September 3rd-September 9th // Estimated Reading Time: 9 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. Another week, another Google antitrust ruling…

"The Future of AI In Advertising was fascinating … I feel like a whole new world has opened up for me."

“I feel like I've only been dabbling into AI until now. I feel way more knowledgeable and want to play more and continue learning."

October AI Accelerator registration is now OPEN. Enroll now with promo code EarlyBirdsAreSmart for 20% off, spots are going fast!

#KnowledgeIsPower #HumansAheadOfAI

Top Story 👁

Google hit with $3.45 billion EU antitrust fine over adtech practices

Source: Reuters

September 5th, 2025

Summary: This is the company's fourth major penalty in a decade-long regulatory battle with the EU.

The EU fine stems from a European Publishers Council complaint that Google has been giving its own ad tech and AdX exchange an unfair advantage since 2014, charging high fees while hurting competitors. The European Commission is threatening stronger remedies—including a potential break-up—if Google doesn't address its "inherent conflicts of interest."

Google has 60 days to propose a compliance plan and 30 days to implement it. The European Publishers Council says a fine won't stop Google from abusing its market position in ad tech.

This comes on the heels of Google being found guilty of monopoly in TWO separate US cases. First was search, in which Judge Mehta issued disappointingly light remedies last week that left the industry frustrated. Now there's ad tech, where Google was specifically found to be a monopoly in the open-web display ad server and ad exchange markets. The remedy phase trial for that case begins September 22nd, with Judge Brinkema ultimately deciding the final penalties.

Google just filed its proposed remedies for the ad tech monopoly case, and as expected, they’re light—behavioral changes mostly limited to open-web display ads, with no divestitures. It’s stuff Google should have been doing all along, like letting publishers access AdX demand through competing ad servers and permitting a Prebid integration. The DOJ, however, wants blood: They're demanding Google divest AdX, set aside 50% of net revenues from AdX and DFP for publisher compensation, and provide extensive migration support to help publishers use alternative tech.

All this while Trump threatens retaliation against the EU for its scrutiny of American tech companies.

Opinion: Now what? On one hand, the fine is large and the European Commission is threatening to take further action. On the other hand, a 3.45B fine is a drop in the bucket for Google and the EU is in a delicate trade war with the US. Trump is making a stink, so maybe the EU just lets this go?

Google's proposed remedies for the US case are silly. "We'll pull back from open-web display ads!" Google declares—while conveniently not mentioning this business has been shrinking for three consecutive years anyway. On one hand, we suspect Judge Brinkema will ask for more. On the other hand, Judge Mehta surprisingly didn’t ask for much in the search case.

If Google skates on antitrust penalties for its ad tech practices, both in the US and EU, the company will become the poster child for how to be a convicted monopolist without facing meaningful consequences. The message to other big tech players would be crystal clear: push boundaries, accumulate market power, and weather the regulatory storm. Amazon's already becoming an ad tech powerhouse in the mold of Google. Meta's increasingly aggressive with its ad offerings. Apple’s lurking.

For the ad industry, a toothless Google resolution would cement the status quo. Publishers would remain stuck with limited alternatives. Independent ad tech would continue fighting for scraps. And marketers would keep dealing with the same lack of transparency and choice they've complained about for years.

The outcome of these antitrust ad tech cases against Google could set the tenor for the digital ad space, and business more broadly speaking, for many years to come. As you can tell, a lot is on the line…

Other Notable Headlines

PubMatic Expects 'Billions' in Damages After Filing Antitrust Suit Against Google🔒- The supply-side platform (SSP) claims Google has illegally monopolized the programmatic advertising market through anti-competitive practices that have harmed publishers, advertisers, and consumers. PubMatic alleges that Google's dominance across multiple parts of the ad tech stack has allowed it to manipulate auctions and extract excessive fees, which "artificially constrained" PubMatic's growth. The lawsuit echoes many claims in the Justice Department's recent win against Google, potentially building on newly established legal precedent about Google's anti-competitive behavior in ad tech. SSP OpenX, and publishers Dotdash Meredith, and Insider🔒have also filed their own lawsuits against Google in the last month for anticompetitive ad tech practices. More are probably coming.

Scope3 Lays Off Staff as Part of Shift Toward Agentic Advertising🔒- The company is restructuring its business to focus more heavily on AI-driven advertising products, resulting in job cuts across its sales team. Scope3, which has been known for helping advertisers measure and reduce the environmental impact of their ad campaigns, is now pivoting to focus on autonomous AI agents that will transform how advertising decisions are made. It is investing in AI bots that can handle everything from media planning to brand safety and optimization at the impression level. The layoffs illustrate the company's significant strategic shift that could determine its competitive position in an increasingly AI-driven market.

Media agencies hope to drive down costs as Walmart opens up DSP roster🔒- What moves will Walmart make now that it has ended its exclusivity deal with The Trade Desk? Media buyers are considering the possibilities. The retailer could simply increase the number of DSP partners it works with, similar to how Netflix has steadily added more DSPs after launching its ads product in 2022 with Microsoft only. Walmart could follow Amazon's lead and build or buy a DSP of its own, which could help attract ad spend if it keeps its fees low. If Walmart goes the Netflix route and works with multiple DSPs, it could mean more pricing leverage for agencies, and the ability to consolidate DSP buying across multiple clients.

Marriott Takes The Leap Into Retail Media With New Media Network - After years of cautious experimentation with commerce media limited mostly to its own properties, Marriott is now making a bigger leap with Marriott Media. Launched in June to monetize its customer data across the travel journey, the network offers hyper-specific targeting using over 200 guest attributes from more than 230M members. Advertisers can target ads on Marriott’s properties, like in-room TVs and their app. They are also extending their targeting capabilities to third-party sites using The Trade Desk (although you have to transact directly with Marriott in order to access this capability). PepsiCo used the network for a Gatorade campaign, leveraging Marriott's first-party data to target business travelers and fitness enthusiasts with hydration messaging throughout their journey. Here’s the new logo:

NFL Data & Analytics Chief Jabs Nielsen For “Under-Counting” Viewers, Says Ratings System “Makes No Sense” - Paul Ballew, the league's chief analytics officer, criticized the "co-viewing factor" used by Nielsen for tentpole events like Thanksgiving games and the Super Bowl. Nielsen uses a co-viewing factor of 2.3 to 2.4, which is applied to the number of households watching to calculate how many individual viewers tuned in. Ballew says that NFL research with third parties suggests a more accurate multiple would be 2.8 or 2.9 viewers per household—a potential gap of 15-20M additional Super Bowl viewers. If this gripe sounds familiar, it’s because the industry has long criticized Nielsen for its methodologies, and it famously undercounted audiences during the pandemic.

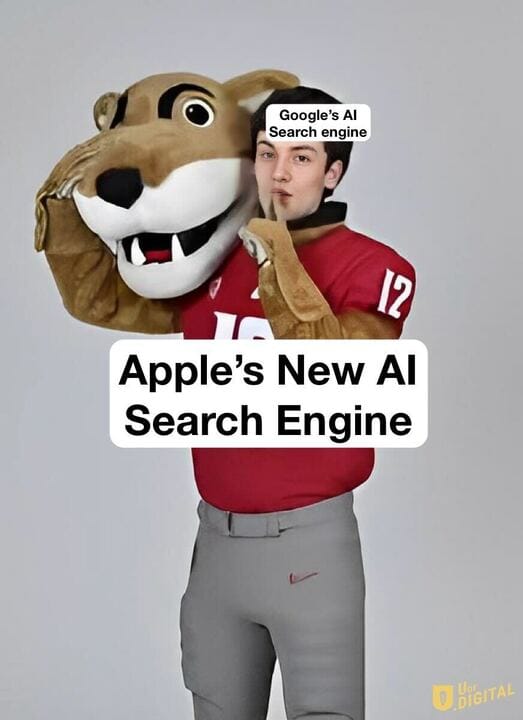

Apple Plans AI-Powered Web Search Tool for Siri to Rival OpenAI, Perplexity🔒- The tech giant is developing an "answer engine" called "World Knowledge Answers" that will be integrated into Siri and potentially added to Safari and Spotlight, with a planned spring release as part of a long-delayed Siri overhaul. Apple will use Google's AI models for at least part of the new system. Three key pieces of Siri will be revamped, including a planner that interprets inputs and figures out how to respond; a search system to scan user and web data; and a summarizer that combines the findings and creates an answer. The company initially evaluated Anthropic's Claude (which was ahead in quality), but chose to partner with Google after Anthropic demanded over $1.5B annually while Google offered more favorable terms.

Other Notable Headlines

(that you should know about too) 🤓

Amazon VP of Global Video Advertising Krishan Bhatia Exits🔒- Bhatia joined from NBCU in April 2024 and helped launch shoppable ad formats, a Shop The Show format, and expand live sports offerings.

Adalytics Asks Judge To Toss DoubleVerify Suit - Adalytics reported that ad tech vendors like DoubleVerify may be billing advertisers for ad impressions served to bots, but DV claimed Adalytics ignored post-bid filtering that removes invalid traffic from billing.

Execs Allege Racial and Gender Discrimination Against Agency Horizon in Federal Lawsuit🔒- Former chief marketing and equity officer Latraviette Smith-Wilson was Horizon's highest-ranking Black woman before her April termination, which was allegedly disguised as "restructuring." A new enterprise CMO was hired within a month.

US Digital Advertising Grew 16% in 2Q25 - Brian Weiser predicts commerce media will grow 19% in Q3.

Minute Media’s Latest Acquisition Brings Automated Content Creation To Its Online Sports Video Network - The sports media holding company acquired VideoVerse and its Magnifi AI software, which cuts long-form games into bite-sized clips for distribution across 1,000+ sites.

Magnite Acquires GenAI Streaming Ads Startup Streamr.ai - The acquisition is all about SMB advertisers who've been priced out of TV but can now create AI-generated video ads and launch them on streaming platforms.

Databricks Raises $1B at a $100 Billion Valuation🔒- It was only nine months ago that the data warehousing platform raised $10B, valuing the company at $62B. Big jump in a short period of time!

Koah raises $5M to bring ads into AI apps - The startup is targeting the "long tail" of AI apps built on top of large language models, especially those serving users outside the U.S. who won't pay $20/month subscriptions.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!