August 27th-September 2nd // Estimated Reading Time: 11 minutes

Below is a roundup of last week’s notable industry news, with summaries and our opinions. Google is a search monopoly, but…

The August AI Accelerator (sponsored by Scope3) was a smash hit. Some quotes:

"The Future of AI In Advertising was fascinating … I feel like a whole new world has opened up for me."

“I feel like I've only been dabbling into AI until now. I feel way more knowledgeable and want to play more and continue learning."

Sign up for the October AI Accelerator waitlist here.

#KnowledgeIsMoney #HumansAheadOfAI

Top Story 👁

Google avoids breakup, but has to give up exclusive search deals in antitrust trial

Source: TechCrunch

September 2nd, 2025

Summary: Google dodged a bullet. US District Judge Amit Mehta declined to break up Google's search business but ordered other changes that affect how the tech giant operates for the next six years.

The big changes: Google can no longer have exclusive deals that lock in Search, Chrome, Google Assistant, or Gemini as the only option on other platforms. In other words, those exclusive arrangements that made Google the default search engine in browsers like Safari and Firefox are done. Non-exclusive deals can continue, which is why Apple stock jumped after-hours, execs at companies like Firefox and Opera celebrated, and Alphabet’s stock popped 9%. Investors clearly breathed a sigh of relief.

Google must also share some data with "qualified competitors," including search index and user interaction data. It must help rivals compete by providing search text ads syndication services and be more transparent about ad auctions. A technical committee will enforce the six-year judgment starting 60 days after the final order.

The emergence of generative AI played a role in the decision, with the judge saying that it has significantly shifted competition in the marketplace. “Google cannot use the same anticompetitive playbook for its GenAI products that it used for Search,” Judge Mehta wrote.

The DOJ wanted much more—forcing Google to divest Chrome and possibly Android, plus broader data-sharing requirements. But Mehta's approach mirrors Europe's Digital Markets Act philosophy with targeted behavioral restrictions rather than structural breakups.

This \sets the stage for Google's ad tech antitrust case, where the remedies trial is scheduled for later this month.

Opinion: So let's get this straight: Google is a search monopoly, but the government can't won't really do much about it?

You can blame this outcome on a number of factors: antiquated antitrust laws, heavy-handed remedies proposed by the DOJ, a judge fearful of having its verdict overturned in appeals court, a political / economic environment that favors Big Tech, etc. What do we think it really came down to? A little bit of opportunism on Google's part and a whole lot of luck. To recap:

Google built a search empire…

Squeezed every last dollar out of it…

Was deemed a search monopoly…

While consumer behavior started to shift away from traditional search towards AI…

Was let off the hook by the courts because of consumer behavioral shift towards AI…

All while getting ahead in AI by cannibalizing its own search business and tripling down on AI early to get ahead of the next wave of AI-native competitors…

Wow.

#ChessNotCheckers #Blessed

So what happens next? Google's position for the AI era looks stronger than ever—and that's because they kept the crown jewels. By retaining Android and Chrome, Google retains the distribution and user data that actually matters: billions of devices capturing every click, search, and behavioral patterns needed for hyper-personalized AI experiences. And while competitors have been scrambling to build AI products, Google has been busy leading the way, integrating Gemini directly into Search, YouTube, Gmail, Google Workspace, and pretty much every touchpoint where consumers spend their time. In Search, they've been boldly pushing AI Overviews and AI mode (even though it cannibalizes their search revenue). In their ad stack, they've been pushing Smart Bidding and Performance Max. They're training both users and advertisers to expect AI-powered experiences across their ecosystem. The strategy has been brilliant: Instead of waiting for AI to disrupt their business, they're using AI to make everything more valuable and even harder to replicate. The irony is rich: Judge Mehta warned Google "cannot use the same anticompetitive playbook for its GenAI products," but keeping Android and Chrome ensures they can and will use exactly the same playbook.

Beware marketers: You're going to be just as beholden to Google in the AI era as you were in the search era, maybe more so. Google's moat isn't really about search algorithms anymore—it's about owning the places where consumers spend their attention (AI-powered Search, YouTube, Gmail, Maps, Android) and having the AI infrastructure to make those experiences irresistible. Whether users are searching, watching, navigating, or chatting with AI, Google's capturing that intent and serving ads against it. The revenue model won't change; it'll just get smarter and stickier.

Meanwhile, the looming ad tech antitrust case suddenly feels like a sideshow. Even if Google "loses" and has to divest AdX and GAM, it might actually benefit them. Ad tech is their lowest-margin, highest-complexity business line. And a regulatory headache that's become a drag on their core operations. Divesting ad tech would create a tremendous amount of shareholder value and allow them to focus entirely on their owned-and-operated properties where margins are fat and competitive threats are minimal. Whatever happens in the ad tech case won't matter nearly as much as this one, because the real game has always been about capturing user attention, not intermediating open web ad transactions.

Google wins, again.

Other Notable Headlines

The Trade Desk's redefinition of supply paths ripples across ad tech 🔒 - The independent DSP has reclassified SSPs as "resellers," steering its AI platform Kokai toward The Trade Desk's own OpenPath and SP500 marketplace. Publishers outside of these paths are seeing payouts decline up to 50% through TTD, while those integrated with its preferred paths see increased spend. Is TTD is becoming the walled garden it once criticized? Is it using their exact playbook to extract value from the ecosystem while claiming to be agnostic?

Media Buyers Block Publicis' Epsilon SSP Over Data Leakage Concerns 🔒 - WPP, IPG, Dentsu, and Havas buyers have unknowingly been feeding money and campaign data to competitor Publicis through multi-hop reselling involving Epsilon SSP. Five buyers have now blocked Epsilon supply entirely after realizing they were essentially paying their rival to spy on them.

Dentsu Weighs 'International' Sale - The Tokyo-based holding company is exploring selling its struggling international operations after laying off 8%🔒 of staff and recording $1.1B in valuation loss. The 2012 Aegis acquisition for $5B has been a disaster, underperforming while Japan operations hit records. Further illustrating Dentsu's struggles, T-Mobile will transition away from Dentsu's creative business🔒, moving most responsibilities in-house. If Dentsu dumps international assets, it signals that global agency consolidation might be reversing—sometimes bigger isn't better.

TikTok owner ByteDance eyes valuation of over $330 billion as revenue surpasses Meta 🔒 - ByteDance's Q2 revenue hit $48B, officially making it the world's largest social media company by sales ahead of Meta's $42.3B. International TikTok revenue surged 38% to $6.3B despite US uncertainty. While TikTok faces uncertainty in the US, its revenue outside the US, in the UK, Europe, and Latin America, surged 38% to $6.3B in 2024. However, regulatory headwinds are also mounting across Europe, where TikTok is facing investigations for child data misuse, election interference allegations, and potential fines under the Digital Services Act. ByteDance is also dealing with a September 17 deadline to divest TikTok's U.S. operations, but President Trump will extend the deadline if a deal can't yet be reached. It appears that a deal may be coalescing around an investor consortium that includes KKR, Andreessen Horowitz, and others.

How Google is preparing to make ad tech unit independent🔒- Google's ad tech division is quietly building capabilities that would make it viable as a standalone company should a federal judge order Google to divest the unit. In April, a federal court ruling found that the company monopolized the ad exchanges and publisher ad server sectors. To become more self-sufficient, Google is reportedly trying to expand Google Ad Manager into new markets like streaming TV and gaming. But it has hit some snags because its tech was built for standard websites, not sophisticated streaming services or specialized apps like Uber. The US Justice Department is expected to argue for a spinoff at next month's remedies hearing. In the EU, Google’s anticompetitive ad tech business practices may receive a slap on the wrist hand and a modest fine🔒in the coming weeks, if any penalty comes at all due to fears of retaliation🔒from the Trump administration.

Amazon Ads Wraps Upfront, Touts 'Significant Growth' - Amazon didn't reveal details about volume or pricing, but some analysts estimate that its upfront revenues could have spiked 30% over last year, reaching $1.8B. Most gains came from Prime Video and Freevee platforms, where CPMs remain competitive at $20-$30 compared to the industry average of $27.25 for premium streaming. Not bad for Amazon Prime Video, which turned on the ads spigot last year, helping Amazon make a play for DSP dominance🔒.

Dotdash Meredith sues Google for antitrust violations, seeking damages - The US’s largest publisher filed a massive lawsuit arguing Google's ad tech practices caused substantial financial harm, citing "Project Bernanke" and other manipulation tactics that cut publisher prices by 50%. This lawsuit could become the template for every major publisher to extract settlements from Google while antitrust momentum lasts.

Roqad Acquires Zeotap's Third-Party Data Arm To Get A Leg Up On Identity In Europe - Two Berlin-based companies that both wanted to be Europe's LiveRamp are joining forces, with Roqad taking over Zeotap's Amazon partnership and audience data business. The identity resolution market continues consolidating as companies realize there's only room for a few winners in the post-cookie world.

Ad buyers lose key tool as Prebid breaks auction tracking system - Prebid.org, a non-profit, open-source organization that helps publishers with monetization, disabled transaction IDs (TIDs) in ad auctions, eliminating advertisers' ability to detect duplicate bid requests coming in from bidders. Previously, a DSP could use TIDs to recognize when the same ad slot was being sold through multiple supply chains, helping weed out duplicative bidding and optimizing efficiency. Marketecture's Ari Paparo, who first flagged the change on X, said that The Trade Desk and others have been encouraging publishers to adopt TIDs. Industry experts expressed frustration at Prebid’s lack of industry consultation, and the IAB Tech Lab condemned the change as violating established OpenRTB specifications.

Other Notable Headlines

(that you should know about too) 🤓

Why Perplexity is now less focused on advertising, and what’s next for the AI search platform🔒- Perplexity is focused on its new AI-powered browser Comet and other projects, deprioritizing ad offerings. Its head of advertising, Taz Patel, left the company last week.

ZeroClick launches with $55 million to build the ad network for AI - The company wants to develop a "reasoning-time ad network for AI." Founder Ryan Hudson also launched Honey, which sold to PayPal for $4B.

Super Bowl 2026 Commercials Have Sold Out, With NBC Seeking at Least $7M per Ad - Most of the inventory was gone by June.

2026 midterm elections projected to set new advertising record - AdImpact predicts political and issue advocacy advertising will reach $10.84B.

Scope3 Names Tim Collier Chief Commercial Officer as It Pushes Into ‘Agentic Advertising’🔒- Collier will help Scope3 build out its strategy to build AI agents that transform how brands, agencies, and media companies buy media.

Ad group WPP's COO Andrew Scott to retire at end of year🔒- Scott will follow Mark Read out the door when Cindy Rose takes the top job at the end of the year.

Google AI Max Asks Advertisers To Give Up Control - Google's AI Max for Search is now generally available.

Empower Merges With Ocean To Form $1.5 Billion Indie Media Powerhouse - The agencies will share centralized resources and take advantage of their combined scale but will maintain distinct operations.

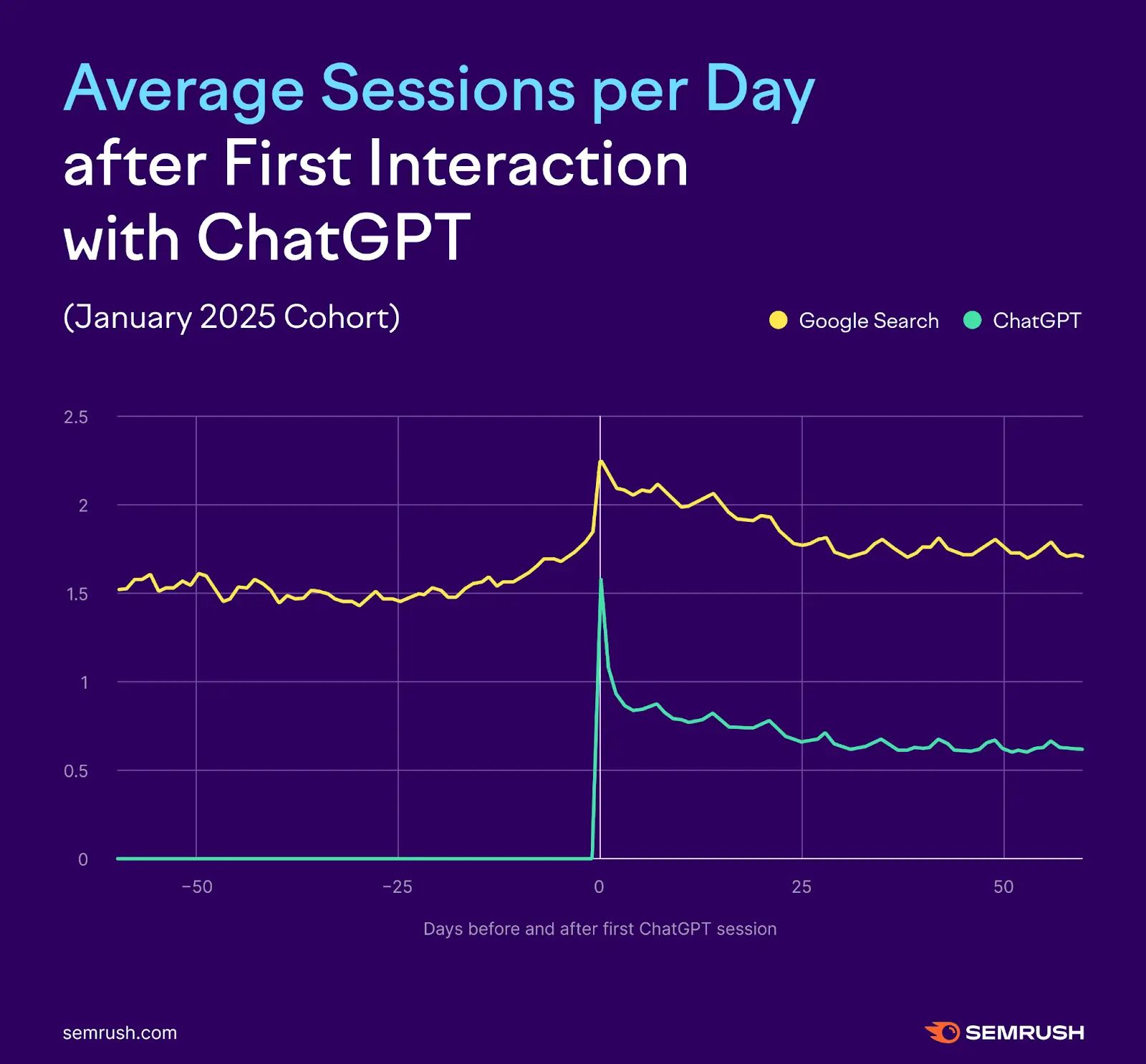

ChatGPT Is Not Replacing Google—It’s Expanding Search [Study] - ChatGPT is expanding how people search online but isn't reducing Google usage.

Washington’s digital ads tax goes into effect on Oct. 1. What could go wrong? - The tax will affect “all digital and nondigital services related to the creation, preparation, production, or dissemination of advertisements," raising alarms about the scope.

Layoffs imminent at Martin Sorrell's S4 Group🔒- S4 Capital's Monks operating brand will restructure and pare down some teams.

Kraft Heinz is splitting into two companies - One company will oversee fast-growing businesses like sauces and shelf-stable meals, and the other will focus on struggling grocery items such as Oscar Mayer. The new companies haven’t been named yet.

That’s It For This Week 👋

The U of Digital Weekly Newsletter is intended for subscribers, but occasional forwarding is okay!

To subscribe visit Uof.Digital/Newsletters or contact us directly for group subscriptions.

And remember, U of Digital helps teams drive better outcomes through structured education on critical topics like programmatic, privacy / identity, CTV, commerce media, AI, and more. Interested in learning more about how we can supercharge your team?

Thanks for reading!