January 29th-February 4th // Estimated Reading Time: 9 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. IT’S Q4 EARNINGS SEASON!!!

U of Digital Will Be Running A Training Workshop At A Live Event For The First Time Ever.

Join Us At Marketecture Live on March 17th For A Fun Session On The Identity Landscape. REGISTER NOW!

Top Stories 👁

Alphabet (👎): Revenue was up nearly 12% to $96.47B, missing estimates. Google advertising, search, and YouTube ad revenue growth have all slowed year over year, and cloud revenue missed expectations. Alphabet will invest $75B in capital expenditures for AI; shares fell 9%.

Meta (👍): Revenue was up 21% to $48.39B, beating estimates, with most of it driven by advertising ($46.8B). Daily active users reached 3.35B. Meta will invest heavily in AI infrastructure; the Meta AI chatbot topped 700M monthly active users. Shares rose slightly.

Microsoft (👎): Revenue was up 12% to $69.63B, beating estimates. AI is delivering $13B in annual revenue, but cloud revenue growth has slowed. Bing ad revenue was up 21%. Microsoft's guidance for the current quarter missed expectations, sending shares 5% lower.

Spotify (👍): Revenue was up 16% to $4.4B, beating estimates. Gross profit was up 40%, helping the streaming giant record its first full year of profitability. Ad-supported revenue was up 7%. Monthly active users reached 675M. Shares rose 13%.

Snap (👍): Revenue was up 14% to $1.56B, beating estimates. Daily active users reached 459M, helped by TikTok's uncertainty. Ad revenue was up 10% to $1.41B. Snapchat+ reached 14M subscribers, with $500 annual revenue. Shares rose 12% in after-hours trading.

Apple (👍): Revenue was up 4% to $124.3B, beating estimates. Services revenue, which includes advertising, was up 14% to $23.12B. IPhone sales dipped but were better in countries where Apple Intelligence (Apple’s AI system) is available. Shares rose 3% in extended trading.

Publicis (👍): Organic net revenue was up 6.3% to $14.35B in Q4, beating estimates, and 5.8% in 2024. Publicis is the largest agency holding company by annual net revenue and growing 3x faster than peers. Publicis predicts 2025 organic growth of 4%-5%. Shares rose nearly 2%.

Omnicom🔒 (🤷): Organic revenue was up 5.2% to $4.3B, beating estimates, and up 5.2% to $15.7B in 2024. The agency holding company expects shareholders to approve its acquisition of IPG in March, and the deal is expected to close in the second half of the year. Shares fell 3%.

Comcast (👎): Revenue was up 2% to $31.92B, beating estimates. Peacock revenue was up 30% to $1.3B, and the streamer narrowed its losses by 54%. Peacock has 36M subscribers, missing estimates. Comcast lost 139K residential broadband customers. Shares fell 11%.

Fox (👍): Revenue was up 20% to $5.1B, beating estimates. Ad revenue was up 21% to $2.4B, due to political spending and live sports. Super Bowl ads are running $8M, so next quarter will be big too. Fox will launch a streaming service; few details were available. Shares rose 4%.

Opinion: In this first batch of Q4 earnings reports, 60% of the companies did pretty well, with investors rewarding their performance. Awesome! Of course, one of the big misses was Alphabet, which casts a cloud of uncertainty on the entire industry. We’ll be watching the company closely this year as it grapples with antitrust pressure and declining search market share. Perhaps it’s just an outlier at this point and doesn’t represent the trajectory of the entire market like it used to. With that said, some companies, including the large agency holding companies, are predicting slower growth in 2025, which is notable considering their proximity to marketers’ ad spend…

Other Notable Headlines ✍

Paramount, Nielsen strike multi-year measurement deal ending bitter standoff - Under the new agreement, Nielsen will provide ratings for all Paramount properties, including broadcast channels, cable networks, and streaming services. CBS used Nielsen's ratings data from the 67th Grammy Awards held a few days ago and will continue to do so for all live events, including NFL playoff games and the Golden Globe Awards. Paramount will use Nielsen's recently accredited Big Data + Panel product, which incorporates panel data with streaming data from smart TVs and streaming services. The deal ends a contentious four-month standoff over Nielsen's pricing.

While this is a big win for Nielsen, we have to wonder: will more broadcasters and networks follow in the footsteps of Paramount and hold Nielsen hostage for better pricing?

Canada’s StackAdapt snaps up $235M for its AI-based programmatic platform - The funding round is among the largest ever for a Canadian startup. It gives StackAdapt, a rising demand-side platform (DSP), an estimated $2.5B billion valuation with $500M in annual revenue. This funding round is unique in that it was led by Teachers’ Venture Growth, a late-stage venture and growth investment arm of the Ontario Teachers’ Pension Plan, and is joined by five other investors. Launched in 2014, StackAdapt also raised $300 million in 2022. Like many ad tech companies StackAdapt has leaned into AI to help customers use automation to improve cost-effectiveness of their media and operations.

The Latest On Chrome’s Cookie Choice Prompt (It’s Gonna Be ‘Global’) - At the recent IAB Annual Leadership Meeting, Google’s Privacy Sandbox VP, Anthony Chavez, said during a workshop that Chrome's third-party consent mechanism would be “a one-time global prompt.” This suggests that the consent mechanism won't be offered for every site, as was done when Apple rolled out its App Tracking Transparency (ATT) policy. The details are pretty scant, but Chavez did say that advertisers and publishers would have several months to get ready for the prompt's release. He didn't say when it would go live. It remains to be seen if this will totally decimate third-party cookies and whether UK regulators overseeing Google's third-party cookie plans will sign off on the approach.

Ad tech startup tvScientific raises $25.5M - Advertisers use tvScientific's platform to target and measure CTV ads. The company’s value proposition is centered on “performance-focused television.” They hope to bring the top 10% to 15% of search and social advertisers over to CTV, offering capabilities they're used to using in digital advertising, like campaign measurement and optimization. CTV, of course, is a major growth area in the industry, with spending predicted to reach $47B by 2028. The company will use the new funding to invest in data science and engineering, and expects to reach profitability before raising more money. It has previously raised nearly $31 million. Roku was part of this round.

Snapchat Launches Ad-Free Subscription Plan - Snapchat's new Platinum Monthly Plan for Snapchat+ will allow subscribers to ditch ads on the platform. It costs $15.99 per month, significantly more than the cost of Snap's existing Snapchat+ subscription ($2.50 per month). According to Snap, the Platinum Monthly Plan “lets you enjoy Snapchat+ with no Sponsored Snaps, and no Story or Lens ads.” It looks like this is the only difference between the two options. The platinum plan, however, isn't completely ad-free—platinum subscribers could still see sponsored places and My AI responses, but their experience navigating the app will be free of ads. The regular Snapchat+ subscription plan has more than 14 million users, making it one of the most successful subscription offerings of any social media platform, raking in $500M in annual revenue. Who knows if subscribers are willing to fork over much more for the new Platinum tier.

Microsoft says it has a revamped strategy to tackle retail media - Microsoft says it hasn't given up on retail media, even though it shut down its PromoteIQ retail media platform last year. Its partnership with Criteo will be a big part of the strategy moving forward. At CES, Microsoft unveiled two new retail media products: Curate for Commerce and Sponsored Promotions by Brands. Curate for Commerce allows brands to use retailer data for ad targeting across the web. Sponsored Promotions by Brands allows brands to target shoppers on Microsoft properties like Bing.

Google opens Meridian, its marketing measurement tool, to all users - Google's open-source marketing mix model (MMM) is meant to help marketers better and measure performance across channels. More than 20 certified measurement vendors can help marketers implement Meridian, which will integrate with Google's MMM Data Platform. While traditional MMM tools have failed to accurately capture performance of search and other digital advertising channels, Google built Meridian to go beyond impressions to capture reach and frequency while better measuring performance. To get started, marketers can download the code for immediate access to the framework.

X Adds Abbott, Colgate, Lego, Nestle, Pinterest, Shell, Tyson To Ad Boycott Complaint - X originally sued the World Federation of Advertisers (WFA), its now-defunct Global Alliance for Responsible Media (GARM), and some advertisers last summer, claiming that they all conspired to boycott X, depriving it of ad revenue and breaking antitrust laws. Now, X has amended the lawsuit and added more brands. The initial lawsuit spurred quick action: Rather than defend it, WFA shut down GARM. Since then, X has been settling with some brands named in suit, seemingly in exchange for them returning to the platform. With Musk being tight with President Trump, the political brown-nosing has been fascinating to watch. For example, Apple is said to be considering returning to X, and Amazon has increased its ad spend on the platform after yanking much of it more than a year ago.

Poor Zuck, he’s trying so hard…

Other Notable Headlines

(that you should know about too) 🤓

Outbrain completes acquisition of Teads - Outbrain paid $900M for Teads in a bid to build a unified, full-funnel, omnichannel ad platform. The new company will be called Teads with a new tagline “Elevated Outcomes” while the Outbrain brand is retired. Makes sense; video ads are cooler than native ads.

AMC Networks Launches Outcome-Based Ad Tool To Help Brands Gauge Consumer Response To Their Spending - The new AMCN Outcomes tool is built on Audience+, AMC's data platform used to create audience segments and target viewers.

Viant and TransUnion Partner to Enrich Viant Household ID - Viant says it can now match its Household ID to 95% of US adults thanks to this partnership.

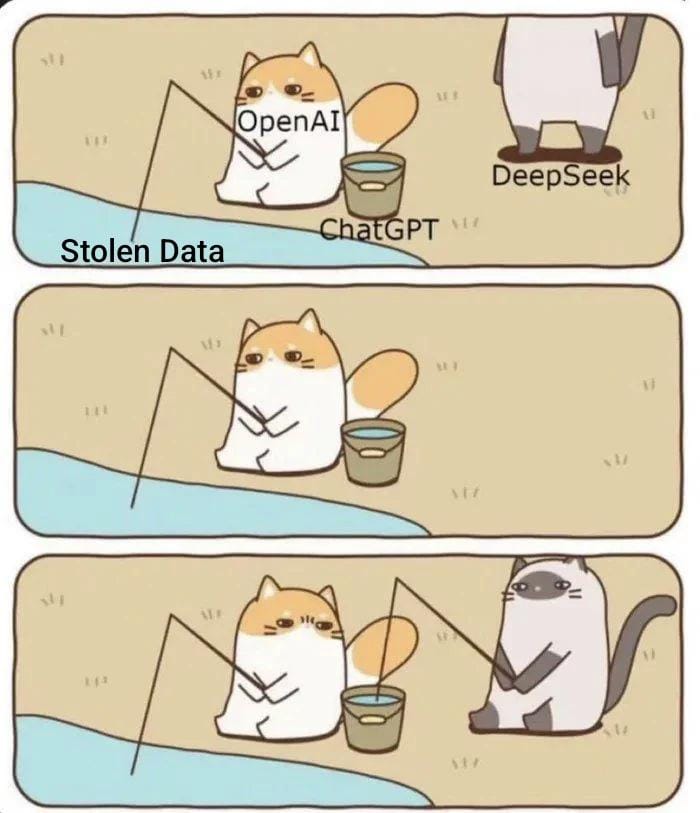

OpenAI says DeepSeek may have 'inappropriately' used its data - That’s pretty rich coming from the company that’s been accused of improperly using other companies’ data to train ChatGPT!

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!