April 23rd-April 29th // Estimated Reading Time: 12 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. We’ll start with Q1 earnings reports (led by Google) and then do a lightning round for the rest!

U of Digital Launches The Advanced TV Essentials Online Course!

TV has undergone rapid change in the last few years, with new platforms, new rules—and an entirely new language. This 60-minute course gives you the clarity and confidence to navigate today’s TV advertising landscape, whether you’re buying, selling, planning, or supporting strategy. No technical background required.

What You’ll Get:

✅ A clear understanding of how Advanced TV fits into today’s media ecosystem

✅ Simple explanations of platforms, formats, targeting, and measurement

✅ The ability to talk about CTV confidently in meetings

✅ Real-world examples and simple frameworks

✅ A shareable digital certification to highlight your skills

Enroll for the Advanced TV Essentials Course here!

Contact us to discuss bulk rates for your team!

Q1 Earnings!

Alphabet (👍): Q1 revenue was up 12% to $90.23B, beating expectations. Ad revenue was up 8.5% to $66.89B, boosted by search ($50.7B) and YouTube ($8.93B, though slightly missing estimates). Alphabet warned of a "slight headwind" to its ads business from a trade-related policy change affecting APAC advertisers. Shares rose over 5%.

Snap (🤷): Revenue was up 14% to $1.36B, beating estimates. Ad revenue was up 9% to $1.21B, driven by direct response. Daily active users grew 9% to 460M. Snap declined to provide Q2 guidance, citing macroeconomic uncertainty and potential impacts on advertising demand. Shares fell 13% in after-hours trading.

Spotify (👎): Revenue was up 15% to ~$4.77B, missing expectations. Monthly active users (MAUs) reached 678M, beating estimates. Higher employee compensation-related taxes hit Spotify's profit margin, sending shares 7% lower.

Comcast (🤷): Q1 revenue was down .6% to $29.89B, beating expectations. Peacock subscribers reached 41M, beating estimates. Peacock's revenue was up 16% to $1.2B, which helped narrow its losses. Comcast lost 199K broadband subscribers, sending shares down nearly 4%.

WPP (👎): Organic revenue was down 2.7%, missing expectations. Performance was dragged down by significant declines in China (-17.4%) and the UK (-5.5%). WPP reaffirmed its full-year guidance of flat to -2% organic growth. Shares dipped less than 1%.

IPG (👍): Organic net revenue was down 3.6%, beating expectations. Restructuring costs and 2024 client losses have created headwinds, but the agency holding company reaffirmed its full-year guidance of a 1%-2% organic revenue decline. Shares rose about 4%.

Opinion: If there's one thing the markets don't like, it's uncertainty. Unfortunately, companies in our sector are swimming in uncertainty right now as we wait to see how Trump's trade war will play out. You know things are bad when even companies with positive performance like Snap aren't confident enough to make near-term predictions. We’ll have a better sense of whether Q2 will be a bloodbath as these earnings reports continue to roll in. Next week, we’ll cover Meta, Amazon, Roku, Criteo, and Viant.

Other Notable Headlines (⚡round)

Apple, Meta Fined by EU, Ordered to Comply With Tech Competition Rules🔒- The European Union has fined Apple $570M for not allowing app developers to tell customers about cheaper ways to buy their digital products outside the App Store. Meta was also fined $228M for forcing users to accept personalized ads on Facebook and Instagram or pay for a subscription for an ad-free experience. The EU ordered them to stop these practices within 60 days or face daily penalties of up to 5% of their daily revenue, but both companies will appeal. These are the first sanctions under the EU’s Digital Markets Act, which aims to foster competition in tech. The timing is tricky because the US and EU are in trade talks, and President Trump has previously characterized EU tech regulations as "overseas extortion." For Apple, this threatens a significant revenue stream since it takes a 30% cut of all purchases through its app store. For Meta, personalized advertising is its main moneymaker, generating $160.6B in ad revenue last year.

Opinion: These fines aren't about the money—they're about changing how these tech giants operate. The $570M and $228M fines are pocket change for Apple and Meta, but the real punch comes from the orders to change their business practices or pay recurring fines. It'll be interesting to see how the Trump administration responds and how these actions will reverberate across the larger trade talks between the US and EU. If this sticks, it could have massive implications for big tech and the ad industry.

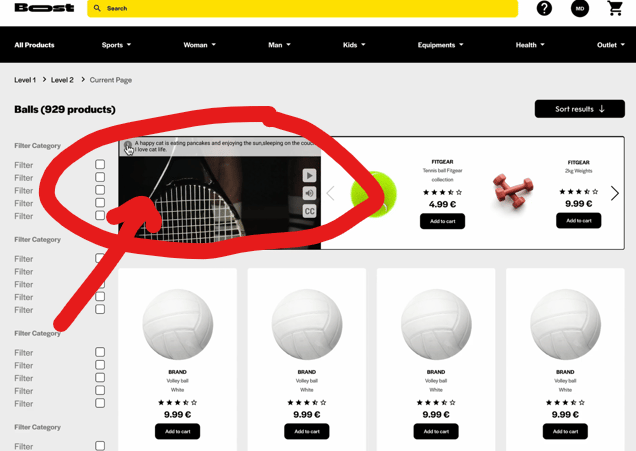

Ad Tech Firm Criteo Is Pitching Hundreds of Retailers on a New Video Ad🔒- Criteo is rolling out shoppable video ads across its network of 220 retailers. While major players like Amazon and Walmart already offer similar onsite formats, Criteo's move aims to simplify the buying process for brands by letting them buy shoppable video ads across multiple sites in one shot. In beta testing, Albertsons reported a 280% jump in clickthrough rate and a 460% sales increase when video ran alongside sponsored product ads. Sponsored video ads can show a product in action as shoppers are in discovery mode, going way beyond banner ads or sponsored product ads, which are better for shoppers who are already familiar with a product. Walmart Mexico and Costco are also testing the ads.

Opinion: This is a smart move for Criteo. Standardization is desperately needed in the commerce media landscape. Onsite video bridges the gap between upper-funnel branding and lower-funnel conversion. By offering a scalable video solution, Criteo makes it easier for brands to leverage the format's storytelling power beyond just the largest retailers. It also helps Criteo move up-funnel to capture incremental dollars.

Meta’s Threads ads arrive fast, but advertisers move at their own pace🔒- Meta pushed Threads ads live globally after a fairly short three-month test phase. The new in-feed image ads appear within Threads' text-based feed, accessible through Meta’s AI-powered Advantage+ buying tool. Meta has turned on the ads by default for new campaigns on Advantage+, but advertisers can opt out manually. Meta's brand safety and suitability filters will be applied to the new ads, and advertisers can use some of their existing Meta creative assets for Threads. Meta launched Threads in 2023 as a competitor to X.

Opinion: Despite Meta's fast rollout, we don't expect Threads ads to gain significant momentum given the platform's underwhelming user experience and scale.

As CTV Blooms, It’s Knives Out For The Trade Desk’s Take Rate - The Trade Desk's take rate (the percentage of ad spend through its system that it keeps as its revenue) has always hovered around 20%, even as other ad tech players have seen their own fees squeezed over the years. Now, competitors are taking advantage of The Trade Desk's sudden vulnerability following a down earnings report to pitch their lower take rates and fees, particularly for highly sought-after CTV inventory. Big players like Amazon DSP and Comcast's Universal Ads are aggressively cutting demand-side fees, capitalizing on their scale and owned media efficiencies to attract advertiser budgets. Simultaneously, specialized DSPs focusing on CTV like Pontiac, Viant, and Azerion are highlighting the cost savings they can offer. So far, The Trade Desk is standing firm, saying it has no plans to reduce its take rate.

Opinion: It looks like more advertisers are A/B testing The Trade Desk against Amazon DSP, which can afford to charge low rates since Amazon owns a lot of media (just like Google). One buyer told Digiday that reaching a certain audience was much cheaper using Amazon’s Complete TV product compared to a similar media plan from The Trade Desk. If the company is forced to lower prices in order to stay competitive (we think they will), that will put even more pressure on the business and stock price.

Big Tech Braces for Tariff-Induced Advertising Slowdown🔒- Growing concerns over Trump's tariffs and economic uncertainty are triggering ripples across the digital advertising industry. Tech platforms like Meta and Google face billions in potential lost ad revenue as key Chinese e-commerce clients such as Temu and Shein pull back ad spending after the closure of the "de minimis" loophole, which previously waived tariffs on imports valued under $800. So far this month, there are also ad spending slowdowns in sectors like auto and ecommerce. Major advertisers like Procter & Gamble have already cut sales forecasts, warned consumers about price hikes, and are seeing consumer pullback. Meanwhile, ad agencies report clients are deep in "scenario planning."🔒Still, IPG and Publicis have maintained their full-year forecasts.

Opinion: Now is the time for everyone to lean into the lessons learned during the pandemic. Marketers need to think through the bottom-line impacts of potential cost increases and shifting consumer demand, while prioritizing media that allows for quick pivots. Ad tech and agencies need to lean into providing advertisers with flexibility and real-time performance data to help them justify every dollar they spend.

DOJ Wants Google to Share Search Data, but Privacy Risks and Tech Hurdles Loom Large🔒- The Justice Department wants Google to share its search data with rivals like Bing and DuckDuckGo as a remedy of its search antitrust case (which Google lost). Google’s search data consists of what users click on and what they search for—hugely important information that has helped Google dominate the search market. Google's scale is also unmatched: Court records show Google handles nine times more searches than all competitors combined, and 19 times more on mobile phones. The DOJ thinks sharing this data could help other companies compete better. It's also gunning for Google to sell its Chrome browser and end deals that make it the default search engine on smartphones. The data-sharing proposal faces big problems. There are worries about keeping user information private and protecting user identity if it's shared with smaller companies that might not have strong security. Google is fighting back hard, saying these changes would hurt users and weaken America's tech position against countries like China.

Opinion: If Google's competitors gained access to this data, we might see a seismic shift in ad spending as brands test whether other search engines like Bing or DuckDuckGo could deliver better ROI with potentially lower costs. To the contrary, it could also create an unfortunate scenario where brands are paying more for worse performance across multiple platforms in aggregate, and dealing with the extra operational burden that comes with working with multiple partners that each have different targeting capabilities, privacy policies, and measurement standards. Frankly, we think this proposal is ridiculous (why should Google have to share its data with competitors?), would set a dangerous precedent, and will never fly.

Other Notable Headlines

(that you should know about too) 🤓

YouTube turns 20 and is on track to be the biggest media company by revenue - YouTube may surpass Disney as the biggest media company by revenue next year, with analysts saying its revenue could reach as much as $550M. Not bad for a $1.65B acquisition back in '06.

Meta Launches ChatGPT Rival, Meta AI App - The standalone app will use Meta's massive user data set to tailor its text, voice, and image capabilities based on individual preferences.

State Lawmakers Pass Washington Tax On Ad Services - Ad agencies would be required to collect sales tax, in the range of 7.5% to 10.6%, on their services, including creating and placing digital ads and planning digital ad campaigns.

PayPal Is Launching Programmatic Ads Powered By Shopping Data - Advertisers will be able to use PayPal's transaction data to reach more consumers beyond its own properties.

Yahoo Joins The CAPI Trend With The Launch Of Its Conversions API - Conversion APIs, aka CAPIs (pixel-less server-to-server integrations for advertisers to share their conversion data with partners) can help brands improve targeting, optimization, and measurement, especially in cookieless environments.

Meta guts virtual reality division amid mounting losses and fading hype - The metaverse belt-tightening continues. Meta laid off over 100 Reality Labs employees, hitting Oculus Studios (VR content), as the division continues bleeding billions (nearly $5B lost in Q4 alone).

Perplexity CEO says its browser will track everything users do online to sell 'hyper personalized' ads - Its upcoming Comet browser, due in May, will track purchases, travel, and general browsing. Perplexity CEO Aravind Srinivas believes users will accept this level of tracking in exchange for more relevant ads. Fascinating to see a huge, consumer-facing AI company so brazenly talk about tracking users for advertising purposes.

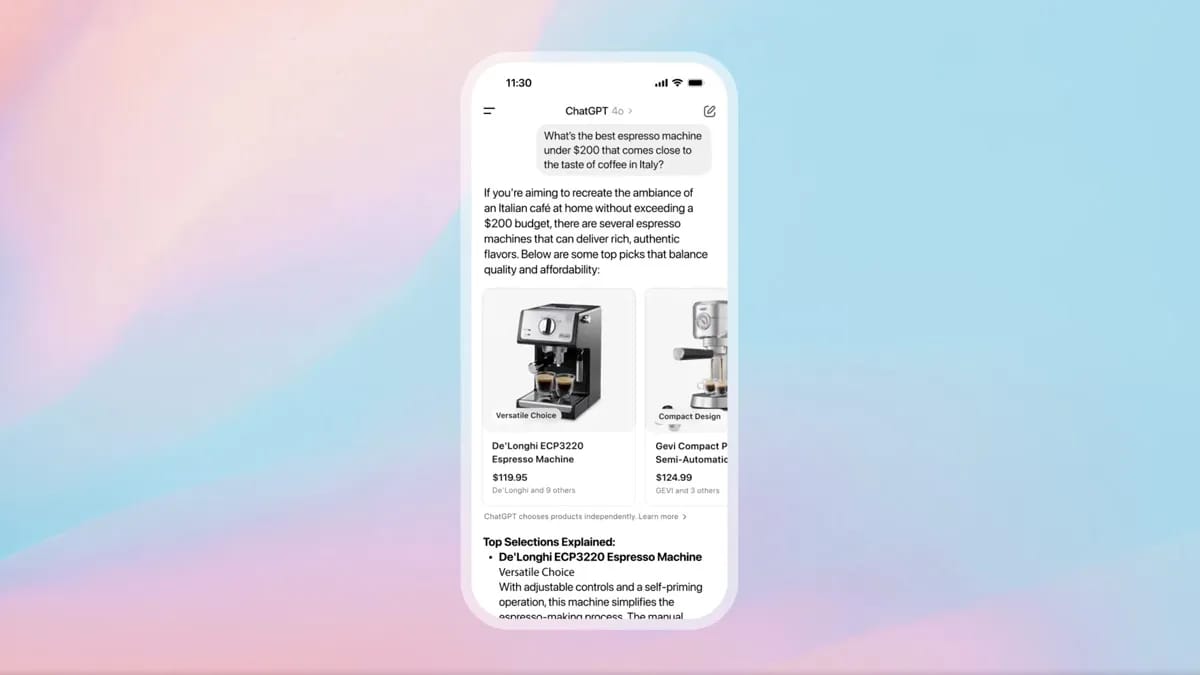

OpenAI Rolls Out AI-Powered Shopping, Taking on Perplexity and Giants Like Amazon 🔒- You can now shop directly via ChatGPT, comparing products with links to retailers. OpenAI says product results aren't ads yet, but recent ad hires and analyst comparisons hint at what's to come.

IAB: Sports helped draw more advertising to connected TV platforms - CTV advertising expanded by 16 percent over a 12-month period last year compared to 2023, driven by live events like football, baseball, and soccer moving to streaming.

The New York Times Sues Madwell for $37,000 in Unpaid Advertising Bills🔒- The indie ad agency is facing loads of drama, including liquidity issues, alleged lavish spending by the CEO, client losses, and furloughed staff.

McCann Worldgroup lays off staff while some leaders choose to exit🔒- IPG continues reducing headcount ahead of its acquisition by Omnicom, which is expected to close later this year.

AdLand.tv joins the Marketecture Family - Ari Paparo's growing media empire will relaunch Adland.tv, a repository with over 80,000 advertisements dating back to the '70s.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!