June 4th-June 10th // Estimated Reading Time: 12 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. At this point, we might as well call it WP-Publicis!

U of Digital has partnered with Zeta Global to create a FREE course for marketers, publishers, and ad pros ready to gain back control and thrive in a privacy-first world!

🧠 Understand the real cost of data loss

🔍 Learn what makes first-party data so powerful

📈 Meet HIRO, a first-party identity solution that actually works

🚀 Future-proof your strategy, without starting from scratch

Practical, real-world training for anyone navigating the 1st-party data future.

🎓 Take the FREE course here and get HIRO certified!

Top Story 👁

WPP CEO to Depart After String of Ad Client Defections🔒

Source: The Wall Street Journal

June 9th, 2025

Summary: Mark Read will exit his role as WPP's chief executive by December, ending a seven-year run that saw the British agency holding company lose its crown as the industry's revenue leader. The leadership transition follows a brutal stretch of high-profile client losses—and the bleeding isn't stopping. We just heard yesterday that Mars is yanking its $1.7B media account from WPP Media and handing it to Publicis, only months after Coca-Cola shifted its $800M North American media account to the same French rival.

The contrast with Publicis is pretty stark: The French holding company's stock rocketed upward by more than 80% during Read's tenure, while WPPs has sunk by more than half. Fresh board leadership under ex-telecom executive Philip Jansen apparently accelerated the pressure for change, with the new chairman diving deep into client relationships and internal operations.

WPP's struggles reflect broader industry upheaval as generative AI automates creative work, platform giants expand advertising services, and marketers reduce spending amid trade uncertainty. While Publicis executed a billion-dollar acquisition spree (Influential, Captive8, Lotame), WPP's defensive moves—acquiring InfoSum for nine figures and investing in Stability AI—appear reactive rather than transformative.

Opinion: Throughout advertising history, agencies have survived by claiming ownership of whatever critical marketing service or tool they could competently and credibly offer as “agents” of their customers.

In the Mad Men era, agencies owned creative production because brands couldn't build TV studios. When media fragmented, they took over planning and execution. When measurement became more complex, they absorbed measurement and analytics. In recent years, they’ve been able to claim ownership of identity and data orchestration. Publicis moved on this quicker and more effectively than WPP.

If you squint hard enough, data orchestration makes an agency holding company look a bit more like a tech company than a services company. That’s why Publicis trades at a significantly higher revenue multiple compared to WPP; they successfully claimed data orchestration through their acquisition of Epsilon (and more recently Lotame)—creating unified, enriched customer profiles using 1st and 3rd party data that can be activated across channels. WPP was slow to the data movement🔒. That’s why Publicis just won the Mars and Coca-Cola accounts and Mark Read is out of a job.

The race for the next movement is already on; it's AI. WPP's Open Intelligence launch and Publicis's massive AI investments signal both companies know what's at stake. But Publicis has a head start with their CoreAI offering. They have stable leadership and revenue growth. WPP is playing catch-up once again with Open Intelligence, they’re losing accounts, and they need a new leader.

AI is up for grabs, but grabbing it won’t be easy. WPP’s next CEO will have their work cut out for them.

Other Notable Headlines

WPP attacks Publicis-owned Epsilon SSP in rare public spat🔒- As WPP struggles, it is going after Publicis with an "intelligence report" claiming that the Publicis-owned Epsilon SSP traffics low-quality inventory with viewability rates of just 43% compared to the industry average of 64.8%. The report follows WPP CEO Mark Read personally warning clients last year that Epsilon's SSP had issues with low-quality placements. The recent report is based on a two-day programmatic buying test WPP conducted that found 26% of Epsilon’s inventory came from "made for advertising" (MFA) sites, with one retail site showing only 2% viewability. Publicis fired back, saying it identified the buy in question, which was small ($200) and purposely engineered to produce the negative results, including disabled protections for MFA, no use of a brand safety provider, and removal of the viewability floor. “To put it simply, it’s like removing the seatbelts, airbags and brakes from a car, putting an unlicensed driver at the wheel, and then blaming the manufacturer for the accident that happens five minutes later.” WPP looking desperate.

The Trade Desk Launches Deal Desk, Its Bid To Make Deal IDs Not Terrible - As a result of increasingly popular curation trend, many campaigns running through The Trade Desk use programmatic deals, but ~90% of those deals don't function properly or scale. Operational failures, such as too many targeting parameters or mismatched data typically keep these campaigns from spending more than $10 a day, according to The Trade Desk. In response, the demand-side platform has launched the Deal Desk within their AI-powered UI Kokai, providing a consolidated programmatic deal setup process and taxonomy that can help advertisers and publishers avoid troubleshooting problematic deals over email or Slack.

Jeff Green Says TTD Has 10 Announcements on the Way - The Deal Desk is the first in a series of 10 announcements The Trade Desk will be making over the next two weeks. CEO Jeff Green is gearing up for a major PR push that will take him to Cannes Lions International Festival of Creativity and beyond to evangelize Kokai, TTD's AI-powered platform. The announcement blitz appears to be TTD's attempt to solidify its AI narrative following an impressive Q1 earnings rebound, especially as the company faces growing competitive pressure from Amazon (see below). On Friday, which was Kokai's two-year anniversary, TTD announced the beta for OpenSincera to give buyers new media supply chain insights. On Tuesday, the company announced that it has integrated with Edo🔒to let buyers access Edo's TV data across all brand categories for the first time. Also yesterday, The Trade Desk revealed that it has partnered with Instacart and Ocado to give self-service advertisers access to SKU-level sales and customer data. What will they announce next?!

Marketers Move Millions in Ad Spend from The Trade Desk to Amazon’s Ad Platform🔒- Eighty percent of PMG's clients have moved tens of millions in CTV budgets to Amazon over the past year, while one agency said that 30% of its customers have moved 100% of their annual ad budgets from The Trade Desk to Amazon in the past six months. The shift is driven by cheaper fees, an improving tech stack, and the ability to apply Amazon data though the Amazon DSP to open web buys. Oh, and Prime Video inventory, among other benefits. Although some worry that Amazon potentially prioritizes its own inventory, its fees are hard to beat: as little as 1% on programmatic guaranteed deals, compared to 7%-15% charged by other DSPs. Many say Amazon's go-to-market strategy seems designed to pick off TTD customers, but both Amazon and The Trade Desk seem to be expanding their market share—for now, at least.

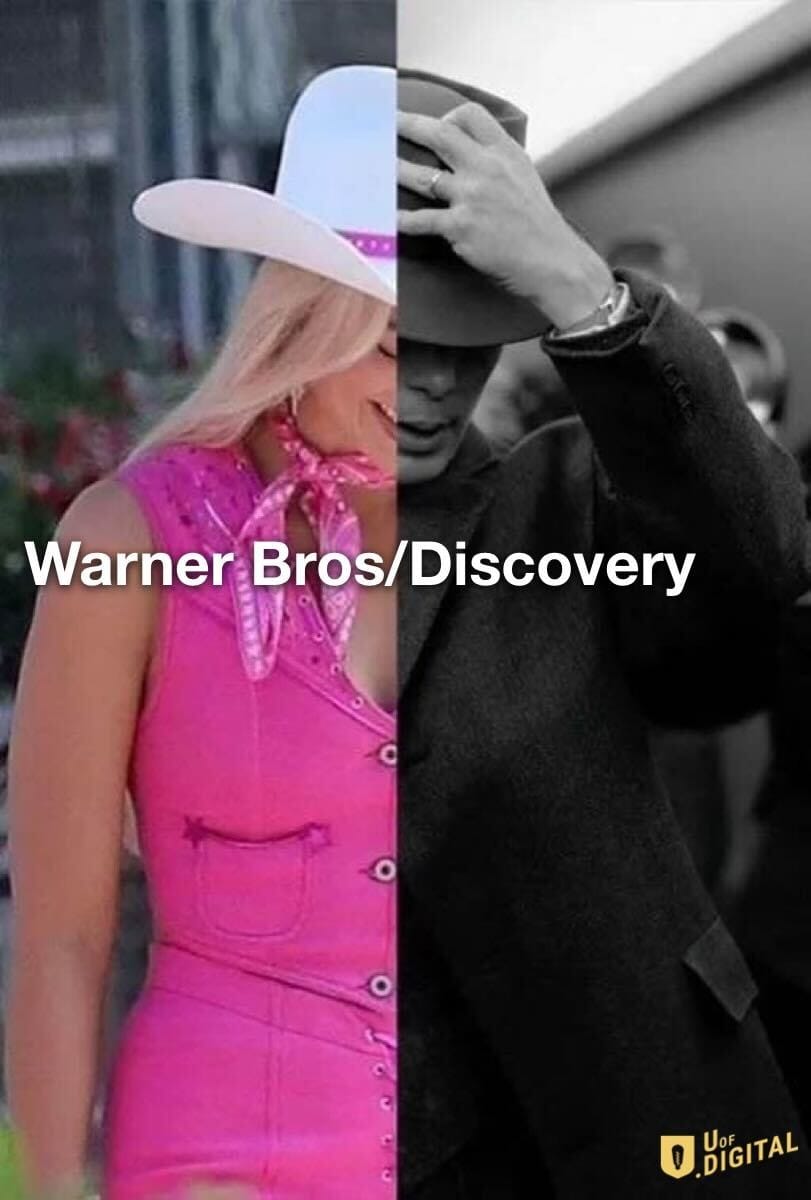

Warner Bros. Discovery to Split Into Two Companies - One company will house streaming and content production, including TV and movie studios, HBO, Max, and gaming divisions, led by Warner Bros. Discovery CEO David Zaslav. The other will focus on traditional television, including the global networks plus digital brands like Discovery+ and Bleacher Report, headed by Gunnar Wiedenfels, the company’s CFO. The traditional TV company will also inherit nearly $38 billion in debt, potentially making it an attractive acquisition target for consolidation-hungry media companies. If this sounds familiar, it's because the move mirrors Comcast's recent decision to spin off NBCUniversal's cable networks into a separate entity called Versant. Warner has been struggling with business declines, having lost NBA broadcasting rights and written down cable property values since the AT&T WarnerMedia-Discovery merger. The split is expected to be completed by this time next year.

MiQ Aims To Unify Fragmented Data Landscape With New AI-Powered Ad Platform - The programmatic media service firm launched Sigma to address a major problem facing buyers and sellers: fragmentation across platforms, data sources, and KPIs. The platform has three main components, including Sigma Intelligence for data visualization that analyzes customer watching, browsing, and buying "modes" to assess purchase habits. A conversational AI trading agent which is built on large language models like Claude, Gemini, and ChatGPT to help MiQ’s internal traders make fast decisions through prompts. nd generative AI personas that can interpret complex advertiser briefs to identify the best audience segments. MiQ chose the name Sigma because in mathematics it means "the sum of all parts," reflecting the platform's goal to unify programmatic advertising through its tools.

Scope3 inks TikTok sustainability pact, reveals Brand Stories tie-up with OMG🔒- The ad tech startup founded by industry vet Brian O’Kelley has inked a sustainability measurement deal with TikTok following a large RFP process, allowing all Scope3 customers to pipe their TikTok campaign data directly into the platform. Meanwhile, its new agentic AI solution called Brand Stories will help advertisers find brand-safe environments in which their messaging will have the greatest impact. Those insights can then help media-buying teams build targeting segments to reach specific audiences, which is a different approach from the legacy keyword-blocking systems used by Integral Ad Science and DoubleVerify. Agency holding company OMG is the launch partner for Brand Stories.

Apple extends Advanced Tracking and Fingerprinting Protection to all browsing - As part of Apple's announcements coming out of its Worldwide Developer Conference, Apple revealed that browsing in Safari "gets even more private with advanced fingerprinting protection extending to all browsing by default." According to Eric Seufert at Mobile Dev Memo, Apple is referring to Advanced Tracking and Fingerprinting Protection (ATFP), which became part of Safari Private Browsing mode in 2023 when Apple rolled out iOS 17. The feature removes tracking parameters from links rendered in Safari, according to Seufert. It also hides the web signals🔒that can be collected by companies when trying to triangulate individuals’ identities via device fingerprinting. It was previously offered as an option to iPhone users when using Safari's Private Browser. Here's a helpful video from Digiday that explains ATFP.

Ads From Verizon, Shell, and Others Ran Next to Explicit Videos on Top Android App🔒- XShorts, which has over a million downloads and ranks as the top free entertainment app on Google Play, was serving ads from major brands alongside sexually explicit and racially offensive content despite having a 'Teen' rating. An Adweek investigation🔒found the ads were served through popular ad networks including Epsilon, Facebook Audience Network, Amazon, AppLovin, and others, with many brands unaware that their campaigns were appearing on the platform due to automated programmatic settings. Google has now blocked XShorts from monetizing after learning of the issue from Adweek, while Meta removed the app from its Audience Network for policy violations. The incident highlights ongoing challenges in programmatic advertising where low-quality inventory gets lumped in with high quality inventory, making brand safety a moving target.

Other Notable Headlines

(that you should know about too) 🤓

Google offers buyouts to employees in its Search and ads unit - To reduce headcount, the buyouts are being offered to employees across its knowledge and information, central engineering, marketing, research, and communications teams. Knowledge and information encompass Google’s search, ads, and commerce divisions. Teams that work on YouTube, Cloud, and AI are safe. Tells us a little bit about what Google thinks is the future of their business…

Disney to Pay NBCUniversal Another $438.7 Million for Hulu Stake🔒- The deal values Comcast’s 33% stake in Hulu at $9.04B.

Sports Surge in TV Upfront Pushes NBC’s 2026 Super Bowl Close to Early Sell-Out - NBC wanted $7M per Super Bowl spot, and it's now asking all buyers to commit immediately or lose their spots to a waitlist of aspiring sponsors.

Gigi Debuts Agentic AI for Amazon DSP Campaigns - It’s an agentic media buying platform that can help agencies scale their Amazon DSP campaigns.

Snap Dangles Thousands in Free Ad Spend As Potential TikTok Ban Deadline Nears🔒- Snap has offered some buyers $10K in ad credits for spending an additional $100K on its platform.

Meta Launches Opportunity Score to All Advertisers - The optimization metric gives advertisers a 0-100 point summary to show how well their ad campaign is set up to maximize performance.

YouTube Quietly Relaxes Content-Moderation Policies - YouTube now prioritizes “freedom of expression” in videos if they appeal to the “public interest.”

News Sites Are Getting Crushed by Google’s New AI Tools🔒- Traffic from organic search to the Washington Post and HuffPost’s desktop and mobile websites declined by around half in the last three years.

Procter & Gamble to Cut 7,000 Jobs🔒- That represents about 15% of its non-factory workforce to be trimmed in the next two years.

A frustrated Zuckerberg makes his biggest AI bet as Meta nears $14 billion stake in Scale AI, hires founder Wang - Meta's CEO wants the company to get further ahead in the AI wars, which will take a reported 49% stake in the startup. Scale AI Founder and CEO Alexandr Wang will help spearhead a new AI research lab at Meta.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!