April 9th-April 15th // Estimated Reading Time: 11 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. Zuck’s back in court…

U of Digital Launches The “AI Accelerator” To Empower Your Team to Thrive in the AI Era.

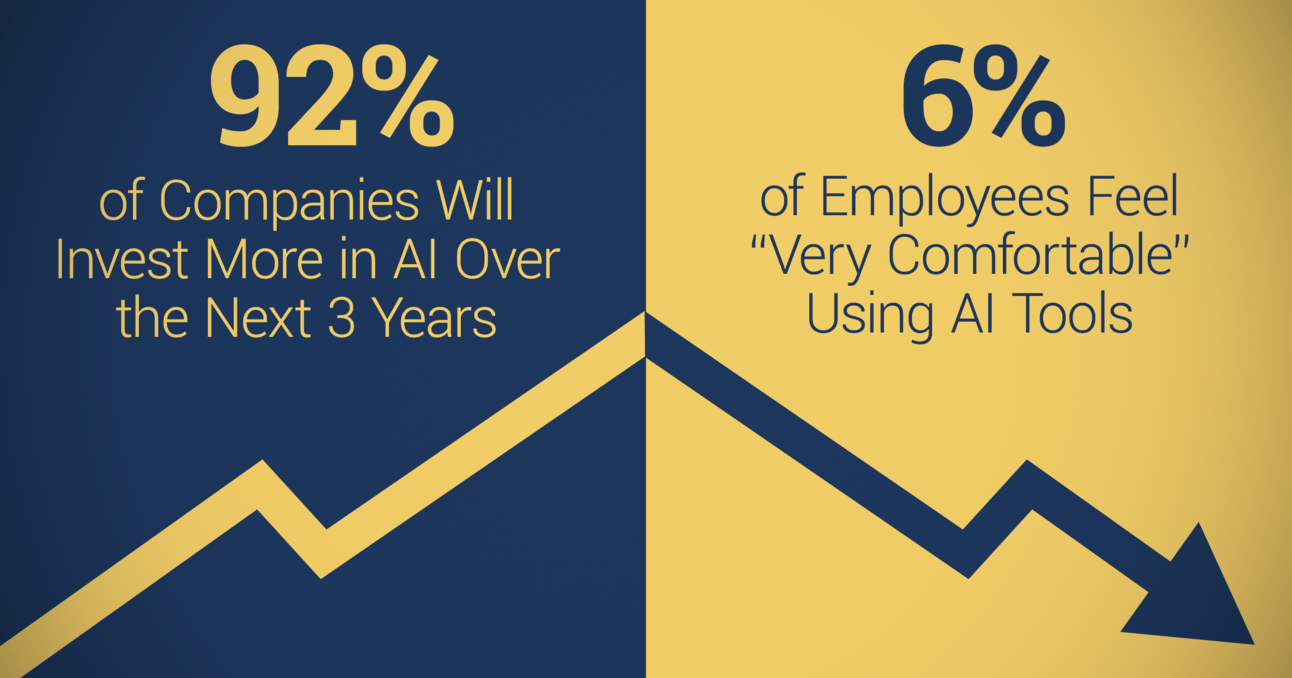

Teams that master AI will own the future. Yet, 54% of marketers feel overwhelmed by AI implementation (per eMarketer). U of Digital’s AI Accelerator gives your team the skills and mindset to seamlessly integrate AI—so they can move faster, think bigger, and drive real results.

Learn more about the U of Digital AI Accelerator here.

Contact us to enroll your team!

Top Stories 👁

Mark Zuckerberg Takes Stand to Defend Meta Against Antitrust Suit🔒

Source: The New York Times

April 15th, 2025

Summary: Mark Zuckerberg testified Monday and Tuesday in what could be the most consequential threat to Meta's business empire in its 21-year history. The FTC's antitrust trial centers on whether Meta illegally built a social media monopoly by acquiring Instagram (2012) and WhatsApp (2014) as part of a "buy-or-bury strategy" to eliminate competitors. The FTC argues that Instagram and WhatsApp would have become meaningful competitors had Meta not bought them.

The trial could fundamentally reshape Meta and the digital advertising landscape. If the FTC is successful, Meta could be forced to sell off Instagram and WhatsApp, torpedoing its $1.3T ad business (Instagram is projected to make up more than 50% of Meta’s US ad revenue in 2025 per eMarketer). The stakes are also high for advertisers, who could see their "one-stop shop" approach to media buying across Meta's properties eliminated, requiring both small and large brands to significantly rethink their ad strategies.

Zuckerberg has had to explain potentially damning internal emails, including a "smoking gun" exchange that mentioned Instagram's threat and "neutralizing a potential competitor." In another email, Zuckerberg wrote: "Instagram was growing so much faster than us that we had to buy them for $1 billion."

While the FTC must prove that Meta wouldn't have achieved its dominance without the Instagram and WhatsApp deals, Meta is countering that it faces intense competition from TikTok, YouTube, and other platforms, giving consumers and advertisers many options. The FTC says Meta has monopolized "personal social networking," with Snapchat being the only comparable platform. (Meta tried to buy Snapchat too.) Meta says its market includes entertainment, with video accounting for more than half of Facebook and Instagram engagement, pitting them directly against TikTok.

Zuckerberg tried to settle the case for $450M, a fraction of the $30B sought by the FTC. He was confident that he'd get back-up from Trump, but FTC Chairman Andrew Ferguson wouldn't budge for less than $18B and a consent decree. Instead, Zuckerberg is getting an eight-week trial that will feature testimony from high-profile witnesses including former COO Sheryl Sandberg and Instagram co-founder Kevin Systrom.

Below are some helpful resources that are providing regular, blow-by-blow coverage of the trial:

Opinion: Let's state the obvious first: breaking up Meta could create healthier competition and innovation in digital advertising. More players competing for ad dollars should lead to better products, lower pricing, more innovation and creativity—all things the industry should welcome.

But the uncomfortable reality: the short-term pain for advertisers would be significant. A Meta breakup would fragment the industry further, making targeting and measurement harder, and likely increasing costs as efficiency drops. Media teams would need separate strategies across newly independent platforms, multiplying workloads without corresponding performance gains.

Don’t forget: Google faces its own antitrust challenges with potential Chrome divestiture or ad tech restructuring. Both dominant digital ad players could be split up simultaneously—creating chaos (or massive opportunity, depending on your perspective).

Winners might include Amazon and Yahoo (stability in chaos), ad tech middlemen like The Trade Desk and Magnite (suddenly essential again), and agencies (complexity = fees). Losers would be small businesses dependent on Meta's self-serve simplicity and performance marketers who've optimized around unified platforms.

The big question: is better competition worth the temporary disruption? Especially during a time of global economic instability? For the long-term health of digital advertising, perhaps.

For 2025 digital ad spend? No.

Other Notable Headlines

Potential buyers are probing Yahoo’s ad tech assets🔒- Yahoo's demand-side platform is attracting interest from investment banks and potential buyers, including a rival DSP. Owner Apollo Global Management has been considering selling the DSP for some time. In the meantime, Yahoo’s DSP business has been ascending, squarely in the DSP “winner’s circle” with The Trade Desk, Google DV360, and Amazon DSP. Since acquiring Yahoo for $5B, Apollo has already shuttered its supply-side platform and partnered with Taboola to power native ads across its properties. The potential sale represents another chapter in Yahoo's journey, from Verizon's failed "content + ad tech + mobile data" vision to a more streamlined business under private equity. While it’s tempting to interpret this as “DSP business must be a slog if Apollo wants to get out of it, despite Yahoo’s success”, it’s important to remember that this is what private equity does: Buy low, sell high. The interpretation should be “Yahoo DSP is killing it, time for Apollo to sell!”

Walmart Connect’s first Vizio play— bringing CTV inventory to retail advertisers🔒- Walmart Connect will begin beta testing a solution that will let advertisers "directly plug in and access" Vizio's connected TV ad inventory. It's the first product to emerge from Walmart's $2.3B acquisition of Vizio, which closed in late 2024. The deal marries Walmart's extensive shopper data with Vizio's viewing data and CTV ad inventory, which could give advertisers more precise ad targeting and boost Walmart Connect’s off-site ad business (of which CTV is the fastest growing component). Walmart Connect previously accessed that CTV inventory through its partnership with The Trade Desk, which operates Walmart Connect's DSP. Walmart is pushing the Vizio team to continue investing in its proprietary operating system Smartcast to improve functionality and discovery. It wants to push other TV manufacturers to use Smartcast to grow its CTV inventory and data footprint. This further cements that Walmart’s acquisition of Vizio was about advertising, not selling TVs.

Apple rebrands its advertising business as 'Apple Ads' - Sorry, Apple Search Ads, you’re now part of a larger suite of ad products called Apple Ads. The rebrand is yet another sign of Apple's ad ambitions, which have shifted into a higher gear in recent years. The company launched Apple Search Ads in 2016, when it offered just one ad at the top of the App Store's search results. In 2022, Apple expanded its ad inventory with new slots in the App Store's Today tab, as well as a "You Might Also Like" slot under its app listings. There is speculation that Apple may launch paid search ads in Apple Maps, and it partnered with Taboola last year to power native ads in the Apple News and Apple Stocks apps in the US, UK, Canada, and Australia. Apple has also been hiring for its ads team and rumored to be building a DSP🔒. Of course, this is all happening as Apple enforces privacy policies that tend to hurt other ad companies. Last year, Apple began testing AI to automatically optimize ad placements.

Uber Is Working With Rival Instacart To Sell Ads🔒- Uber has replaced Criteo's tech with Instacart's as part of a new strategic advertising partnership. Uber will integrate Instacart's Carrot Ads tech to power its Uber Eats ad sales in the US. The partnership enables CPG brands to run campaigns across both platforms, accessing sponsored search and shoppable display ads within Uber Eats. This may be an early sign of consolidation in retail media as advertisers seek greater scale from their campaigns. Uber Eats and Instacart are two of the biggest players in the online grocery category, with Uber's ad revenue alone topping $1B🔒last year. Alcohol brands, in particular, could benefit from this type of mashup since regulatory constraints may prevent them from advertising on some retail media platforms.

MRC Rebuts Sensational 'Fraud' Report, Says It Failed To Grasp How Brands Filter Ads Served To Bots - The Media Rating Council (MRC) says Adalytics' recent study claiming that major brands' ads were being served to non-human "bots" was flawed, based on a fundamental misunderstanding of industry practices. Adalytics shouldn't have focused solely on "pre-bid" filters, according to the MRC, because the industry uses back-end processes to filter invalid traffic after ads are served, so advertisers don’t have to pay for those impressions. The MRC says it actually discourages pre-bid filters because they can provide signals that could be used by bad actors to game the filtration process. But that raises the question, as Mediapost noted: Are brands still harmed even if they don't have to pay for their ads being served to bots? The MRC rebuttal was an unusual move, since it's never commented on Adalytics reports before, but decided to speak up about this one because some allegations crossed with its standards. Verification vendors cited in the report were accredited by either the MRC or TAG (or both).

Disney expands global ad tech platform - Disney is giving European advertisers access to its audience graph. Disney already began offering its audience graph and identity solution Bridge ID to Latin American advertisers in 2024. Advertisers can use the audience graph to target ads and reach viewers across platforms and across a growing number of regions. In another development, Disney is making it easier for advertisers to buy ads during live events running on Disney+, Hulu, and ESPN+ using the Disney ad server. Disney has also enabled dynamic ad insertion (DAI) for live events on Disney+, a feature previously available on Hulu inventory. US advertisers can now access Disney inventory through more than 35 DSPs.; Disney now supports Google DV360's Instant Deals feature through the Disney Real-Time Ad Exchange (DRAX) to help advertisers create and activate deals quickly. Disney continues to be the most innovative publisher when it comes to programmatic and ad tech monetization.

Lawsuits Allege Trade Desk Secretly Breaks US Privacy Laws🔒- Two lawsuits allege The Trade Desk violates privacy laws through unauthorized tracking and profiling. One lawsuit specifically targets Unified ID 2.0, claiming it violates California's wiretapping laws by using personally identifiable information without proper consent. The second suit positions TTD as both a DSP and data broker that "artificially inflates bid values" using consumer data. These legal challenges hit at the core of TTD's business model and come at a particularly vulnerable time as the company adjusts to disappointing Q4 results and organizational restructuring. The hits keep coming for TTD.

Other Notable Headlines

(that you should know about too) 🤓

Marin Software plans to shut down after years of decline - Once a leading search and social marketing platform, Marin is closing its doors after years of decline as competitors overtook its once-innovative offering.

BeReal launches US advertising platform led by former TikTok exec - The authenticity-focused social app that debuted in 2020 has already attracted 200 brands to its advertising platform, signaling its transition from growth-focused startup to revenue-generating business.

Big Tech fines just got political, whether the Commission likes it or not - The European Commission has delayed finalizing its Digital Markets Act (DMA) cases against Apple and Meta as Trump threatens additional tariffs in response, turning regulatory fines into political bargaining chips.

Yahoo DSP and Costco Partner to Deliver Value for Costco Members - Costco is moving deeper into commerce media with a new partnership that gives Yahoo’s advertisers access to its first-party data.

Fox News Aims to Snatch Ad Dollars From CBS, ABC, NBC in Bold Bid - The network is aggressively courting advertisers with promises of large, live audiences that rival traditional broadcast networks, positioning itself as a stable alternative in the fragmented streaming landscape.

Comscore Accredited For Demos, Becomes New Gold Standard For Local TV Ratings - Comscore received MRC approval for TV ratings with demographic data, becoming the gold standard for local TV measurement where Nielsen lost its MRC accreditation in 2021. This advances Comscore as a legitimate currency alternative in an increasingly competitive TV measurement landscape.

HubSpot Launches New and Enhanced AI Agents, Plus Over 200 Updates at Spring 2025 Spotlight - The CRM platform has introduced new AI Knowledge Base Agents to expand support resources and prospecting tools to help sales teams build pipelines.

DV360 is removing bid multipliers - Google's DSP is forcing advertisers to use either auto bidding or custom bidding starting next month, removing manual controls and pushing more campaigns toward algorithmic (i.e. black box) optimization.

Google's Vulnerability In Search Is Growing🔒- Google's search market share dipped below 90% for the first time in 10 years.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!