April 30th-May 6th

Below is a roundup of last week’s notable industry news, with summaries and our opinions. Big news out of the Google ad tech antitrust case!

U of Digital Launches The Advanced TV Essentials Online Course!

TV has undergone rapid change in the last few years, with new platforms, new rules—and an entirely new language. This 60-minute course gives you the clarity and confidence to navigate today’s TV advertising landscape, whether you’re buying, selling, planning, or supporting strategy. No technical background required.

What You’ll Get:

✅ A clear understanding of how Advanced TV fits into today’s media ecosystem

✅ Simple explanations of platforms, formats, targeting, and measurement

✅ The ability to talk about CTV confidently in meetings

✅ Real-world examples and simple frameworks

✅ A shareable digital certification to highlight your skills

Enroll for the Advanced TV Essentials Course here!

Contact us to discuss bulk rates for your team!

Top Stories 👁

DOJ asks court to split up Google’s ad tech empire

Source: The Verge

May 6, 2025

Summary: The US Department of Justice (DOJ) wants Google to sell the AdX ad exchange and, in phases, offload its dominant ad server Google Ad Manager (aka DoubleClick for Publishers, or DFP). Key demands include forcing Google to share real-time bidding data with competitors, allowing easy data portability for publishers, open-sourcing some auction tech, including the code that determines which ads are served on specific pages (auction logic), and face a 10-year ban from operating an ad exchange. The DOJ also wants limits on Google using its vast user data (from Search, YouTube, etc.) to advantage its ads business. The DOJ said Google could avoid a breakup if the other remedies restored competition to the market.

Google is resisting a forced sale, arguing that it would disrupt the industry for at least five years and that its acquisitions were legitimate. Instead, Google proposes behavioral fixes:

Sharing bid data from AdX with rival publisher ad servers

Ending Unified Pricing Rules (UPR), an unpopular policy that took control from publishers and prevented them from setting their own variable pricing floors; and

Pledging not to revive past anti-competitive auction tactics like "First Look" (a product to neutralize header bidding, which was a publisher monetization hack to counteract Google's self-preferencing ad auctions) and "Last Look" (which gave Google a chance to outbid the winners in ad auctions).

This legal wrangling follows a judge’s finding that AdX made it hard for clients to use other exchanges and that Google forced Ad Manager on users by tying it to AdX with unfavorable terms, while UPR solidified its dominance. Google has spent years building its ad tech stack to give brands a one-stop-shop for advertising, so a forced sale could radically alter the ad landscape. The ad tech remedies trial is set for September, with a lengthy appeals process likely to follow.

Here is the full timeline:

Opinion: This tells us two things:

Google is negotiating, which means it has admitted some level of guilt, and will move forward with some remedies. That’s big.

The goal posts have been set: At one extreme are the DOJ’s dramatic breakup demands, and at the other extreme are Google's minimal behavioral fixes. The final remedy will likely fall somewhere in between.

A sensible middle-ground scenario? Google keeps its ad tech stack but with significant forced transparency, operational firewalls between AdX and Ad Manager, and mandated equal access to data / information for competitors. Or perhaps Google has to spin-off AdX but keeps Ad Manager (that would get quite complicated, though).

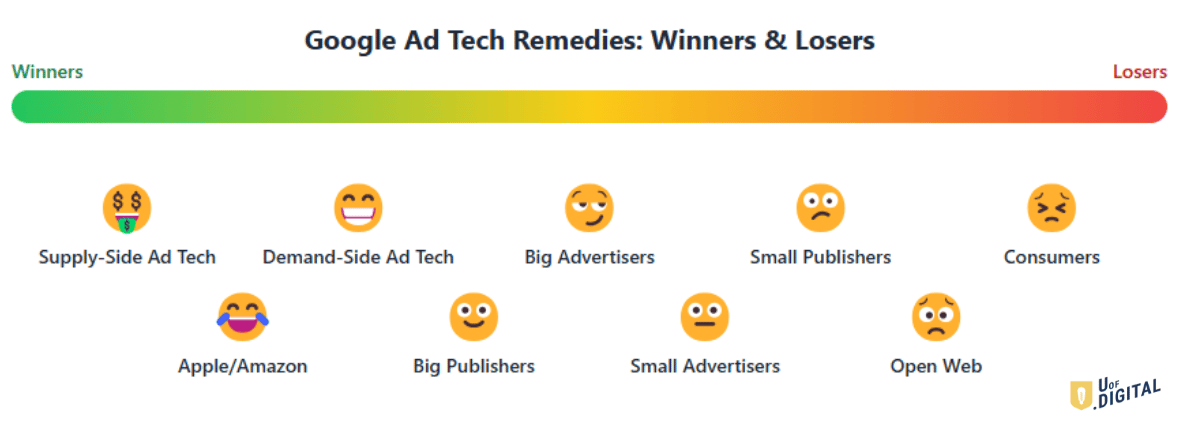

Any middle path creates distinct winners and losers. Independent ad tech companies (the competition), especially supply-side companies like ad servers and exchanges, would benefit from fairer access. One antitrust goal accomplished! Advertisers should benefit too, as they gain more competitive pricing and more optionality without facing the operational nightmare of rebuilding their entire ad stacks. Awesome! Premium publishers may gain some leverage but small-mid publishers take a hit by not being able to access as much demand, as easily, through Google Not great. That hurts the diversity and viability of the open web and pushes consumers into walled gardens even more. Oof. Meanwhile, Amazon and Apple quietly continue building their own advertising empires while Google endures regulatory spotlight. The end user would suffer most. And this would be an abject failure of antitrust action against Google.

Is there an elegant solution that would make this a success? Perhaps. Regardless, the irony in all of this is, by the time this case concludes (likely years from now), the industry's technical landscape will have evolved substantially, AI will have changed everything, and some of the remedies will likely be obsolete before they're even implemented. And by then, the next anticompetitive walled garden(s) may already have their stranglehold on the ad ecosystem…

Paid Subscribers See ALL The Digital Advertising News.

Thank you for reading the U of Digital Newsletter.

Continue reading by upgrading.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!