December 4th-December 10th // Estimated Reading Time: 13 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. It’s an end-of-the-year, holiday-season, shopping spree!

Check Out Ryan Barwick’s Piece For Marketing Brew: “Shiv Gupta, ad tech’s educator, is preparing for category ‘whiplash’ in 2025”

Top Stories 👁

Omnicom to Acquire Interpublic in Deal That Will Reshape Advertising Industry🔒

Source: The Wall Street Journal

December 9th, 2024

Summary: Omnicom Group's all-stock deal for Interpublic Group (IPG) would create the world's largest agency holding company. The merger of the industry's third- and fourth-largest agency holding companies would collectively generate more than $20B in net annual revenue and help them better compete against Publicis, Google, Meta, and other tech platforms that are expected to encroach into their territory with the rise of generative AI.

The deal values IPG at more than $13B and will likely close in the second half of 2025 if it passes government scrutiny. Omnicom and IPG expect cost synergies of around $750M within two years. The merger will bring together the Omnicom Media Group and Mediabrands ad-buying units, as well as storied agencies TBWA, BBDO, and FleishmanHillard from Omnicom and Weber Shandwick, McCann, and FCB from IPG.

The combined company will operate under the Omnicom brand led by Omnicom Chairman and Chief Executive John Wren. Omnicom's Phil Angelastro will continue as CFO. IPG CEO Philippe Krakowsky and President and COO Daryl Simm will be co-presidents and COOs of Omnicom.

IPG's shares rose 7% after the acquisition was announced, while Omnicom's fell nearly 9%. Even with the boost, IPG's stock is flat for the year, while OMG's has increased about 15%. In comparison, industry leader Publicis has seen its shares soar about 33% in 2024, driven by a slew of client wins and well-executed tech and acquisition strategy that includes digital consultancy Sapient, data firm Epsilon, and influencer marketing platform Influential.

Omnicom bought e-commerce company Flywheel for $835M earlier this year but has otherwise opted for smaller acquisitions. It was reportedly attracted to IPG's Acxiom business, which IPG acquired in 2018 for $2.3B, giving it a foothold in data management tech

Last week, IPG sold the digital experiences company Huge to private investment firm AEA Investors for an undisclosed price tag. It also recently bought Intelligence Node, a retail analytics firm based in Mumbai in a deal valued at nearly $100M.

Deal Grades:

IPG: C

Omnicom: B-

Opinion: There’s only one agency holding company that has been kicking ass in recent years, and that’s Publicis. IPG and OMG have done just OK, while WPP and Denstu have been sucking wind:

Is it possible that the thought process behind the merger is as simple as follows?

“We’re two of the biggest holding companies, and Publicis is beating us both right now. What if we combined forces to get more scale than Publicis, use that scale to throw our weight around, get better rates, win new business based on better rates, get even more scale, get even better rates, and keep going and going and going?!”

Maybe! After all, it’s not rocket science, it’s just agency business.

But that logic may not work in today’s day and age. That’s pre-AI agency M&A calculus. In 2024 and 2025, when investors look at a mega-huge agency tie-up, they are going to be expecting synergies that go way beyond getting better rates. AI means that M&A can’t just deliver 1+1=3 — it now needs to deliver 1+1=10. Investors are going to expect AI to amplify the value of everything: data assets, people, capabilities, and tech. Can two massive, slow-moving organizations pull off that kind of transformation and meet Wall Street’s expectations? Doubtful.

Another angle to consider:

Omnicom stayed on the sidelines when the hold cos started acquiring data tech (Publicis -> Epsilon, Dentsu -> Merkle, IPG -> Acxiom). This merger gives Omnicom data tech.

IPG stayed on the sidelines when hold cos started acquiring commerce media tech (Publicis -> CitrusAd, OMG -> FlyWheel Digital). This merger gives IPG commerce media tech.

Now “Intercom” has both data and commerce media tech and can (theoretically) go toe to toe with Publicis.

Big picture, we think this deal is dumb. These agency hold cos are already poorly run, overly complex, and bloated. Integration will be long and painful. There will be vicious politicking, rampant confusion, and morale will plummet. Clients will be unhappy. And remember, agency business is fickle. By the time it’s all said and done, 2+2 could equal 3. Or less.

Other big hold cos and major indie agencies are probably salivating at the new business opportunities that are going to shake loose from this deal...

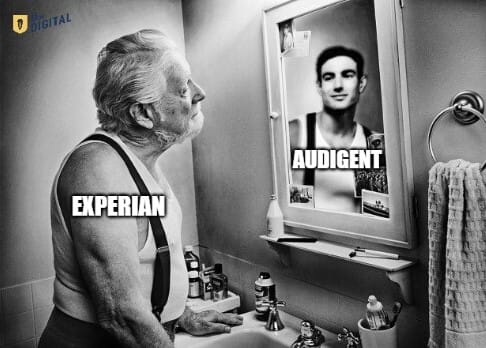

A sign of things to come: Experian’s acquisition of Audigent highlights curation’s rising influence🔒

Source: Digiday

December 5th, 2024

Summary: Audigent is a data activation, curation, and identity platform that partners closely with publishers. The deal, which Digiday sources pegged at $200M to $250M, would give Experian, a global credit reporting and identity / data company, more precise identity solutions and a foothold in the popular curation market. Specifically, Experian hopes to build on its "holistic identity activation technology," which will become all the more important as the third-party cookies continue to disappear. Audigent has been looking for a buyer for a while and has collaborated with Experian since 2022, when Audigent began integrating Experian’s identity and audience data into its private marketplace offering SmartPMP. Audigent will continue to operate as a stand-alone company until Experian figures out how to integrate the brand into its ad tech stack.

Deal Grades:

Experian: B+

Audigent: B+

Opinion: Experian collects data on consumers through various financial and credit monitoring services. It uses that data to sell targeting and identity solutions to marketers. But it’s a little old-fashioned and the marketing angle is mostly offline to online data linkage. Audigent collects data on consumers by helping publishers analyze and monetize their audiences. It uses that data to sell targeting and and identity solutions to marketers. But it’s new-fashioned and the angle is all about online to online data linkage. If you squint hard enough, these companies are analogs of each other and a mashup makes lots of sense.

Experian benefits from acquiring Audigent in the following ways:

Direct data relationships with publishers

More data of the digital variety to sell

More party data of the digital variety to fuel their ID resolution service

A foothold in the hot, growing, programmatic curation space

Net new customers, partners, integrations, and revenue!

Did Experian pay the right price to acquire the modern, digital version of their business? We’re not sure. But we like their thinking!

Now they just have to make sure the company is given the proper runway to be itself and help modernize Experian, instead of the other way around…

Other Notable Headlines ✍

LoopMe Acquires Chartboost from Zynga - UK-based ad tech company LoopMe will buy mobile advertising and monetization platform Chartboost for an undisclosed price. LoopMe bills itself as an AI-powered, brand and performance platform that will grow via acquisitions after its gross revenue enjoyed a "fully organic" 40% compound annual growth rate between 2018 and 2023. LoopMe says adding Chartboost will help it significantly deepen its footprint in the mobile app and gaming ecosystem, expand its SDK network, and generally enhance its platform. The deal will also give LoopMe a bigger presence in the US. Gaming publishers use Chartboost's mediation tech; Chartboost also connects audiences to brands with immersive ads and has a DSP. Zynga, a publishing label of Take-Two Interactive Software, has been looking to sell Chartboost🔒 to focus on premium gaming. AppLovin was also rumored to be a potential suitor. Chartboost was part of Take-Two's $12.7B acquisition of Zynga in 2022, a year after Zynga bought Chartboost for $250M.

TikTok asks federal appeals court to bar enforcement of potential ban until Supreme Court review - TikTok wants the federal appeals court to stop the Biden administration from enforcing the law that would force a sale or ban of the platform until the Supreme Court has a chance to review its challenge. The law, passed by Congress in April, gives TikTok's parent company ByteDance a Jan. 19 deadline to sell the short-form video platform due to national security concerns. Last week, TikTok failed to get the law overturned when a federal appeals court upheld the ban. TikTok says that more than 170M US users would be affected by a ban, and it would lose 29% of its global targeted ad revenue in 2025. Frank McCourt's Project Liberty is a consortium he has put together to make a bid for TikTok. So far, they seem to have raised $20B (which doesn’t seem like it would be nearly enough).

Nielsen, TikTok Strike Measurement Pact - TikTok may be fighting for its life in the US, but it's still making moves, including this partnership with Nielsen. TikTok will integrate with Nielsen ONE, Nielsen's new product that aims to provide deduplicated measurement of ads across screens. Adding TikTok to the mix will help advertisers and agencies compare ad performance on TikTok with ads on other screens, including digital, connected TV, and linear. Nielsen has been under pressure to improve its methodology and maintain a leadership position in measuring audiences. The Media Rating Council recently accredited its integration of live streaming data into Nielsen's national TV ratings measurement. But Nielsen still faces pushback from some broadcasters, including Paramount Global, owner of CBS, which stopped using Nielsen due to cost.

Trump Taps Vance Aide Gail Slater as Top DOJ Antitrust Cop - Slater is an Oxford-educated economic policy adviser to Vice President-elect JD Vance who would replace Jonathan Kanter as assistant attorney general for antitrust. Slater has been described as "a pro-enforcement, populist Republican," especially for tech, and some see her as likely maintaining the Biden administration's aggressive antitrust approach. She previously worked as a tech policy adviser on the National Economic Council and spent a decade at the FTC, including as an adviser to Julie Brill, a former Democratic FTC commissioner. She's also had stints at the now-defunct trade group the Internet Association, Fox Corp., and Roku. She'll have to deal with several high-profile cases and potential mergers once she's sworn in, including Google's search and antitrust cases and Capital One's proposed acquisition of Discover. Trump also named Andrew Ferguson head of the FTC to replace the outgoing Lina Khan. While many think Trump’s administration will be pro business and ease up on regulations and enforcement, Trump’s rhetoric indicates that he will continue to be aggresive with big tech.

Global ad revenue to top $1 trillion, dominated by Google and Meta - GroupM predicts that Google, Meta, ByteDance, Amazon, and Alibaba will capture more than half of the digital ad revenue this year, which will exceed $1 TRILLION for the first time ever. That's a 9.5% increase over 2023, with digital advertising accounting for the lion's share. In 2025, digital advertising is projected to comprise 82% of all ad revenue. In the US, ad revenue is expected to hit $379B. In China, ad revenue will grow by an estimated 13.5%, reaching $204.5B. GroupM says economic uncertainty and geopolitical risks may put some pressure on ad spend, but those headwinds may be offset by automation and breakthroughs in AI. GroupM, the media investment arm of WPP, expects tech platforms to take a greater share of ad spend in the coming years as AI continues to advance.

LG Ad Solutions Renews Global Partnership with Magnite - LG will continue to use Magnite as its global SSP. Advertisers will be able to access LG ad inventory directly via Magnite’s ClearLine, without having to use a DSP. LG will also expand the usage of Magnite’s SpringServe to serve ads on other LG devices, such as smart refrigerators, digital signs, etc.

Uniphore acquires ActionIQ and Infoworks - The M&A train continues chugging along — especially when it comes to AI. Uniphore, a conversational AI and automation company has scooped up two companies — ActionIQ and Infoworks — as it works to build its “zero data AI cloud.” The company says this type of platform helps organizations address data access, accuracy, flexibility, data sovereignty, and other major barriers to AI adoption. ActionIQ will lend its experience in customer data management to the effort, while Infoworks brings its data engineering and automation chops to make it easier to clean and prep data for AI analysis. Meanwhile, CRM player Hubspot has acquired Frame AI, an AI-powered conversation intelligence platform that turns unstructured data like emails and meetings into real-time insights and actionable recommendations.

Other Notable Headlines

(that you should know about too) 🤓

OpenAI releases Sora, its buzzy AI video-generation tool - When a user types out the kind of scene they want, Sora creates a high-definition video clip.

Perplexity Adds The Independent, LA Times, Blavity, and Others to Its Publisher Revenue-Sharing Program - The publishers will receive revenue when their content is shown alongside ads on Perplexity’s AI search platform.

Condé Nast Culls Its C-Suite in Fresh Round of Layoffs🔒 - It's not clear how many employees received pink slips. Those impacted include Chief Business Officer Eric Gillin; Chief Business Officer Craig Kostelic; Senior VP of Global Commercial Marketing Eric Johnson; and Global VP of events Krista Boyd, among others.

Bluesky CEO Jay Graber isn’t ruling out advertising - Bluesky’s CEO says it's not "necessarily true" that the Twitter copycat will always be ad-free, but it wants to avoid a model "where the user's attention is the product."

EBay Stock Slides After Analysts Warn of Slowing Ad Revenue Growth - Jefferies downgraded the stock from "hold" to "underperform" because ad revenue is "decelerating" and marketing investments are increasing.

Brussels probes Google and Meta secret ads deal to target teens - In August, an FT investigation found that Meta and Google covertly ran campaigns that targeted 13- to 17-year-olds with Instagram ads on YouTube.

Mondelez made a takeover approach for Hershey, sources say - Mondelez also tried to mount a takeover bid for Hershey in 2016, but the company's board rejected it. Let’s see what happens this time…

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!