October 1st-October 7th // Estimated Reading Time: 10 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. It’s Ad Week and partnership announcements are flying around. Starting with a big one between Microsoft and … Amazon.

U of Digital’s AI Accelerator is THE go-to course for marketing and advertising professionals looking to get a head start on AI.

And now the industry’s leading AI DSP, Yahoo DSP, is the exclusive sponsor of the AI Accelerator!

The next Accelerator launches next week on October 14th. Use promo code YahooDSP for 20% off individual tickets. Email [email protected] for team discounts. SEATS ARE ALMOST SOLD OUT, ENROLL NOW!

#KnowledgeIsPower #HumansAheadOfAI

Top Story 👁

With Microsoft in tow, Amazon’s DSP tightens its grip on the open web🔒

Source: Digiday

October 7th, 2025

Summary: Amazon's DSP is on a roll, and a new deal with Microsoft is the latest win. Microsoft announced in May that it is shutting down its demand-side platform, Microsoft Invest (formerly Xandr and AppNexus), by March 2026. Its advertisers across North America, Latin America, the EU, and Asia Pacific will migrate to Amazon DSP. The migration includes full-service support—either direct Amazon reps or activation partners may handle the move based on client size and existing agency ties.

Even more significant: Amazon is getting preferential access to Microsoft's programmatic marketplace (Monetize) through its Certified Supply Exchange program. This brings more programmatic inventory under Amazon's control and strengthens its positioning as the infrastructure layer for open web buying. The value prop goes something like this: Advertisers get Amazon's commerce data, greater scale and inventory access, and rock-bottom fees in a single platform.

This caps off a monster year of inventory deals for Amazon. Over the past few months, the company has locked in partnerships with Netflix, Spotify, Roku, Disney, and SiriusXM.

Amazon is also trying to make its tools and data more accessible. A new data collaboration with Adobe announced this week🔒will integrate Amazon's clean room with Adobe's customer data platform (CDP). This will let Adobe CDP users securely tap Amazon's shopper data and signals from Amazon DSP to get insights on intent and help them find more relevant audiences.

And, as Amazon is known to do, it is undercutting on pricing to take share: Amazon DSP fees typically run 4%-8%, but drop to 1% or even zero to win business. All of these moves are working: Amazon pulled in $15.7B in ad revenue last quarter (up 22%), and buyers report DSP spend is up 12%-45% this year.

Opinion: Amazon’s combination of shopper data and advertiser demand is irresistible, even for Amazon’s biggest competitors. Microsoft is a massive ad company with tons of demand in their own right, and even Microsoft wants to hand the keys to Amazon. It tells us that Amazon is much more effective at eliciting value out of ad inventory than anyone else now. Incredible.

Some other takeaways:

DSP consolidation continues, it’s becoming a mature sector. Especially for enterprise advertisers. Expect more consolidation.

The mid-market is wide open and growing, and every company, from Comcast to The Trade Desk to Microsoft, wants a piece of it.

Inventory used to be a commodity when it came to DSPs. Everyone accessed pretty much everything through exchanges. But Amazon seems to be changing that. This matters a lot as the open web gets squeezed and premium inventory becomes more valuable / harder to find.

Amazon is executing the Google playbook, but even more aggressively. And the nothinburger remedies coming out of the Google search antitrust trial are emboldening Amazon.

We might look back on this run by Amazon as a major turning point for the company and for the industry. It’s the year of Amazon Ads!

Other Notable Headlines

Can Publishers Trust The Trade Desk’s New Wrapper? - The Trade Desk’s OpenAds auction wrapper for publishers leverages Prebid's open source code but “forks it” by still using universal transaction IDs, which Prebid controversially eliminated in August. The product launch was accompanied by the launch of PubDesk, a dashboard giving publishers data about how buyers value their inventory and the signals that drive bid pricing. TTD says OpenAds creates a "fair and high-integrity auction environment" free from auction manipulation tactics like bid duplication and ID bridging. TTD says the new tools are meant to increase yield for publishers, but publishers may be skeptical, as TTD serves advertisers first and foremost. In other TTD news, the company is still pushing Ventura, the streaming TV OS it launched last November. The company has now partnered with DirecTV🔒on a customized TV OS, which combines DirecTV's consumer-facing interface and content aggregation with Ventura's ad tech infrastructure, creating what they hope will be an attractive turnkey package for TV manufacturers that lack their own OS. However, it's been nearly a year since Ventura's launch, and TTD still hasn't secured a hardware partner to ship the OS—a Sonos deal fell through—making this partnership more theoretical than practical until a TV OEM comes on board. TTD is shipping product aggressively, which is great to see, but nothing seems like a sure shot as of now.

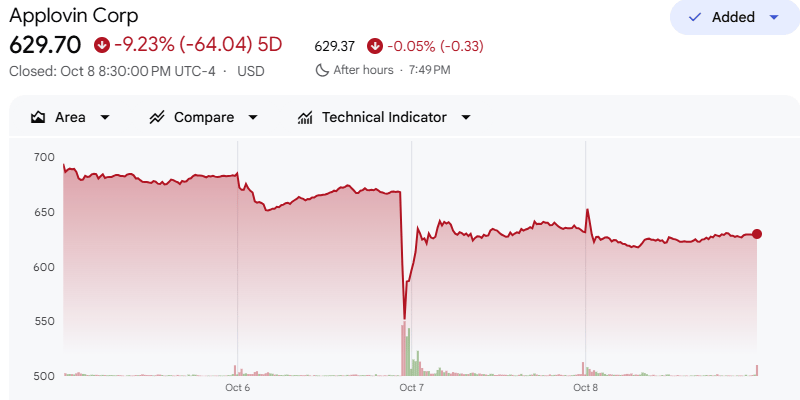

AppLovin stock tanks on report SEC is investigating company over data-collection practices - AppLovin shares tanked on Monday (then rebounded nicely) following a Bloomberg report🔒that the US Securities and Exchange Commission (SEC) is investigating the mobile advertising company over its data-collection practices. The SEC is examining whether AppLovin broke agreements when serving targeted ads to consumers, in response to a whistleblower complaint and short-seller reports filed this year. One short-seller accused AppLovin of improperly extracting proprietary IDs from Meta, Snap, TikTok, and other platforms to serve targeted ads to users without consent. The timing is notable given AppLovin's meteoric rise—the stock surged over 700% in 2024 and another 80% this year thanks to its AI-powered ad engine AXON AI, and it joined the S&P 500 last month.

Paramount+ Is Letting Advertisers Buy Show-Specific Streaming Ad Spots - The new ad format, called "streaming fixed units" lets advertisers buy a fixed placement within a specific episode on streaming TV for the first seven days after it goes live. The format is designed to "event-ize" popular shows like "Tulsa King," "Landman," and "Mayor of Kingstown," capitalizing on the traffic spikes Paramount+ sees when fans watch new episodes immediately upon release. After the seven-day window, the fixed placements revert to dynamic ad insertion with targeting. Paramount will expand the format to "Yellowstone" spin-offs and possibly streaming-exclusive sports broadcasts in 2026. In other Paramount Skydance news, the company acquired Bari Weiss' The Free Press for $150M and named her the top editor of CBS News, which will embrace “diverse viewpoints.”

CPG Advertisers Can Now Target Instacart Shoppers on TikTok🔒- TikTok users will soon see ads that take them to Instacart and add items to their cart with one click, thanks to a partnership initially available to select CPG advertisers. The integration lives in TikTok Ad Manager, where brands can access their full product catalogs, run shoppable ad campaigns, and measure purchase conversions on Instacart. Instacart's GM of advertising calls this an "end-to-end integration" with TikTok, meaning advertisers can leverage Instacart's first-party shopping data to improve targeting and track whether their TikTok ads lead to actual purchases. The move solidifies Instacart's position among delivery platforms like DoorDash and Uber that have rapidly built powerful ad businesses, in some cases surpassing traditional retailers in their commerce media capabilities.

Advertisers Can Now Buy DoorDash Ads Through Criteo🔒- DoorDash and Criteo's new multi-year partnership positions Criteo as an extension of DoorDash's US ad sales team. The deal gives brands and agencies access to DoorDash inventory through Criteo's platform, covering onsite sponsored products, display, video, and sponsored brand ads, plus offsite display, search, social, and video inventory. This deal doesn't supplant any of DoorDash's existing ad tech stack. Separately, DoorDash also rolled out new reporting tools, including category-level share reporting enabled by Circana, and a new measurement standard for “Ghost Ads”, which are product listing ads.

Amex and Mastercard Both Launch Commerce Media Networks - American Express officially entered the commerce media space with Amex Ads, a platform that lets brands buy display ads on Amex-owned properties starting with AmexTravel.com. Amex Ads will reach 34M US consumer card members and use transaction and travel booking data. Amex Ads will be direct-sold rather than programmatically to maintain brand safety. Meanwhile, Mastercard launched Mastercard Commerce Media last week, drawing on 500M enrolled customers, 25K existing advertisers, and 160B annual transactions. Mastercard also has partnerships with Citi, WPP, American Airlines, and Microsoft to expand its capabilities and reach. Finance media networks are hot!

Mozilla Taps Index Exchange as First Programmatic Partner🔒- Mozilla, maker of the Firefox browser, is giving advertisers programmatic access to Firefox New Tab ad inventory through private marketplace (PMP) deals with Index Exchange. Firefox New Tab is the customizable default Firefox start page, which can show users shortcuts to sites they've saved or visit frequently, popular articles, and their recent activity. The platform promises brand-safe environments without personal identifiers or cross-site tracking. Everything is an ad network.

Other Notable Headlines

(that you should know about too) 🤓

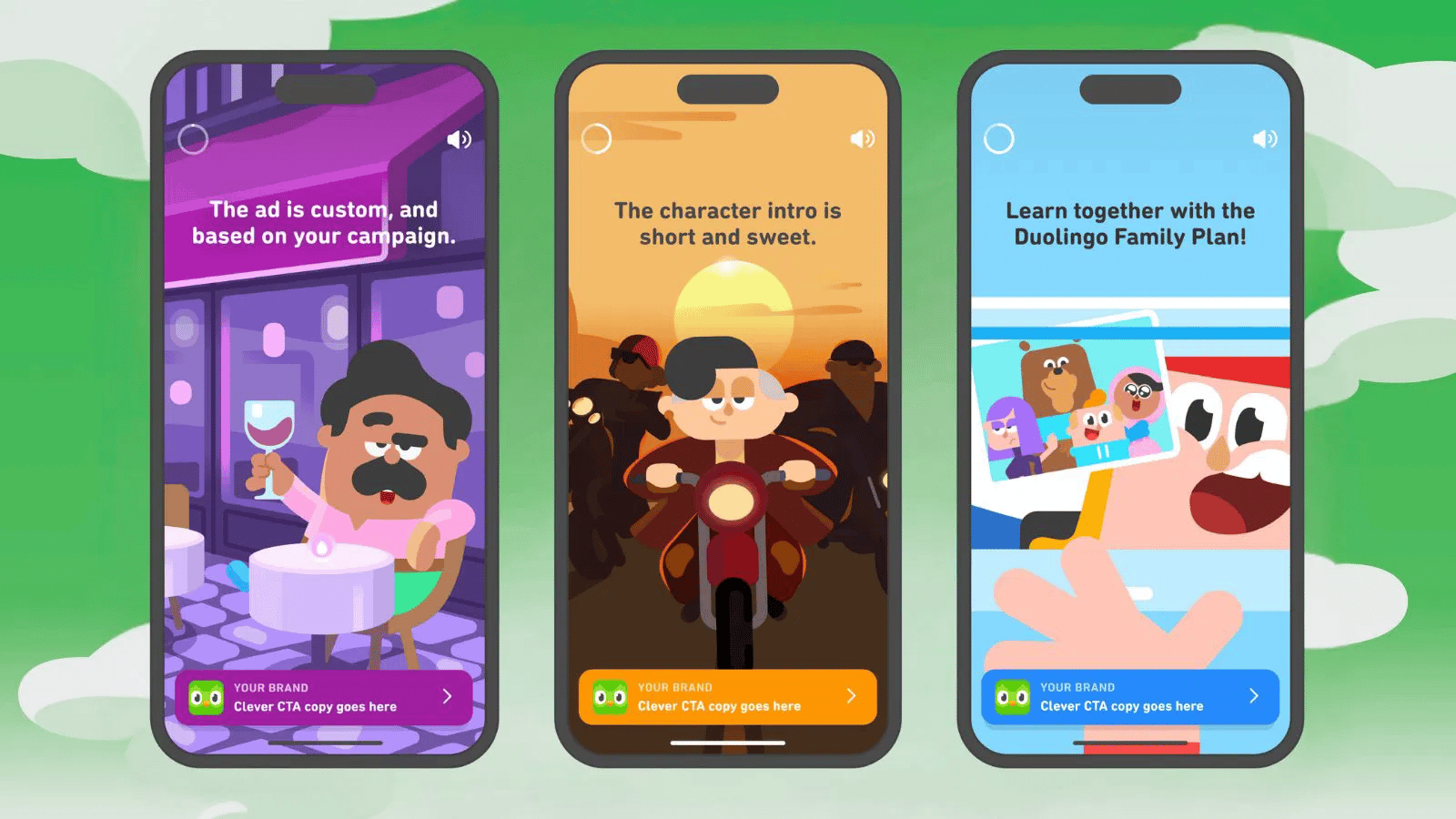

Duolingo rolls out character-led ads platform to charm Gen Z - The mobile learning app will help brands connect with its mostly young 128M monthly active users.

Media.net, Claritas Partner For Attribution Driven By AI, Search Intent - SSP Media.net and Claritas launched "Elevate," a product that embeds real-time measurement into the supply path to help media companies get higher CPMs.

PayPal Ads Manager creates network of small-business media networks - The platform helps SMBs centralize their ad campaign management and stand up their own commerce media networks.

Nielsen enhances its cross-platform offering with attention metrics from Adelaide🔒- Nielsen ONE becomes the first major audience measurement platform to add Adelaide’s AU attention metric.

YouTube launches Activation Partners program - The third-party experts are knowledgeable in YouTube strategic planning, media buying, and campaign management.

HUMAN Expands Its IVT Detection Tool Kit With A New Product For Advertisers, Not Platforms - The new Page Intelligence product detects invalid traffic on advertiser landing pages after ad clicks and works across all traffic sources, including walled gardens.

Oracle AI Agents Help Marketing, Sales, and Service Leaders Unlock New Revenue Opportunities - New role-based AI agents are embedded in Oracle Fusion Cloud Applications to help marketing, sales, and service teams automate processes and unlock revenue opportunities.

OpenAI launches apps inside of ChatGPT - ChatGPT users will be able to use apps from Figma, Canva, Spotify, Zillow, and other companies.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!