July 2nd-July 8th // Estimated Reading Time: 10 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. AI is coming, quick, someone put out the c̶l̶o̶u̶d̶ flare for publishers!

Due to popular demand, U of Digital’s AI ACCELERATOR is coming BACK for round 2 in August! Space is limited. Use EarlyBirdsAreSmart promo code for 20% off. Email [email protected] for team discounts. ENROLL NOW!

Top Story 👁

How brands can get AI bots to pay for scraping their websites🔒

Source: Ad Age

July 7, 2025

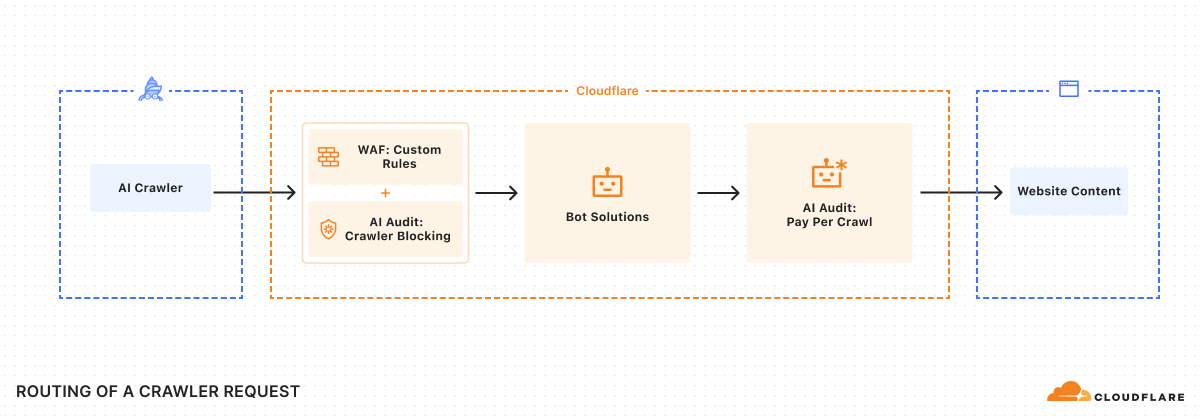

Summary: Cloudflare made headlines last week when it introduced a new "pay per crawl" product that promises to transform how AI platforms access website content. This new type of marketplace allows publishers and brands to charge fees when AI bots scrape their sites to train their models, addressing a fundamental imbalance in the digital economy.

Pay per crawl, currently in private beta testing, distinguishes between different types of crawlers, blocking training-focused bots while preserving access for search-related bots that help consumers find real-time information. Website owners can choose to block all bots, let the bots crawl their sites for free, or scrape their sites for a set fee.

Research reveals that AI platforms take far more than they give back—some services crawl thousands of times more than they send visitors to publisher and brand websites. When consumers get information from AI bots, publishers and brands miss out on traffic to their sites. That means lost revenue for publishers, which is damaging to the open web and open web advertising

Opinion: Bravo Cloudflare for trying to help publishers recoup some revenue and opening up a new revenue stream for themselves. But this whole thing feels like slapping a Band-Aid on a gunshot wound. Publishers are stuck choosing between three crappy options:

Block AI crawlers and become completely invisible

Let them crawl for free and watch traffic disappear

Charge a few bucks and still watch traffic disappear

Option 3 is probably the least of all evils.

For brands, it's a little trickier. Sure, you want to be visible in AI. But when people just ask ChatGPT about your product instead of visiting your site, you're losing way more than traffic. You're losing the chance to build an actual relationship with your customers, collect data that actually matters, and control how your story gets told. You might make a few bucks from crawl fees, but you're basically selling out your entire data-driven marketing strategy. Still, it’s probably the right move.

The bottom line is this: people are using AI because it’s better and faster and easier than clicking through five different websites to get to content or compare products. AI usage is going to continue to grow, and soon it’ll become the entire consumer experience. So publishers and brands can either figure out how to work with that reality or become irrelevant.

Some companies will reluctantly make the obvious, net-negative trade-offs, like taking the Cloudflare revenue. And they’ll do little else. They won’t win. The companies that figure out how to make AI work for them instead of against them will win. That might mean playing a scale game in order to dictate their terms to AI companies. That might mean building their own AI toolset or “owning” the AI layer. That might mean innovating totally new ways to connect with customers that AI can't disintermediate. These companies will be in the minority. And they WILL win.

Everyone else is just trying to monetize their own obsolescence.

Other Notable Headlines

EU Complaint: Google AI Overviews Hurting Publisher Traffic - Complaining is another tactic! A coalition of UK publishers is fighting Google's AI-powered search summaries with a formal antitrust complaint. They argue that Google is systematically undermining the publishing ecosystem by scraping and summarizing their content for AI Overviews. Publishers say they can't opt out of their content being used for the summaries or for AI training without getting excluded from Google's general search results page. Publishers argue that this is causing significant traffic and revenue losses. Google's AI Overviews, now shown in over 100 countries with ads integrated since May, generate detailed summaries that can span 250 words—essentially replicating news stories in search results rather than driving clicks to publisher sites. Internal documents reveal Google considered allowing publisher opt-outs back in April 2024 but ultimately chose not to implement the protections. Shocking!

Amazon Is Asking Some Advertisers to Double Their Spend During Prime Day🔒- Amazon's pitch deck for an advertiser recommended that they increase their daily ad budget by 100% during the four-day event (July 8-11), with additional 25% bumps before and after to capture awareness and retargeting opportunities. This translates to roughly a quarter of the advertiser's monthly spend allocated to each Prime Day, compared to 22% per day last year when the event was only two days. However, brands are showing more caution this year due to economic uncertainty and tariffs, with agencies like Tinuiti expecting only 10%-25% year-over-year increases in Prime Day ad spend. The extended timeline and competitive pressure from Walmart and Target's concurrent sales events are making Amazon's aggressive spending recommendations a tougher sell this year. Still, the longer sale will likely help Amazon capture momentum before an anticipated holiday spending pullback.

Google Wipes 350 Android Apps Tied to Ad Fraud Driving 1.5B Daily Bid Requests🔒- The IconAds scheme used seemingly innocent apps like flashlights and photo tools to avoid detection. These malicious apps served interstitial ads even when not in use, generating fraudulent revenue in the seven-figure range with traffic coming primarily from Brazil, Mexico, and the U.S. Cybersecurity firm HUMAN uncovered the scheme, which marks the second major Android ad fraud takedown in four months. It highlights the ongoing cat-and-mouse game between tech platforms and increasingly sophisticated bad actors who keep finding new ways to siphon ad revenue by spoofing ad impressions.

Why Advertisers Can’t Figure Out If They’re Monetizing Illicit Content On YouTube - A new Adalytics report reveals that scammers are systematically gaming YouTube's Content ID tool to illegally distribute copyrighted movies, TV shows, and live sports. These accounts post content like Disney's "Lilo & Stitch" and Netflix's "Squid Games," quickly removing or editing videos within days to avoid detection while racking up hundreds of thousands of views (and ad dollars). Agency buyers say that millions of dollars in YouTube spend between 2023-2025 went to videos later removed for copyright violations, with most of these placements eventually categorized under the vague "Total: Other" bucket. YouTube says 90% of Content ID flags are approved by rights holders who choose to share the ad revenue, but the lack of transparency makes it nearly impossible for advertisers to understand their true exposure to pirated content.

Bold Calls for the back half of 2025🔒- Digiday journalists give us a preview of what they think will happen in the second half of the year. They predict that Google will begin making strategic concessions to third-party ad tech vendors ahead of September's ad tech antitrust remedies trial, perhaps including greater API access and operational separations between its demand and supply-side businesses. Netflix may counter YouTube's dominance by adding its own FAST channel. And publishers will face a potential traffic catastrophe with projected 30%-50% declines in referral traffic by year-end as AI Overviews and answer engines eliminate site visits. Meanwhile, Publicis's winning streak may lead to operational overstretch as the agency holding company giant struggles to integrate its acquisitions across multiple Fortune 500 accounts simultaneously.

Microsoft's Existing OpenAI Deal May Be Undercutting Ad Agency Partnerships🔒- OpenAI's push into enterprise sales is running into a Microsoft-sized problem: Many agencies already have access to OpenAI's models through their existing Microsoft partnerships, making direct deals harder to justify. OpenAI is reportedly signing nine enterprise contracts per week and has reached 3M business users, but agencies like Havas are sticking with Microsoft's ecosystem to access OpenAI’s models rather than directly paying OpenAI's $40-60 per user monthly enterprise pricing. In one such enterprise deal, OpenAI requested a $1M upfront commitment for annual joint projects and expanded tool licenses. While OpenAI has doubled its annual recurring revenue to $10B, the company still lost nearly $5B in 2024 and is seeking new monetization paths.

How agencies are pricing AI—and what it means for industry compensation🔒- Traditional agency compensation models built around billable hours and headcount are becoming obsolete as AI dramatically trims both the time and personnel needed for creative and campaign work. Forward-thinking shops are experimenting with new approaches including product-based pricing for proprietary AI tools, subscription models for AI-as-a-Service platforms, and outcomes-based compensation tied to specific business metrics rather than time spent. Agencies like Monks have found success with "talent and machine" packages that combine human expertise with AI capabilities for fixed fees, while others are developing premium pricing for senior talent who can effectively manage AI systems. Industry experts predict that within 18-24 months, no agencies will be billing based on time, forcing the entire sector to redefine value propositions around business results rather than labor inputs.

Other Notable Headlines

(that you should know about too) 🤓

Consent Management Consolidates With Didomi’s Acquisition Of Sourcepoint - Didomi plans to build a single unified platform that merges its consent management platform with its competitor Sourcepoint's privacy platform.

Paapi’s Hybrid Model Tackles Ad Measurement Without Third-Party Cookies - The startup (named after a Privacy Sandbox API) assesses performance using the Sandbox APIs, probabilistic tracking, consented deterministic data, and other privacy-enhancing technologies.

Ad Tech Firm Seedtag Names Brian Gleason as CEO🔒- Gleason was most recently Criteo's global chief revenue officer and president of retail media.

Dick's Sporting Goods Combines Data With Roku in New Retail Media Play🔒- Dick’s Media is the first commerce media network to use the Roku Data Cloud to merge data from its 45M loyalty program members with Roku's 125M users.

TikTok might be working on a standalone U.S. app, but marketers aren’t sold on the idea – yet🔒- The platform is reportedly building a new version of TikTok and will discontinue the current app in the States next year. Marketers worry that the app will lose its large user base.

Microsoft laying off about 9,000 employees in latest round of cuts - The layoffs amount to 4% of Microsoft's global workforce. The company also fired 6,000 employees in May.

Yahoo takes cues from platforms as it offers more editorial control to creators🔒- Since the company launched the Yahoo Creators platform last year, its revenue and engagement have grown as creators become more visible on Yahoo's homepage.

Threads nears X in daily users, new data reveals - Threads has 115.1M daily active users compared to 132M for X.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!