July 23rd-July 29th // Estimated Reading Time: 9 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. AI is eating the open web…

U of Digital’s AI Accelerator is THE go-to course for marketing and advertising professionals looking to get a head start on AI.

And now ad tech’s leading AI company, Scope3, has officially stamped the AI Accelerator as an exclusive sponsor.

Use promo code SCOPE3 for 20% off individual tickets. Email [email protected] for team discounts. SPACE IS LIMITED, ENROLL NOW!

Top Story 👁

Publishers race against Google Zero doomsday clock

Source: Axios

June 23rd, 2025

Summary: The traffic apocalypse is no longer theoretical. Google's AI Overviews (AKA Google Zero) have exploded to over 2 billion monthly users🔒, up from 1.5B last quarter, and they're devastating publisher traffic. When AI Overviews appear, only 8% of searches result in clicks to websites compared to 15% for traditional search results. Clicks on source links within the AI Overview? Just 1% of the time.

Publishers are scrambling to adapt. Wired, for example, is launching premium subscriptions that feature livestream AMAs with journalists in response to the traffic declines. The Verge rolled out personalized feeds to keep readers on-site. Business Insider is pivoting to events and video while pulling back from SEO-driven commerce. And Bustle Digital Group's CEO told Adweek they're "basically an events company"🔒now, not a website.

Some publishers are hedging with AI licensing deals, but those typically last just 2-5 years and aren't considered reliable long-term revenue without meaningful revenue-sharing terms. Google recently added micropayment tools to its ad manager—perhaps an acknowledgment that AI Overviews are killing referral traffic. We wrote about Cloudflare’s new pay-per-crawl solution, but this is nascent and likely won’t offset the negative revenue impact from decreased site traffic.

Opinion: Google's AI needs publisher content to train its models, but AI Overviews are destroying the economic model that funds publisher content creation. Huh?!

Google says it monetizes AI Overviews at the same rate as traditional search. We’re skeptical of that assertion. Regardless, Google will eventually figure out monetization, and in the grand scheme, Google wins and publishers lose as AI Overviews scale up. Licensing deals are just temporary life support.

The “cookiepocalypse” inspired publishers to build direct relationships with their audiences, and those lessons also apply now. Subscription models, events, apps, newsletters—anything that creates value exchange without algorithmic middlemen will help publishers in a "post-click web," where it isn't so much about traffic but about ownership of audience relationships.

The end-state of all of this is unclear. Certainly, many publishers will not be able to reinvent themselves and will die off because of the rise of AI. It’s already happening🔒. Those that remain will do so because of ingenuity, and they will emerge bigger and stronger.

Looking into our crystal ball, we think the following will also happen in the age of AI (publishers, take note):

The “upper funnel” will become more important for marketers, as human creativity will create real value and differentiation here, whereas a lot of lower funnel advertising will become entirely ‘AI-ified’, as Zuck so eloquently stated.

The lower funnel will become commoditized, and way more about influencing agents than about getting humans to click and convert.

Voice / audio as an advertising medium will explode.

Banners ads on the open web … RIP.

Q2 Earnings!

Alphabet (👍): Revenue was up 14% to $96.43B, beating estimates. Ad revenue was up 10.4% to $64.61B, and YouTube's $9.8B ad revenue also beat expectations. The Gemini AI chatbot has 450M monthly active users. The Google Network slightly declined by about $100M. The company revealed it would spend $85B on AI, higher than previously announced. Shares rose 3%.

Spotify (👎): Revenue was up 10% to $4.84B, missing estimates. Ad revenue was down 1% to $523M; the Swedish music platform will focus on new ad tools and adoption in H2. Spotify posted a net loss and issued weak Q3 guidance, sending shares 11% lower. They also let go of their ad chief, Lee Brown, who will be heading to DoorDash.

Opinion: Google’s network business (AKA Google’s open web ads business, AKA Google Ads and DV360) continues to be a drag on Alphabet’s earnings. So why fight antitrust authorities to keep it? Just spin it off already!

There will be 14 companies in our industry reporting earnings in each of the next two weeks, providing a clearer picture of the current economic state of the industry. Stay tuned.

Other Notable Headlines

Eyeo Names New CEO, Cuts 40% Of Staff And Refocuses The Business On Privacy - Douglas de Jager, founder of Google-acquired ad fraud detection firm spider.io, has taken the helm after the departure of Frank Einecke, who held the top job for three years. The company is pivoting from primarily developing ad-blocking tools like AdBlock Plus to creating privacy-first solutions that protect users by default, without requiring downloads or extensions. This "strategic refounding" includes plans to work with hardware manufacturers to embed anti-tracking technology directly into devices and develop differential privacy tools for advertisers to measure campaign performance without compromising individual user data. The company will shed about 40% of its workforce as it tries to become "as small as possible." The restructuring comes as eyeo acknowledges that mobile-first internet usage and app-dominated experiences have fundamentally changed how personal data is collected and used.

Ad giant Publicis is shopping for AI companies. Here are 6 targets industry insiders think could be on its wish list. - The streaking French agency holding company has allocated nearly $350M for "bolt-on acquisitions" in the second half of 2025, following $700M already spent this year as part of Publicis' broader AI strategy centered on its Core AI platform. Any M&A will probably reinforce its existing operations rather than transformative deals, likely targeting startups in areas such as agentic AI workflow automation and big data analysis. Industry experts suggest potential targets could include Persado for AI-generated messaging, Superscale.AI for instant social media campaign creation, and Newton Research for autonomous data science agents. Smart money is on Publicis making bets on emerging AI technologies before they scale up and intense bidding wars develop. Other potential targets include Akkio for data analysis automation and Prescient AI for e-commerce ad optimization.

Amazon Turns Off Google Shopping Ads - Marketing agency Tinuiti reports that Amazon's Google Shopping ad presence plummeted from 60% impression share in the US to zero from July 21-23, 2025, the most recent client spending data available, representing its first complete withdrawal from Google's shopping auctions since early 2020. The sudden departure opens opportunities for rival retailer brands to capture traffic at lower cost, potentially reshaping market share dynamics if Amazon's exit is permanent. Amazon pulled a similar move in Q2 about three weeks before Prime Day, which may have been an incrementality test. Amazon had been gradually reducing its Google Shopping investment throughout 2024, but Tinuiti's analysts theorize that the most recent halt signals an "AI search turf war" as Amazon prioritizes its own Rufus AI assistant over feeding Google's advertising machine.

The FCC approves Paramount’s $8B deal with Skydance after months of chaos and political intrigue - Ahead of the approval, Paramount agreed to a controversial $16M settlement with President Trump about his gripes with 60 Minutes. Then, after “Late Show” host Stephen Colbert criticized his own network for the settlement on air, the “Late Show” was cancelled. Then Paramount handed South Park creators Trey Parker and Matt Stone $1.5B for a 5-year streaming deal. Then, the first episode of South Park (on Paramount) endlessly mocked Trump and Paramount’s apparent kowtowing to the Trump administration…

What happens now?

Other Notable Headlines

(that you should know about too) 🤓

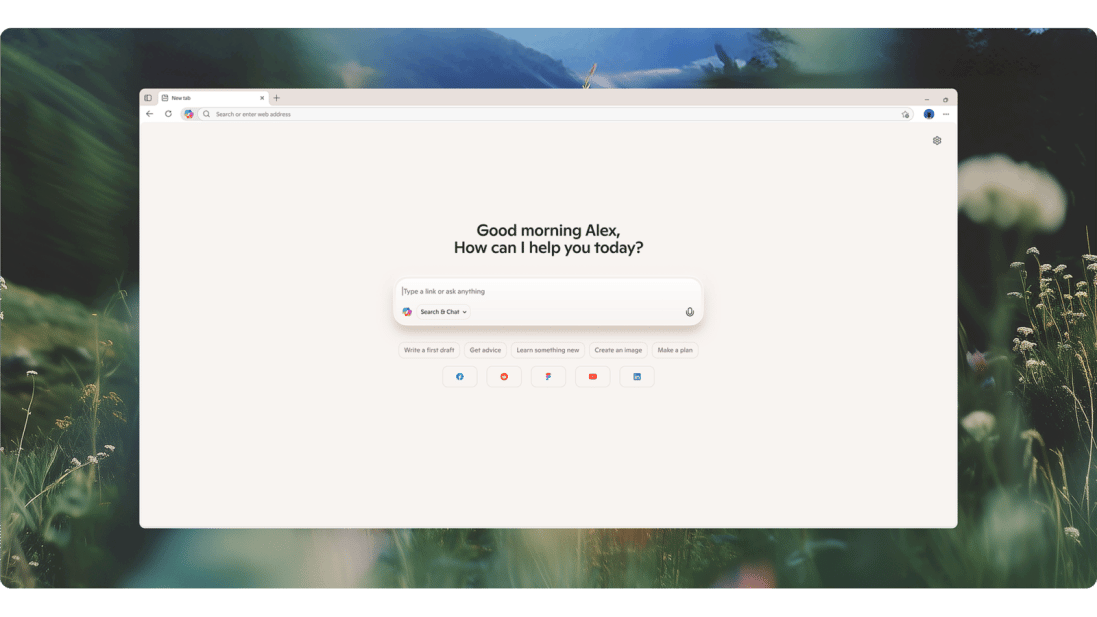

Microsoft Edge is now an AI browser with launch of ‘Copilot Mode’ - The feature adds another AI layer between users and websites, capable of viewing all open tabs if allowed, handling bookings, and answering questions about content without users ever clicking through to the source.

WPP Media Touts 'First-Of-Its-Kind Activation' With Criteo - Roku, Samsung, and Scripps will pilot the first application of WPP's Open Intelligence data platform to CTV, powered by Criteo commerce data.

Disney Wraps Upfront With Sports Advertising Near $4B, Overall Volume Flat - Streaming accounted for more than 40% of Disney's total upfront volume. Sports ad volume across linear and addressable approached $4B.

IAB: Retail Commerce Media To Drive $74B Ad Spend In 2026 - Retail media, including sponsored products, on-site display, in-store signage, and off-site ads, continue to be a bright spot in digital advertising. Travel media, an emerging subset of commerce media, is expected to rake in $2.96B in ad spend next year.

Meta will cease political ads in European Union by fall, blaming bloc's new rules - The EU's “unworkable” Transparency and Targeting of Political Advertising regulations would force the platform to label political ads and disclose who bought them. Doesn’t seem too “unworkable” to us?

TikTok doubles down on Search Ads as commerce ambitions cool - TikTok is capitalizing on brands reevaluating their search practices and budgets and expanding its search team.

LiveRamp Must Face Privacy Claims, Judge Rules - LiveRamp is defending itself against a class-action complaint that it tracks hundreds of millions of people and "indefinitely" stores their personal information.

Ryan Reynolds’ Maximum Effort ad agency turned Astronomer’s viral moment into marketing gold - Reynolds tapped Gwyneth Paltrow (Coldplay singer Chris Martin’s ex-wife) as the company’s “temporary spokesperson” to comically respond to the company’s CEO Coldplay kiss-cam scandal and educate consumers about its products. Well played...

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!