November 19th-November 25th // Estimated Reading Time: 8 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. We have some tea leaves to read from the Google ad tech antitrust case…

A new, interactive map that shows how AI is used across every part of the advertising workflow. From data to creative to measurement.

⛰️ Get a clear view of where AI actually sits in the industry, what the products are, and what they do.

📊 Filter by category or search to see the tools relevant to you.

⚖️ Compare platforms and understand how they use AI without sorting through scattered sources.

Give it a spin here!

Top Stories 👁

The Fate of Google’s Ad Tech Monopoly Is Now in a Judge’s Hands🔒

Source: The New York Times

November 21st, 2025

Summary: Closing arguments wrapped up Friday in the US Department of Justice's antitrust case against Google's ad tech business.

Federal Judge Leonie Brinkema will now decide whether to force Google to sell parts of its ad tech business—which would be the first major tech breakup of the internet era—or simply require behavioral changes.

In April, Brinkema found that Google runs illegal monopolies in the open web display ad server and ad exchange markets. Since then, publishers and rival ad tech companies have filed dozens of lawsuits to try and get their fair share out of any resolution.

Prosecutors want Google to sell off AdX, among other remedies. At the hearing, Brinkema acknowledged that Google will probably appeal the decision, but an appeal would postpone any forced sale by years. Behavioral changes, like those being offered by Google, mostly limited to open-web display ads, could take effect much faster.

Brinkema’s decision is expected in early 2026.

Opinion: The judge seems to recognize that by the time appeals wrap up—likely 2028-2029—the open web display ad market will be far less relevant. CTV, retail media, and AI will dominate ad spending.

To recap recent antitrust outcomes:

Last week, Meta was found not guilty in its antitrust case

In September, Google was found guilty of being a search monopoly, but the remedies were a nothing-burger

Now this AdX case looks headed for behavioral remedies that won't matter either

Can’t blame the judge. Forcing Google to sell AdX in 2028 would be like breaking up Blockbuster in 2010. It won’t really matter; if anything, it’ll just create a lot of headaches. Once again, antitrust enforcement is too little, too late. Big Tech will move on to dominating the next thing (in this case, AI), and by the time the next thing is disrupted, they’ll be on to the next thing while government is litigating the last thing. And again, it will be too little too late.

Marketers should stop waiting for regulation to level the playing field. Build strategies that assume Google, Amazon, and Meta will continue consolidating power in old and new frontiers. Invest in capabilities that work across ecosystems rather than depending on any single platform. And recognize that "independent tech" increasingly means "compatible with Big Tech's infrastructure."

This isn't defeatism, it's realism. It’s Big Tech’s world and we all just live in it.

Other Notable Headlines

Media Buyers Are Being Pushed to Switch to The Trade Desk’s Kokai—and Hitting Glitches on the Way🔒- The Trade Desk isn't letting buyers use its older Solimar interface to create campaigns, according to some advertisers, forcing them to use its newer Kokai interface, despite earlier assurances that buyers would have "indefinite access" to the legacy system. Multiple buyers told Adweek they've encountered significant bugs in Kokai recently, including campaign launch failures, delayed API connections, and inability to save audience segments. The Trade Desk has been open about its goal to move 100% of clients to Kokai (85% are already using it), positioning the AI-enabled platform as a way to lower costs and optimize campaigns more effectively. But frustrated buyers say Solimar is "far more intuitive to use" than Kokai, with one declaring the migration "a f—ing disaster" and threatening to switch DSPs entirely.

Omnicom expects to close IPG deal by late Wednesday after EU approval🔒- The $13B acquisition received unconditional EU approval and is expected to close by end of business Wednesday, creating the world's largest agency holding company. The run-up has been painful—IPG has shed 3,200 employees ahead of the takeover, and industry reports suggest some individual agency brands could be retired as part of the merger. Omnicom estimates its media offerings will expand 50%-60% with the addition of IPG, with leadership citing media, healthcare, and precision marketing as key areas of growth. As this acquisition saga closes, more agency consolidation could be coming—Dentsu is reportedly mulling a sale of its international business, and Havas has shown acquisitive interest (though it recently squashed rumors of an investment in WPP).

Paramount, Comcast, Netflix submit bids for Warner Bros. Discovery - Warner Bros. Discovery received formal takeover offers from Paramount Skydance, Comcast, and Netflix ahead of a first-round deadline (Nov 20), which could mean another major consolidation move is coming in the struggling legacy media landscape. The bids reflect different strategic visions: Netflix and Comcast are targeting only the streaming assets, while Paramount wants the whole company after its previous $23.50-per-share offer was rejected. If a partial sale succeeds, WBD's cable networks including CNN and TNT Sports would spin out separately as "Discovery Global."

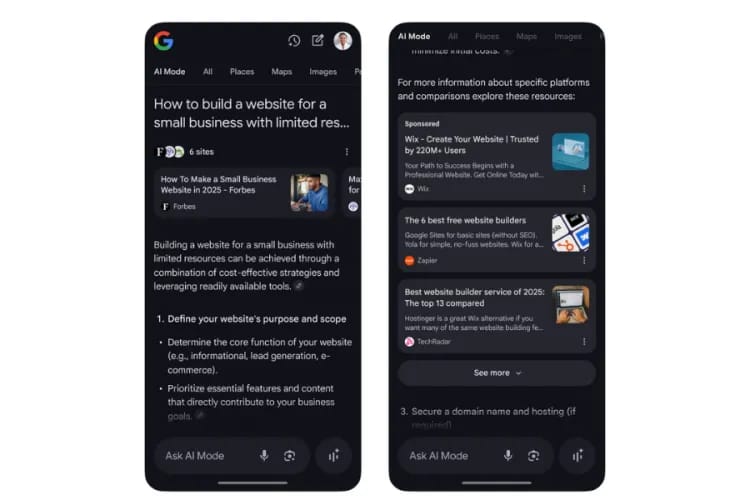

Google Ads begin surfacing inside AI Mode as tests expand - Google's months-long test of ads in AI Mode appears to be quietly expanding, with multiple industry observers spotting sponsored content embedded directly in AI-generated search answers in recent weeks. Google first confirmed desktop ad testing in AI Mode back in May, but sightings have jumped recently. The expansion signals Google is moving to normalize ads inside AI experiences ahead of what's likely to be a wider AI rollout across Google Search. For advertisers, this represents a major new ad surface that will impact visibility—everyone should be experimenting before AI ads become a mainstream channel.

Other Notable Headlines

(that you should know about too) 🤓

Ex-WPP Boss Mark Read Appointed Chair of Kantar Media - WPP launched Kantar Group in 1992 as its market research division before creating Kantar Media in 2010. Investment firm HIG Capital bought Kantar Media in January.

White House Pauses Federal AI Draft Order - The order would have tried to avoid a patchwork of conflicting state-level AI laws.

NYT Advertising Blows Past Google Search To Build Its Own Destiny - The New York Times has developed BrandMatch, gen AI-powered targeting tech that has been used in 150 client campaigns.

Nvidia’s quiet ad tech deals point to its next big move in AI🔒- Nvidia is pushing into the open web’s ad and publishing stack through partnerships with SSP PubMatic and search optimization company Next Net. The world’s most valuable company wants a piece of ad tech!

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!