April 9th-April 15th

Below is a roundup of last week’s notable industry news, with summaries and our opinions. Zuck’s back in court…

U of Digital Launches The “AI Accelerator” To Empower Your Team to Thrive in the AI Era.

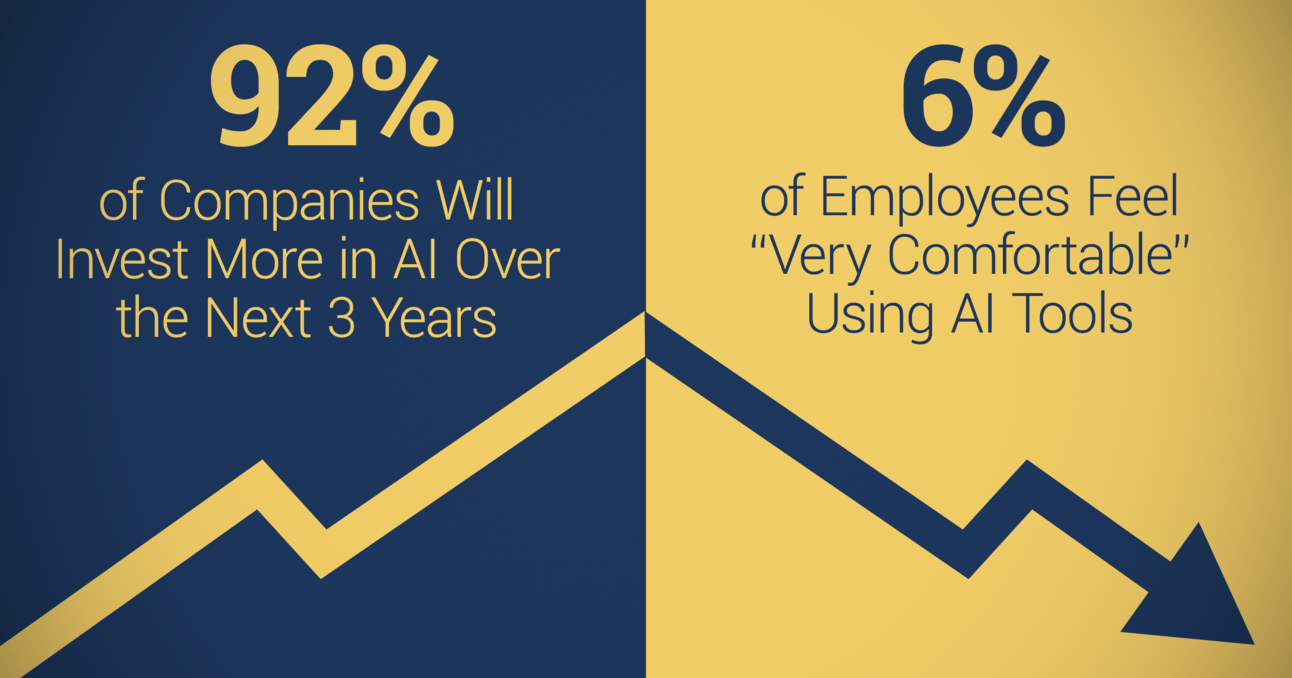

Teams that master AI will own the future. Yet, 54% of marketers feel overwhelmed by AI implementation (per eMarketer). U of Digital’s AI Accelerator gives your team the skills and mindset to seamlessly integrate AI—so they can move faster, think bigger, and drive real results.

Learn more about the U of Digital AI Accelerator here.

Contact us to enroll your team!

Top Stories 👁

Mark Zuckerberg Takes Stand to Defend Meta Against Antitrust Suit🔒

Source: The New York Times

April 15th, 2025

Summary: Mark Zuckerberg testified Monday and Tuesday in what could be the most consequential threat to Meta's business empire in its 21-year history. The FTC's antitrust trial centers on whether Meta illegally built a social media monopoly by acquiring Instagram (2012) and WhatsApp (2014) as part of a "buy-or-bury strategy" to eliminate competitors. The FTC argues that Instagram and WhatsApp would have become meaningful competitors had Meta not bought them.

The trial could fundamentally reshape Meta and the digital advertising landscape. If the FTC is successful, Meta could be forced to sell off Instagram and WhatsApp, torpedoing its $1.3T ad business (Instagram is projected to make up more than 50% of Meta’s US ad revenue in 2025 per eMarketer). The stakes are also high for advertisers, who could see their "one-stop shop" approach to media buying across Meta's properties eliminated, requiring both small and large brands to significantly rethink their ad strategies.

Zuckerberg has had to explain potentially damning internal emails, including a "smoking gun" exchange that mentioned Instagram's threat and "neutralizing a potential competitor." In another email, Zuckerberg wrote: "Instagram was growing so much faster than us that we had to buy them for $1 billion."

While the FTC must prove that Meta wouldn't have achieved its dominance without the Instagram and WhatsApp deals, Meta is countering that it faces intense competition from TikTok, YouTube, and other platforms, giving consumers and advertisers many options. The FTC says Meta has monopolized "personal social networking," with Snapchat being the only comparable platform. (Meta tried to buy Snapchat too.) Meta says its market includes entertainment, with video accounting for more than half of Facebook and Instagram engagement, pitting them directly against TikTok.

Zuckerberg tried to settle the case for $450M, a fraction of the $30B sought by the FTC. He was confident that he'd get back-up from Trump, but FTC Chairman Andrew Ferguson wouldn't budge for less than $18B and a consent decree. Instead, Zuckerberg is getting an eight-week trial that will feature testimony from high-profile witnesses including former COO Sheryl Sandberg and Instagram co-founder Kevin Systrom.

Below are some helpful resources that are providing regular, blow-by-blow coverage of the trial:

Opinion: Let's state the obvious first: breaking up Meta could create healthier competition and innovation in digital advertising. More players competing for ad dollars should lead to better products, lower pricing, more innovation and creativity—all things the industry should welcome.

But the uncomfortable reality: the short-term pain for advertisers would be significant. A Meta breakup would fragment the industry further, making targeting and measurement harder, and likely increasing costs as efficiency drops. Media teams would need separate strategies across newly independent platforms, multiplying workloads without corresponding performance gains.

Don’t forget: Google faces its own antitrust challenges with potential Chrome divestiture or ad tech restructuring. Both dominant digital ad players could be split up simultaneously—creating chaos (or massive opportunity, depending on your perspective).

Winners might include Amazon and Yahoo (stability in chaos), ad tech middlemen like The Trade Desk and Magnite (suddenly essential again), and agencies (complexity = fees). Losers would be small businesses dependent on Meta's self-serve simplicity and performance marketers who've optimized around unified platforms.

The big question: is better competition worth the temporary disruption? Especially during a time of global economic instability? For the long-term health of digital advertising, perhaps.

For 2025 digital ad spend? No.

Paid Subscribers See ALL The Digital Advertising News.

Thank you for reading the U of Digital Newsletter.

Continue reading by upgrading.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!