April 30th-May 6th // Estimated Reading Time: 13 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. Big news out of the Google ad tech antitrust case!

U of Digital Launches The Advanced TV Essentials Online Course!

TV has undergone rapid change in the last few years, with new platforms, new rules—and an entirely new language. This 60-minute course gives you the clarity and confidence to navigate today’s TV advertising landscape, whether you’re buying, selling, planning, or supporting strategy. No technical background required.

What You’ll Get:

✅ A clear understanding of how Advanced TV fits into today’s media ecosystem

✅ Simple explanations of platforms, formats, targeting, and measurement

✅ The ability to talk about CTV confidently in meetings

✅ Real-world examples and simple frameworks

✅ A shareable digital certification to highlight your skills

Enroll for the Advanced TV Essentials Course here!

Contact us to discuss bulk rates for your team!

Top Stories 👁

DOJ asks court to split up Google’s ad tech empire

Source: The Verge

May 6, 2025

Summary: The US Department of Justice (DOJ) wants Google to sell the AdX ad exchange and, in phases, offload its dominant ad server Google Ad Manager (aka DoubleClick for Publishers, or DFP). Key demands include forcing Google to share real-time bidding data with competitors, allowing easy data portability for publishers, open-sourcing some auction tech, including the code that determines which ads are served on specific pages (auction logic), and face a 10-year ban from operating an ad exchange. The DOJ also wants limits on Google using its vast user data (from Search, YouTube, etc.) to advantage its ads business. The DOJ said Google could avoid a breakup if the other remedies restored competition to the market.

Google is resisting a forced sale, arguing that it would disrupt the industry for at least five years and that its acquisitions were legitimate. Instead, Google proposes behavioral fixes:

Sharing bid data from AdX with rival publisher ad servers

Ending Unified Pricing Rules (UPR), an unpopular policy that took control from publishers and prevented them from setting their own variable pricing floors; and

Pledging not to revive past anti-competitive auction tactics like "First Look" (a product to neutralize header bidding, which was a publisher monetization hack to counteract Google's self-preferencing ad auctions) and "Last Look" (which gave Google a chance to outbid the winners in ad auctions).

This legal wrangling follows a judge’s finding that AdX made it hard for clients to use other exchanges and that Google forced Ad Manager on users by tying it to AdX with unfavorable terms, while UPR solidified its dominance. Google has spent years building its ad tech stack to give brands a one-stop-shop for advertising, so a forced sale could radically alter the ad landscape. The ad tech remedies trial is set for September, with a lengthy appeals process likely to follow.

Here is the full timeline:

Opinion: This tells us two things:

Google is negotiating, which means it has admitted some level of guilt, and will move forward with some remedies. That’s big.

The goal posts have been set: At one extreme are the DOJ’s dramatic breakup demands, and at the other extreme are Google's minimal behavioral fixes. The final remedy will likely fall somewhere in between.

A sensible middle-ground scenario? Google keeps its ad tech stack but with significant forced transparency, operational firewalls between AdX and Ad Manager, and mandated equal access to data / information for competitors. Or perhaps Google has to spin-off AdX but keeps Ad Manager (that would get quite complicated, though).

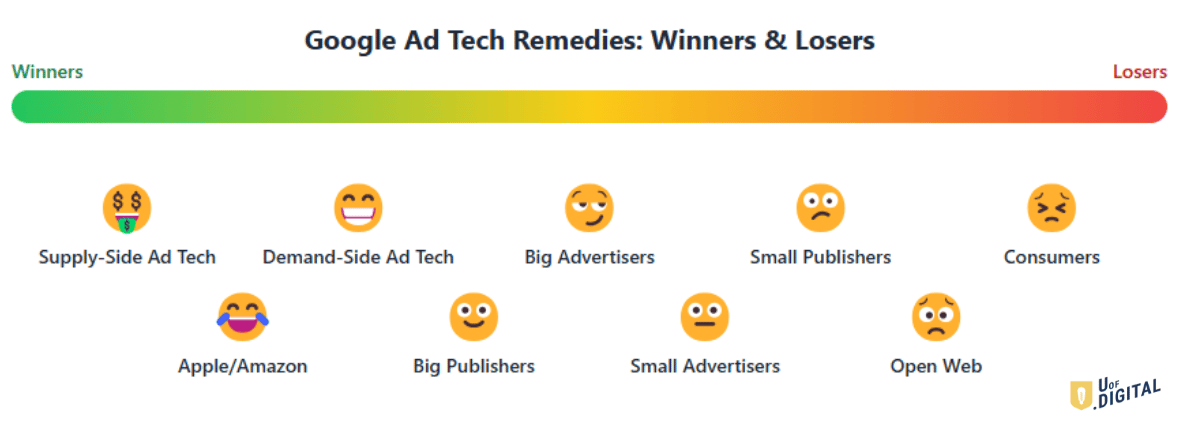

Any middle path creates distinct winners and losers. Independent ad tech companies (the competition), especially supply-side companies like ad servers and exchanges, would benefit from fairer access. One antitrust goal accomplished! Advertisers should benefit too, as they gain more competitive pricing and more optionality without facing the operational nightmare of rebuilding their entire ad stacks. Awesome! Premium publishers may gain some leverage but small-mid publishers take a hit by not being able to access as much demand, as easily, through Google Not great. That hurts the diversity and viability of the open web and pushes consumers into walled gardens even more. Oof. Meanwhile, Amazon and Apple quietly continue building their own advertising empires while Google endures regulatory spotlight. The end user would suffer most. And this would be an abject failure of antitrust action against Google.

Is there an elegant solution that would make this a success? Perhaps. Regardless, the irony in all of this is, by the time this case concludes (likely years from now), the industry's technical landscape will have evolved substantially, AI will have changed everything, and some of the remedies will likely be obsolete before they're even implemented. And by then, the next anticompetitive walled garden(s) may already have their stranglehold on the ad ecosystem…

More Q1 Earnings!

Meta (👍): Revenue was up 16% to $42.31B, beating estimates. Ad growth was driven by a 5% increase in ad impressions and 10% increase in average price per ad. Daily active users were up 6% to 3.43B. Meta's Q2 revenue guidance met expectations, but the company issued warnings about lower ad spend by Asia ecommerce exporters (Temu and Shein) and EU regulatory headaches. Shares rose as much as 5%.

Amazon (🤷): Revenue was up 9% to $155.7B, beating estimates. Ad revenue was up 19% to $13.92B, also beating estimates, placing Amazon third behind Alphabet and Meta. Like Meta, the company also warned that Asia e-commerce companies have cut ad spend due to tariffs. AWS sales were up 17% to $29.3B. Amazon's Q2 guidance missed expectations. Shares fell 2%

Microsoft (👍): Revenue was up 13% to $70.1B, beating estimates. Search and news advertising revenue, excluding traffic acquisition costs, increased 21%. Microsoft's current quarter guidance beat expectations, driven by strong Azure growth forecasts, offering relief to investors worried about tariffs. Shares rose about 9%.

Reddit (👍): Revenue was up 61% to $392.4M, beating estimates. Ad revenue was up 61% to $358.6M, driven by search changes and strong user growth. Daily active uniques were up 31% to 108.1M. Reddit's Q2 revenue guidance beat expectations, though it noted potential near-term bumpiness from search ecosystem changes and a shaky economy. Shares rose about 5% in after-hours trading.

Roku (🤷): Revenue was up 16% to $1.02B, beating estimates. Platform revenue, which includes advertising, was up 17% to $881M, driven by growth in video advertising and streaming service distribution. Roku's Q2 guidance missed expectations, citing macro uncertainty and potential tariff impacts on its devices segment. Shares fell 1.3%.

Apple (👎): Revenue was up 5% to $95.4B, beating estimates. Services revenue, which includes advertising, was up 11.65% to $26.65B, missing estimates. Apple anticipates a $900M hit from tariffs and is uncertain about the impact beyond June. Shares fell as much as 4% in extended trading.

Zeta Global (👎): Revenue was up 36% to $264M, beating estimates. A strong pipeline and healthy Q2 visibility led Zeta to raise its current quarter guidance. But the company missed its earnings per share estimates, sending shares 7% lower.

Criteo (👎): Revenue was up 0.3% to $451M, missing estimates. Criteo is once again bullish on its retargeting business now that Google will keep third-party cookies in Chrome. But its largest retail customer will stop using Criteo's managed services, and the company issued soft guidance. Shares fell 15%.

Viant (👍): Revenue was up 32% to $70.64M, beating estimates, likely helped by its IRIS.TV acquisition. CTV spend "eclipsed" 45% of total ad spend on Viant's platform. Viant's current quarter guidance met expectations. Shares rose 7% in after-hours trading.

Opinion: On one hand, companies like Meta, Microsoft, Reddit, and Viant posted robust revenue growth, beating estimates. Meta and Reddit, in particular, had strong user growth, indicating strong platform engagement. On the other hand, the industry is facing several headwinds. We’ve heard repeatedly that Asia-based ecommerce giants Temu and Shein have cut ad spending due to tariffs. There are regulatory concerns brimming in the EU as the bloc begins enforcing new regulations aimed at reigning in Big Tech. But most significantly, a volatile economic landscape is causing many companies to issue underwhelming guidance for their performance this quarter and for the rest of the year. Others are unable to see very far ahead; Apple, for example, can't forecast past June. Uncertainty breeds pessimism. Next week, we'll get a better look at how independent ad tech is doing, with reports from AppLovin, Magnite, DoubleVerify, and others. The Trade Desk too; will it redeem itself after a rare miss last quarter? We'll see.

Other Notable Headlines

Google Tries to Salvage Privacy Sandbox After Cookie U-Turn at Possible Conference - Google is trying to manage the fallout after its decision to abandon plans to eliminate third-party cookies in Chrome, which has thrown the Privacy Sandbox into disarray. Despite Google's attempts to reassure the industry that the Privacy Sandbox is still moving forward—many ad tech vendors and publishers are expressing deep skepticism and frustration over wasted time and resources. However, the whole saga did spur everyone to focus on their first-party strategies, which many say was a good thing. Cute!

As the Privacy Sandbox faces an uncertain future, Google is charging ahead on the product development front. The company gave advertisers a few items on their Performance Max (PMax) transparency wishlist: channel-level, search term, and creative asset reporting. Advertisers have long criticized AI-powered PMax for providing no information about where their ads are appearing, but now they will be able to gain insights into things like how many impressions were served in each channel, the number of conversions from each channel, and the search terms used in targeting. Google also overhauled its search advertising capabilities with the launch of AI Max for Search campaigns. The product uses AI to predict user intent, customize ad creative, and find new search opportunities. Early tests show a 14% average lift in conversions without raising acquisition costs.

Court Sides with Epic Games, Sanctions Apple for Defying App Store Order - A federal judge has sanctioned Apple, ruling that it willfully ignored a 2021 injunction meant to curb its anticompetitive App Store behavior. The court had ordered Apple to let developers communicate directly with users about alternative payment systems outside of Apple and share alternative payment links. Judge Yvonne Gonzalez Rogers sharply criticized Apple's actions, accusing an executive of lying under oath and noting CEO Tim Cook chose an anti-competitive path. The matter has even been referred for a potential criminal contempt investigation. Epic Games plans to bring Fortnite back to the US App Store this week.

Vizio Gives Advertisers First Peek at Walmart’s Ownership - At its 2025 NewFronts, Vizio said advertisers will soon be able to leverage Walmart's demand-side platform (DSP) to target Vizio's 79M viewers, with Walmart reportedly asking for $200,000 initial commitments from advertisers for Vizio ads. This move aims to fuse Vizio's brand-building CTV ad inventory with Walmart's performance marketing engine and first-party shopper data following Walmart’s $2.3B acquisition of Vizio. To drive viewer engagement and more ad opportunities, Vizio is enriching its SmartCast platform with significantly more content, inventory, and new discovery hubs like "Sports Zone" and the personalized "MyHub." As Walmart leans into Vizio's possibilities, it appears to be retreating from white-labeling its ad tech stack for other retailers. Walmart had won a pitch from a European grocer looking to launch its own media network but then pulled out of the deal for unknown reasons.

Roku Acquires Streaming Bundle Service Frndly TV For $185M - Frndly TV is known for its affordable TV bundles with channels like A&E and Hallmark, while strategically avoiding pricey sports. The service offers plans with general-entertainment channels ranging from $7-$13 per month and hit 700,000 subscribers as of 2022. This deal is aimed at growing Roku's platform revenue and direct subscribers. Frndly TV's team will join Roku after the deal closes this quarter. This strategic purchase highlights Roku's effort to tap into the budget-conscious viewer demographic.

Mark Zuckerberg just declared war on the entire advertising industry - In a recent interview, Meta’s CEO detailed a future where businesses might only need to state a marketing objective and link a bank account for their ad campaigns. The company's AI would then generate countless ad creatives, manage all targeting, execute campaigns, measure performance, and potentially even process sales directly. This "infinite creative" concept could fundamentally reshape the roles of creative agencies, media buyers, and measurement specialists. Initial reactions from advertising industry leaders have been deeply skeptical, primarily citing concerns about Meta grading its own homework, an age-old industry gripe. While this end-to-end automation could lower barriers for small advertisers, the lack of transparency and independent verification is a major turnoff for larger brands.

ZUCK DGAF

Other Notable Headlines

(that you should know about too) 🤓

Trump’s Tariff on Cheap Chinese Imports Will Cost Big Tech Billions - Trump eliminated the de minimis rule, which let products that cost less than $800 avoid tariffs. The move hurts Asian ecommerce giants like Shein and Temu, which have pulled significant ad spend from Meta, Amazon, and other platforms.

WPP to rebrand GroupM as WPP Media—industry leaders react - WPP is consolidating individual agency investment teams under the WPP Media banner. GroupM is the world's largest media agency network.

What’s the fate of the GAID? - Following Google's decision to eliminate third-party cookies from Chrome, Eric Seufert believes the company will also abandon its plans to deprecate the Google Advertising ID (GAID) in Android.

TikTok Fined $600M in EU Over China Data Transfers, Privacy Compliance - TikTok didn't tell users that their data would be sent to China, putting them at risk of being spied on, according to the EU.

Madwell Is Shutting Down. Read the Email CEO Chris Sojka Sent to Staff. - The indie ad agency couldn't survive a mountain of debts. The finger-pointing over who's to blame continues.

Google’s Cloud President And Workspace Leader Jerry Dischler Is Leaving - Dischler played a big role in Google's various ad products over the years, at one point leading ad product strategy, engineering, and user experience for products like search, display, shopping, travel, and video advertising.

Fivetran acquires Census to become end-to-end data movement platform - Another customer data platform (CDP) bites the dust.

Lamar Advertising Acquires Premier Outdoor Assets - Premier Outdoor Media operated nearly 200 billboard faces, including 45 digital units, across New Jersey, Delaware, Maryland, Pennsylvania, and New York.

R/GA Launches AI SEO Tool Amid Search Disruption - The tool helps brands determine how they're faring in AI-generated search results.

Visa and Mastercard unveil AI-powered shopping - AI agents are taking the shopping reins from credit card customers based on their preselected preferences.

CVS Media Exchange Expands On-Site Solutions with Sponsored Brand Ads - In early testing, the sponsored brand campaigns produced a 2.2% clickthrough rate.

Comcast's cable spinoff to be named Versant, picked to emphasize corporate versatility - Versant will include the bulk of Comcast's NBCUniversal cable network portfolio, including USA, MSNBC, and CNBC, as well as digital assets such as Fandango and Rotten Tomatoes.

StackAdapt Launches Integrated Email and Data Hub, Bridging Martech and Programmatic Advertising Under One Platform - StackAdapt is making marketers' lives easier by launching an email and Data Hub solution they can use to activate first-party data across channels.

LinkedIn Emerges as Serious Player in B2B Creator Economy - Welcome to the golden era of B2B influencer marketing on LinkedIn.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!