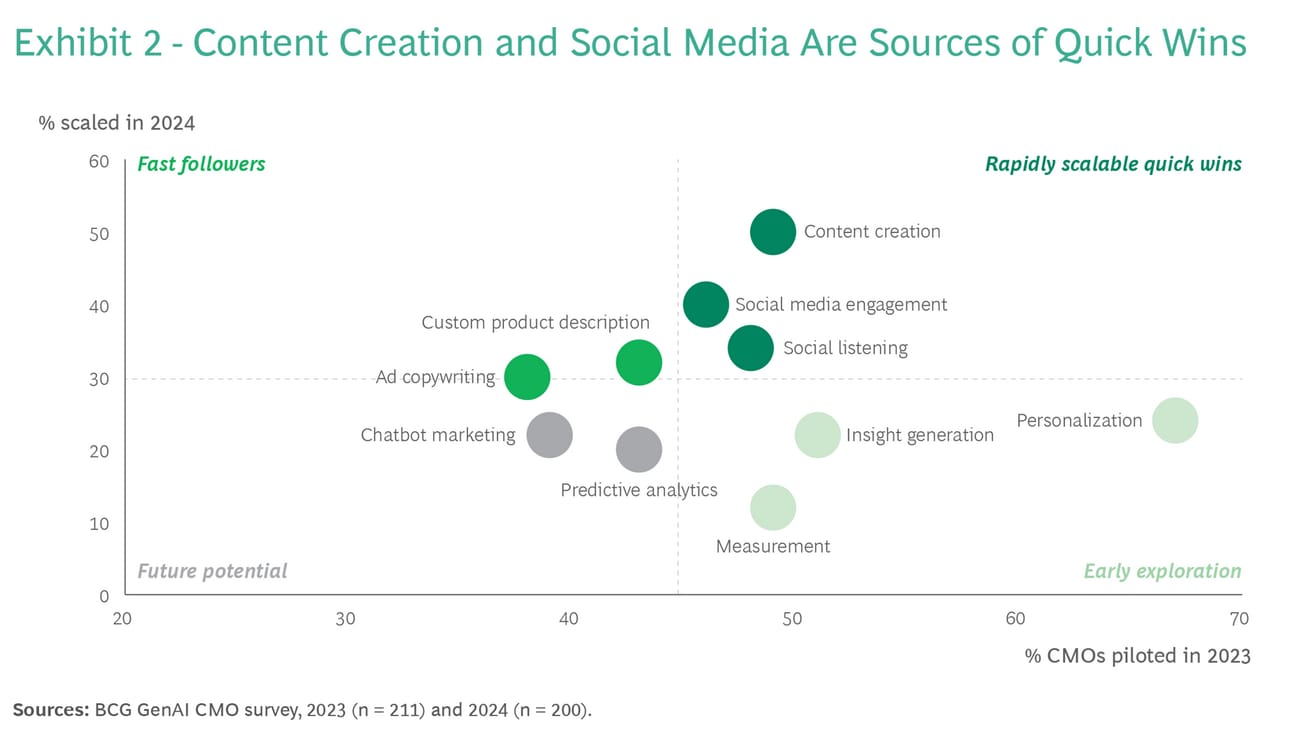

How CMOs Are Shaping Their GenAI Future - Great research on what marketers want, need, and expect from AI.

Advertisers and publishers call on Apple CEO Tim Cook to suspend the iPhone's new Distraction Control feature 🔒- Users can choose to hide webpage elements like ads or images. Could be hugely damaging to the ad industry. French media groups are "considering all available legal resources."

IAB Tech Lab launches Ad Format Idol initiative for CTV - The IAB Tech Lab wants the industry to submit its most successful, new CTV ad formats, so they can standardize them and make it easier for buyers and sellers to transact.

Google granted request to pause order on Play store overhaul - Google is appealing the order to require it to allow Android users to download other app stores and use alternative payment methods.

Yahoo Identity Solutions extends publisher availability - Publishers can now use Yahoo Identity Solutions through Amazon Publisher Services, InMobi Advertising, Magnite, and PubMatic.

Who is @digital_chadvertising, the ad industry’s self-appointed memelord? 🔒- We still don’t know. We do know one thing, though: We never want digital_chadvertising to stop.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!